The Market Brief

U.S. futures slipped as investors awaited indications on the U.S. economy and the monetary policy path following the end of the longest government shutdown in the country’s history.

Macro Viewpoint

After an incredible rally that began in April, markets have hit a choppy stretch in recent weeks as traders grappled with a data blackout and growing unease over stretched tech valuations.

Investors are now bracing for further volatility as the government resumes releasing economic figures, with markets not yet settled on the Federal Reserve’s next steps.

Meanwhile, SPW (S&P 500 Equal Weight Index) outperformed SPX again, adding more “color” to the capital rotation factor we’ve flagged since last week. Beyond the tech sector, global equities have generally held up well while AI narrative is de-risked.

The market will need a strong catalyst to break convincingly into new highs. If mixed signals emerge regarding monetary policy or trade risks, or if the AI earnings narrative fails to meet expectations, a corrective pullback could materialize.

Prime Intelligence

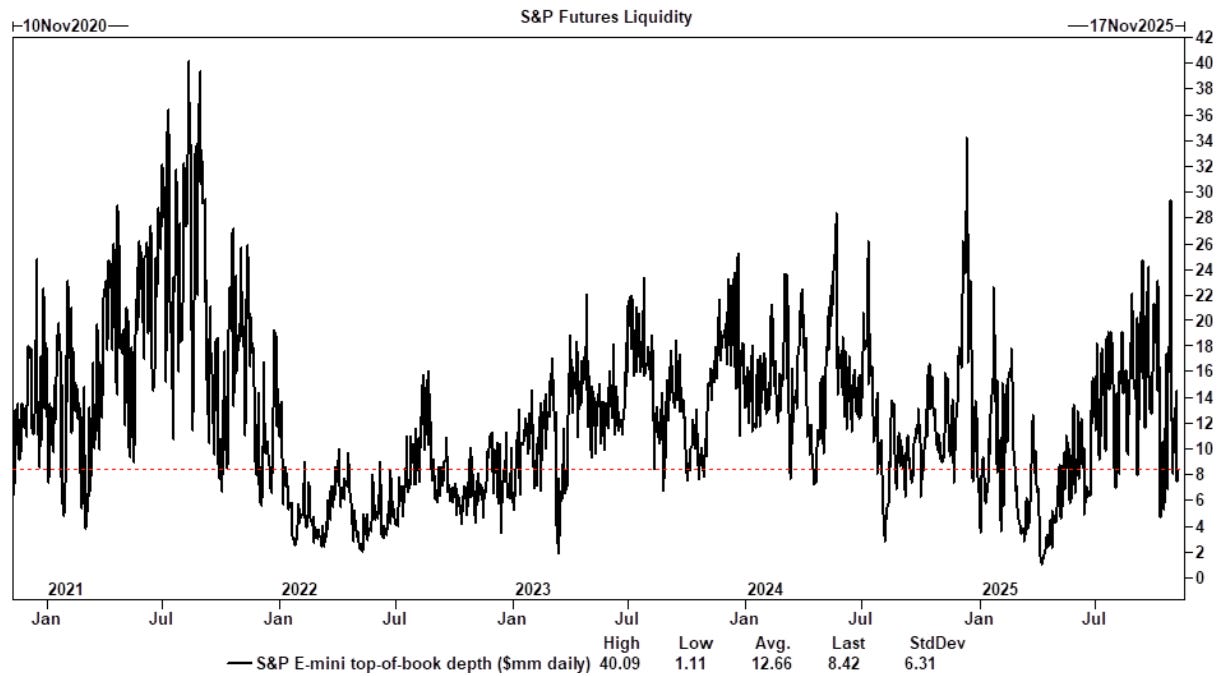

Market liquidity, the ease with which assets can be bought or sold without causing significant price movement, is critical for efficient and orderly markets. In futures markets, top-of-book liquidity represents the readily available volume for immediate execution at the prevailing price.

We note that over the course of last week, liquidity has dropped significantly from recent highs. This can both have a volatility-induced effect as well as make moves seem more significant than they are.

Reduced depths at the best bid and offer reflect that fewer limit orders are posted and, consequently, that it takes less volume to move the price, resulting in a more fragile or less resilient order book.