The Market Brief

Hey team. U.S. futures edged lower as optimism around tariff cuts between the US and China gave way to lingering concerns about inflation and economic growth.

Let’s see what’s ahead for the markets!

Impact Snapshot

🟥 CPI Inflation - 8:30am

Macro Viewpoint

CPI Preview

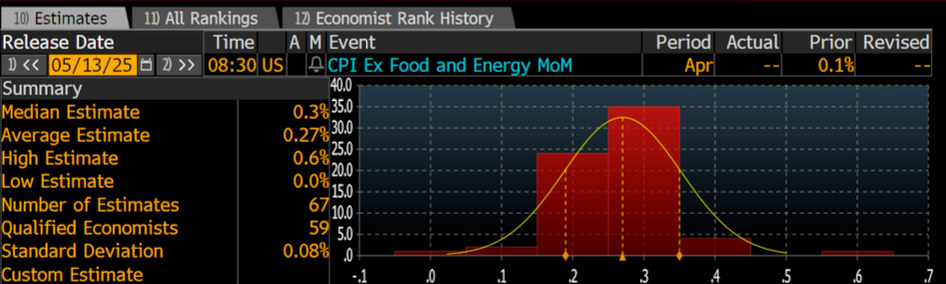

After a research across Wall Street’s biggest investment banks and their forecasts, we expect tariffs to begin creeping into the CPI in this week’s release.

We see expectations point to a 0.32% rise in the consumer price index (CPI) for April—a firmer print compared to the last couple of months, though still softer than what we saw in December and January.

That said, we believe April marks the beginning of a series of CPI readings that will reflect the impact of recent tariff hikes. These pressures are likely to feed through gradually, particularly across categories tied to imported goods.

Should April's projection prove accurate, the year-on-year increase in headline CPI would remain at 2.4%. However, we anticipate a more pronounced pickup in inflation over the next few quarters before the influence of the tariffs begins to taper off.

That said, uncertainty about how much tariffs might have impacted last month’s readings is elevated, and we see scope for more volatility within the April CPI report than is typical.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.