The Market Brief

U.S. futures staged a rebound in early trading on Wednesday after September opened on a negative note, following a loss of momentum in stocks during Tuesday’s session.

Impact Snapshot

🟥 JOLTS Job Openings - 10:00am

🟧 Beige Book - 2:00pm

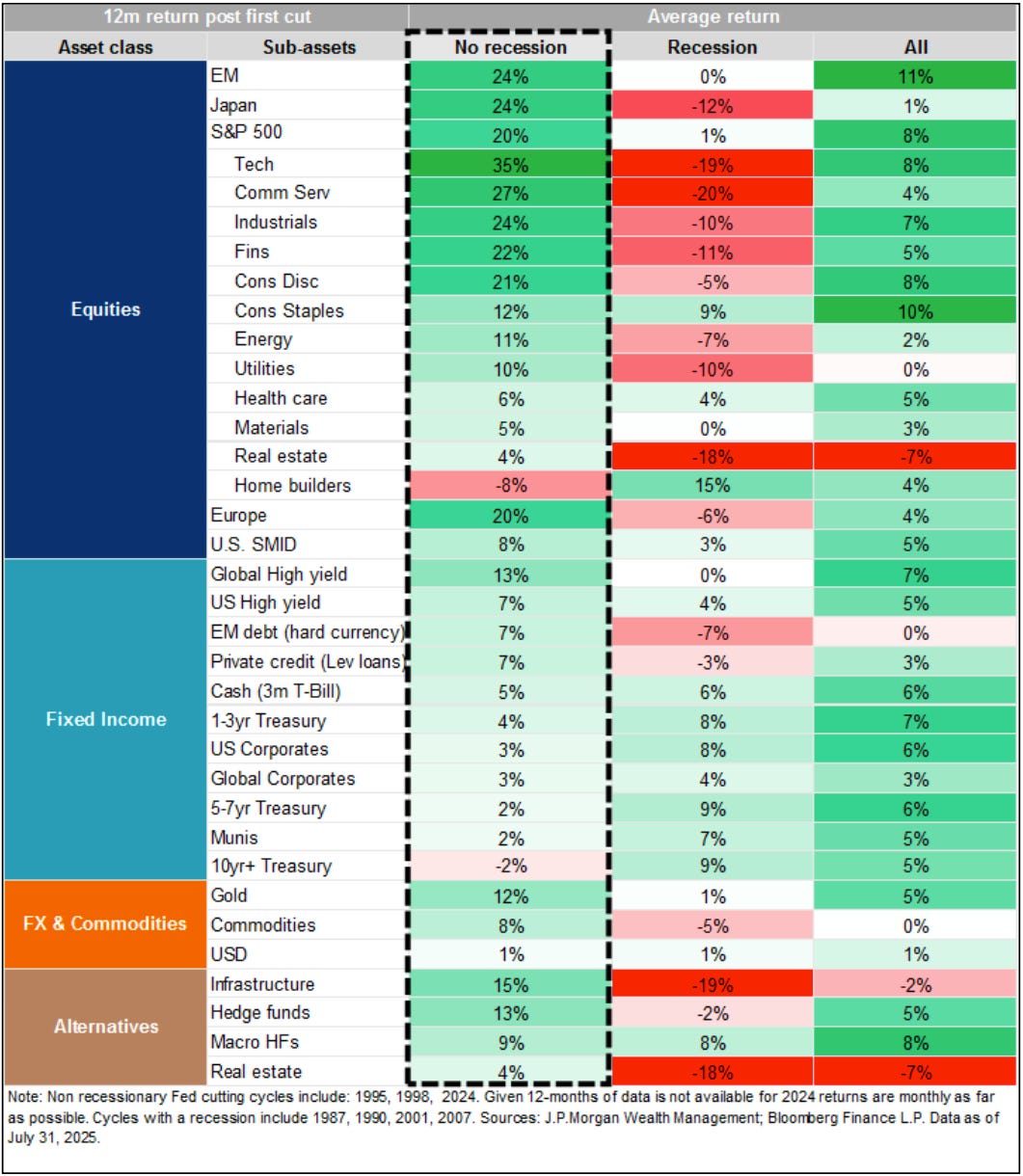

Macro Viewpoint

September’s negative seasonality has skewed to be more negative than positive in recent years. The question remains whether investors allow seasonality to be the dominant driver of the market given the imminent rate cut.

AI fatigue started in mid-August and is now visible across vol parameters and hedging activity. The potential for a moderate pullback in US stocks seems greater than normal for the short term due to:

Above-average positioning

Historical pattern of 5–8% pullbacks around 5–6 months post-positioning

Risky factor performance still near highs

Poor seasonality in September

The SPX has often seen a 5–8% pullback from highs around this time during recoveries from positioning lows comparable to those hit during early April’s sell-off.

Ultimately, the S&P has quickly snapped back from these pullbacks, which have been tactical in nature, offering a great BTD opportunity. Unless we see the Fed pause in September, it is unlikely that we will see any significant pullback materialize and we share some of the reasons why in today’s intelligence. 👇

If you want to receive our additional daily institutional-grade insights right in your inbox, supported by quantified data from the biggest institutional floors, consider becoming a paid subscriber.👇