The Market Brief

U.S. markets are higher during early trading ahead of the Fed’s widely expected 25-basis-point cut on Wednesday, the first move in a policy easing round projected to run into 2026.

Impact Snapshot

🟥 Retail Sales - 8:30am

Macro Viewpoint

US equities print higher all-time highs amidst an upswing in growth expectations and capital formation.

With the latest inflation data behind us (PPI & CPI), the two key risks to the market that can potentially change the trajectory of the factor are the labor market weakening morphing into something worse, and if the market is pricing too much Fed easing while growth remains resilient.

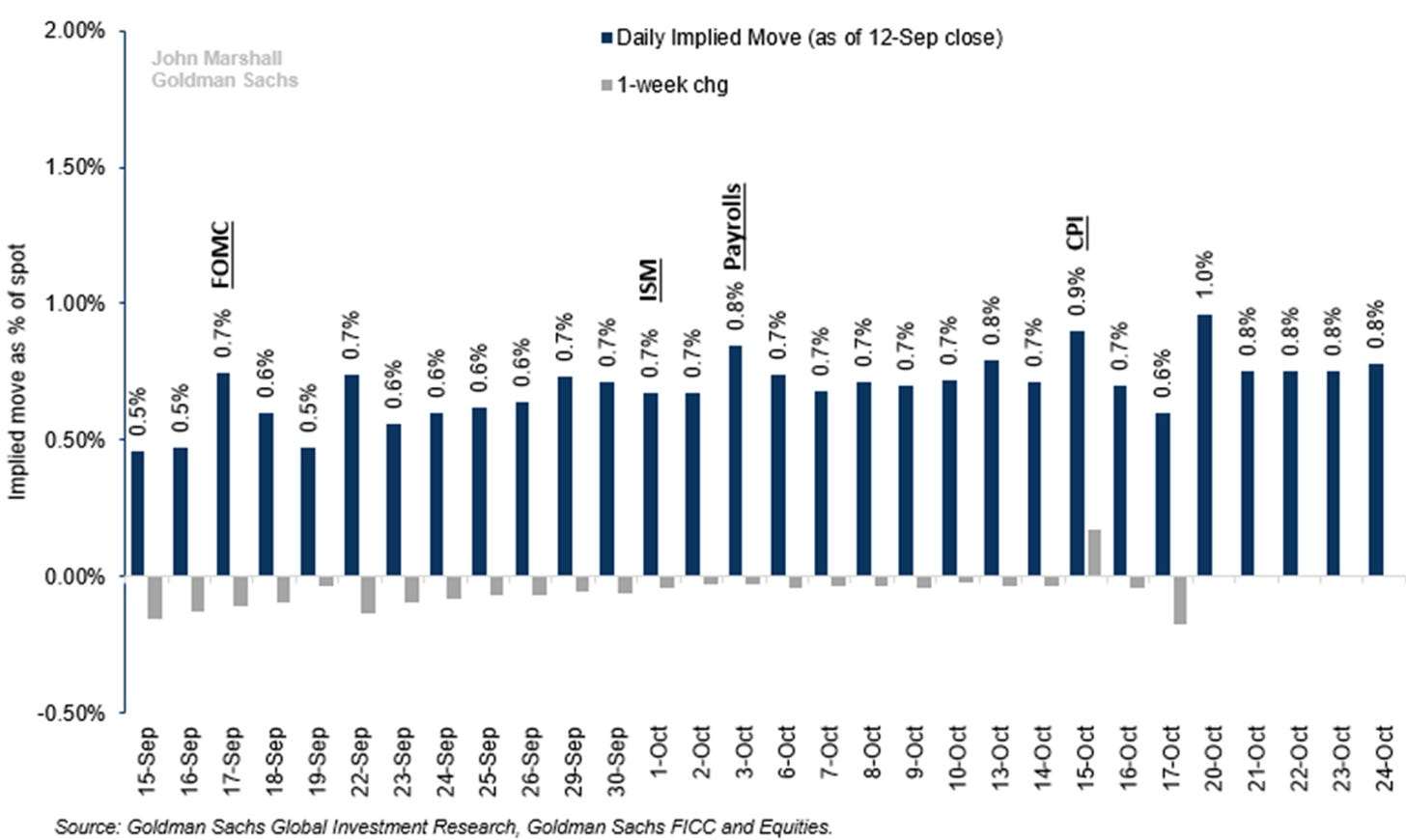

Options investors are focused on the potential for volatility on FOMC day but see relatively modest moves for the remainder of the month.

