The Market Brief

Hey team. U.S. stock futures edged slightly lower during early trading on Friday as traders navigated renewed uncertainty about tariff policies and their impact on the American economy.

Let’s see what’s next for this market!

Impact Snapshot

🟥 PCE Inflation - 8:30am

🟥 Consumer Sentiment -10:00am

Macro Viewpoint

Last night's overly optimistic tone now looks premature. The court’s decision to strike down the use of the International Emergency Economic Powers Act (IEEPA) as the foundation for broad 10% tariffs and reciprocal duties is a clear setback for the administration’s trade strategy.

It introduces more uncertainty into the outlook—but it may not ultimately alter the outcome for most key U.S. trading partners.

The Trump administration is likely to pursue alternative legal pathways to implement tariffs. As a result, we still anticipate the majority of the expected tariff revenue will be realized.

Tariff headlines are once again steering the direction of markets as increasing unpredictability about the impact and scope of Trump’s trade agenda prompts investors to re-assess their appetite for riskier assets.

Wall St. Prime Intel

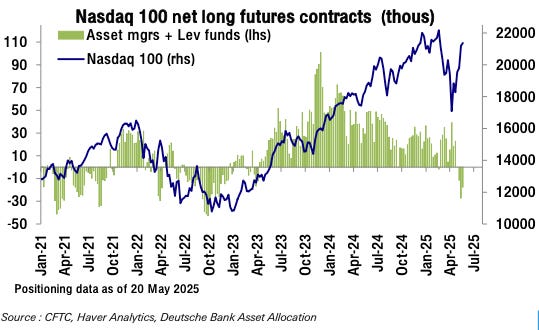

At the start of the month, we published a newsletter named “Pain trade”. In it, we gave you clues about how asset managers and institutional clients operate against their peers and how a tech-led rally would hurt the biggest market participants the most.

Fast forward to the end of the month, tech is still severely underowned by them.

Good luck trying to explain why you missed the entire squeeze to your clients and boss.

We’ve had a bullish investment bias since 4800 on S&P 500 and highlighted that the risk was skewed to the upside after looking at a collection of data points to support it.

If you want our UPDATED market view, consider becoming a paid subscriber.👇

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.