The Market Brief

Hey team. U.S. stock index futures eased during early trading on Thursday while investors shifted their focus to upcoming economic data and pivotal trade talks.

Lets see what’s ahead for the market!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟧 30-y Bond Auction - 1:01pm

Macro Viewpoint

Despite all the noise around tariffs this week, the momentum in U.S. equities hasn’t really faltered. Traders continue to buy, encouraged by solid economic data, confidence heading into earnings season, and ongoing excitement around AI.

Last week’s strong jobs report helped push major indexes to new all-time highs, marking a strong comeback from April’s steep sell-off that followed the “Liberation Day” tariff news.

The strength of the U.S. economy gives the Fed some breathing room—allowing them to assess how the latest tariffs might impact inflation and growth before making any further moves on interest rates.

Wall St Prime Intel

Unlike the significant amount of clueless LARPS that are allergic to math around this space, we employ quantitative analysis to model the market’s direction and offer our Substack subscribers a solid framework to not only understand what happens behind the scenes but also get a statistical advantage based on actual data.

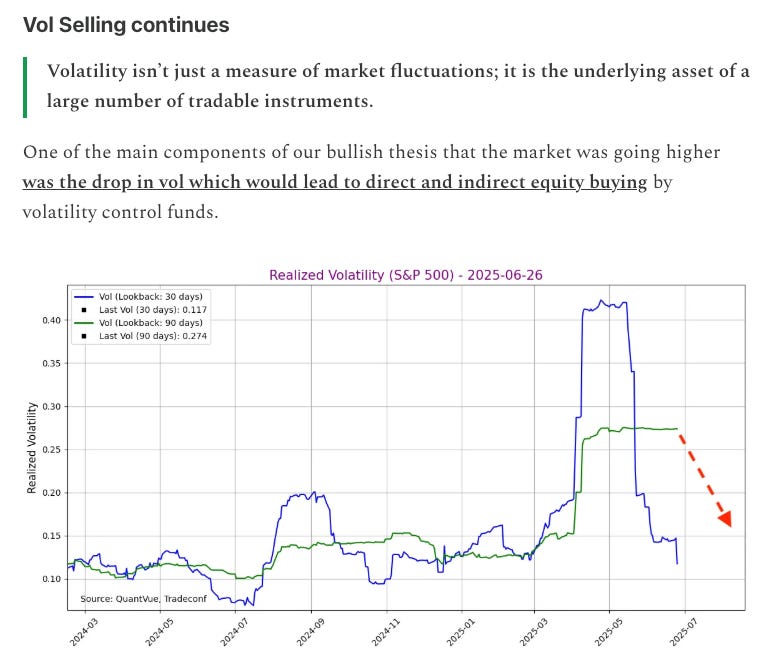

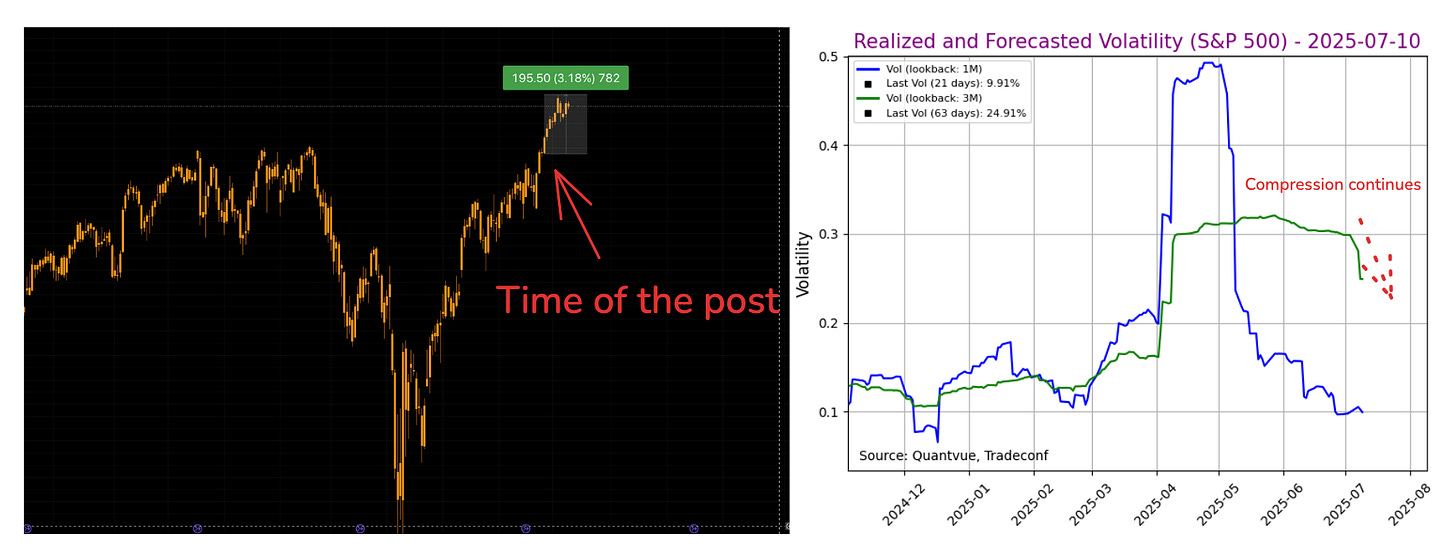

The image above, along with the context, was shared last month during our brief on 6/26 [HERE]. Since the time of that post, the market is up around ~200 points, and vol projection continued to follow the compression path, which allowed the market to go higher.

We’ve written a short article on the impact of vol-compression, a main component of our bullish thesis we’ve had since the market was below the 5000s, in today’s brief.

This is a free edition of the Market Brief. To receive our additional updated institutional-grade research and data analysis, please consider becoming a paid subscriber. 👇