Prime Intelligence

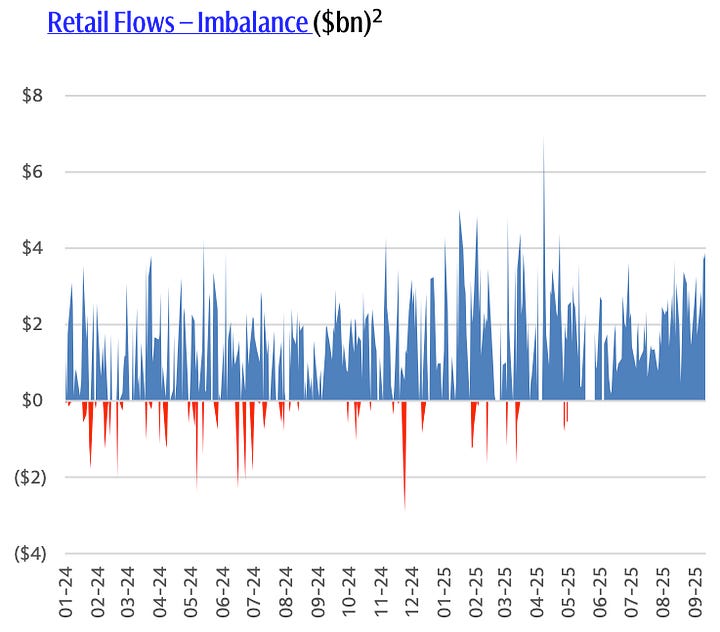

A significant amount of clueless gurus will have you believe that “retail activity” doesn’t matter and following the “smart money” is all you need.

This can significantly cloud your judgment, as many investors & traders were waiting for “retail” to capitulate prior to entering the market, leading to a missed opportunity, especially back in April.

In Q3 to date, odd lots, defined as orders of less than 100 shares, comprise ~66% of US equity trades; this is up from only 31% in January 2019.

The growth since 2019 has been driven by increased retail participation, the adoption of fractional shares, market fragmentation, and enhancements to algorithmic trading.

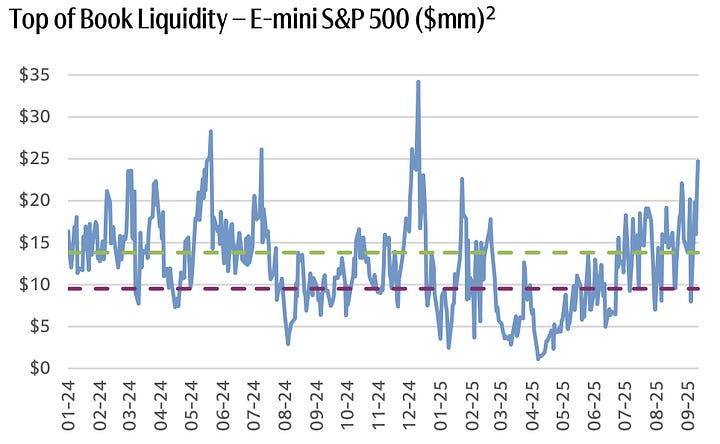

Heading into year-end, we now observe a return of inflows with increased volume and liquidity in contrast to the late summer months.

Last week, retail flows had a net buy imbalance of $16bn. E-mini S&P 500 top-of-book liquidity was up +19% vs. the 10-day average. Overall market volumes were up +8% WoW.