The Market Brief

Hey team, we have a busy week ahead with a series of key economic data releases and Fedspeakers likely to influence the outlook on interest rates.

Let’s re-cap Monday’s session and see what’s next!

Impact Snapshot

🟥 JOLTS Job Openings - 10:00am

Macro Viewpoint

U.S. equity futures pointed to a muted open on Wall Street as investors anticipated a packed schedule of Federal Reserve speeches and economic data releases, seeking insights into the trajectory of interest rates.

The S&P 500 and Nasdaq closed at record highs in the previous session, as a tech-driven rally extended into December, building on the impressive performance of U.S. equities in November.

Key events for investors this week include Friday's payrolls report, expected to reveal a rebound in hiring for November, and Fed Chair Jerome Powell’s participation in a moderated discussion on Wednesday.

Traders currently assign over a 72% probability to the Federal Reserve reducing interest rates by 25 basis points at its upcoming meeting later this month.

Prior Session Deep Dive

A significant part of what we do in this Substack is to communicate the ability to understand the market environment.

This understanding helps you build a more solid narrative for the intraday session and prepares you to identify key factors to watch during that session.

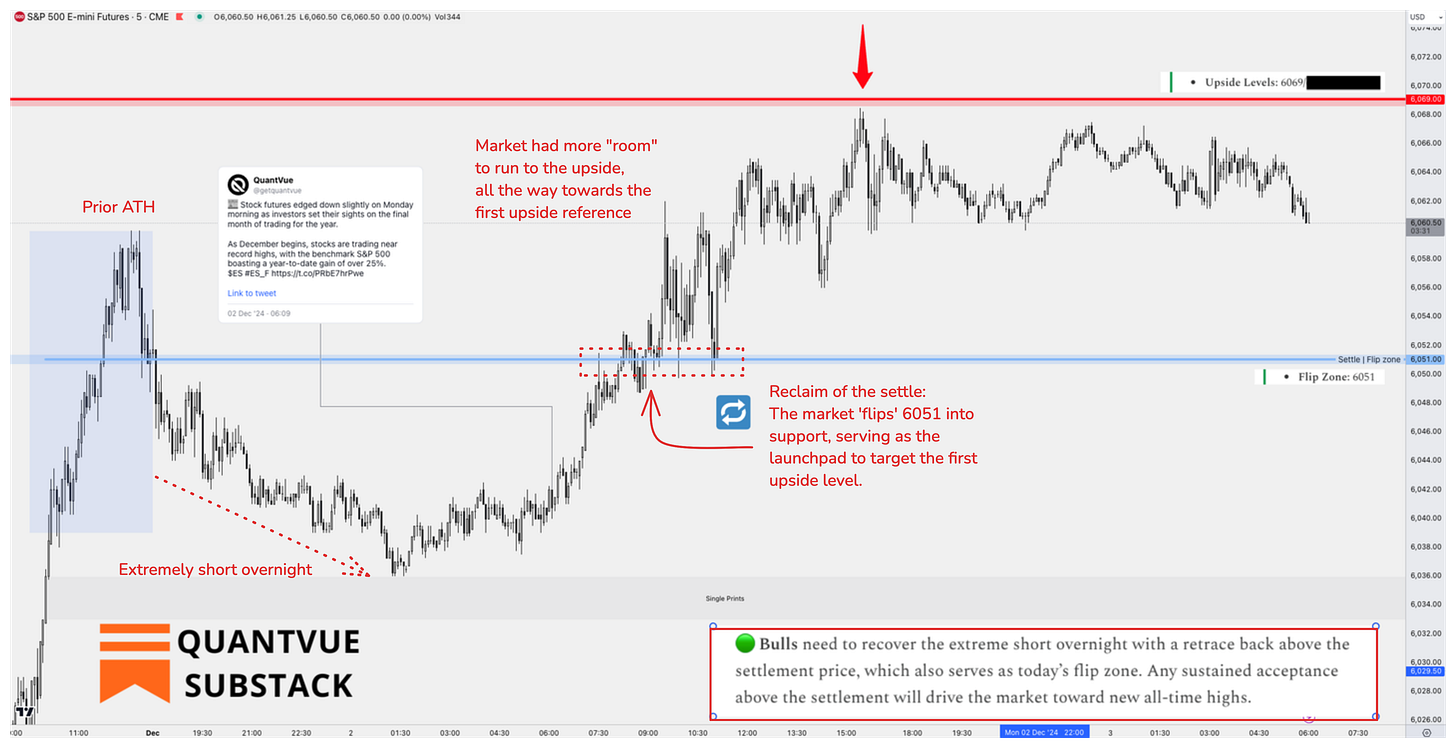

Monday’s session began with an extremely short overnight, which eventually corrected back toward the settlement. Buyers successfully flipped the 6051 level into support, which then served as a launchpad for the market to target the first upside level.

As expected, market conditions can change by the minute. However, even though none of these candlesticks could have formed on the chart by the time of our overnight posts, the market often tends to follow the exact paths outlined in our scenarios.

We’re not talking about prediction, of course. We’re discussing potential and framework. Predicting the market is not the goal—unless you’re a portfolio manager at a major fund, prepared to execute large blocks of equity orders.

Instead, we focus on building a framework for how to respond effectively if certain scenarios unfold. This ensures that (a) we’re not caught off guard when they happen, and (b) we’re prepared to act decisively and efficiently when the time comes.