The Market Brief

Hey team. U.S. stock index futures gave up early gains on Thursday as concerns over the impact of U.S. tariff policies resurfaced in the markets.

Let’s re-cap the last session and see what’s next for the markets!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

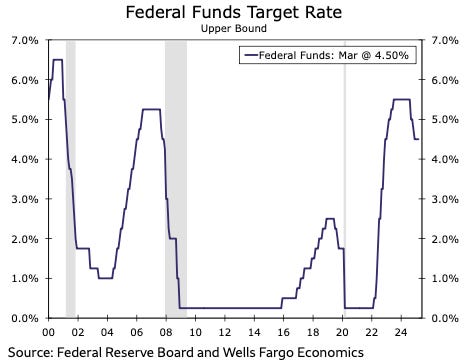

US equity futures declined, reversing earlier gains, as concerns emerged over the Federal Reserve’s capacity to implement substantial interest rate cuts this year amid the risk of inflationary trade tariffs.

As broadly expected, the Fed held rates steady for 2nd time in the 4.25%-4.50% range with the update dot-plot showing 2x cuts by year end but showing large forecast dispersion within the Committee and a more hawkish outlook compared to December.

After cutting rates by a cumulative 100 bps at three consecutive policy meetings between September and December, the FOMC has now been on hold for the past two meetings.

No huge surprises within the statement with acknowledgements of ‘uncertainty around the economic outlook has increased’ while removing language saying risks to achieving inflation and employment goals are ‘roughly in balance’.

The late day rally may not be indicative of near-term direction as the Fed’s forecast shifted to support the stagflation narrative and Powell reintroduced transitory inflation, neither are likely to give confidence to investors.

Where is the “safety haven” if we see the market adopt a Stagflation narrative?

Wall St. Prime Intel

CTAs are now short $34bn of US equities vs. long $52bn of European equities; that spread is the largest we have ever seen by a decent margin.

Today’s Wall St. intelligence covers the latest on CTAs' positioning.👇