The Market Brief

U.S. stock futures cautiously higher as investors increased bets on a quicker series of interest-rate cuts from the Federal Reserve.

Impact Snapshot

🟥 ADP Payrolls - 8:15am

🟥 Unemployment Claims - 8:30am

🟥 ISM Services PMI - 10:00am

Macro Viewpoint

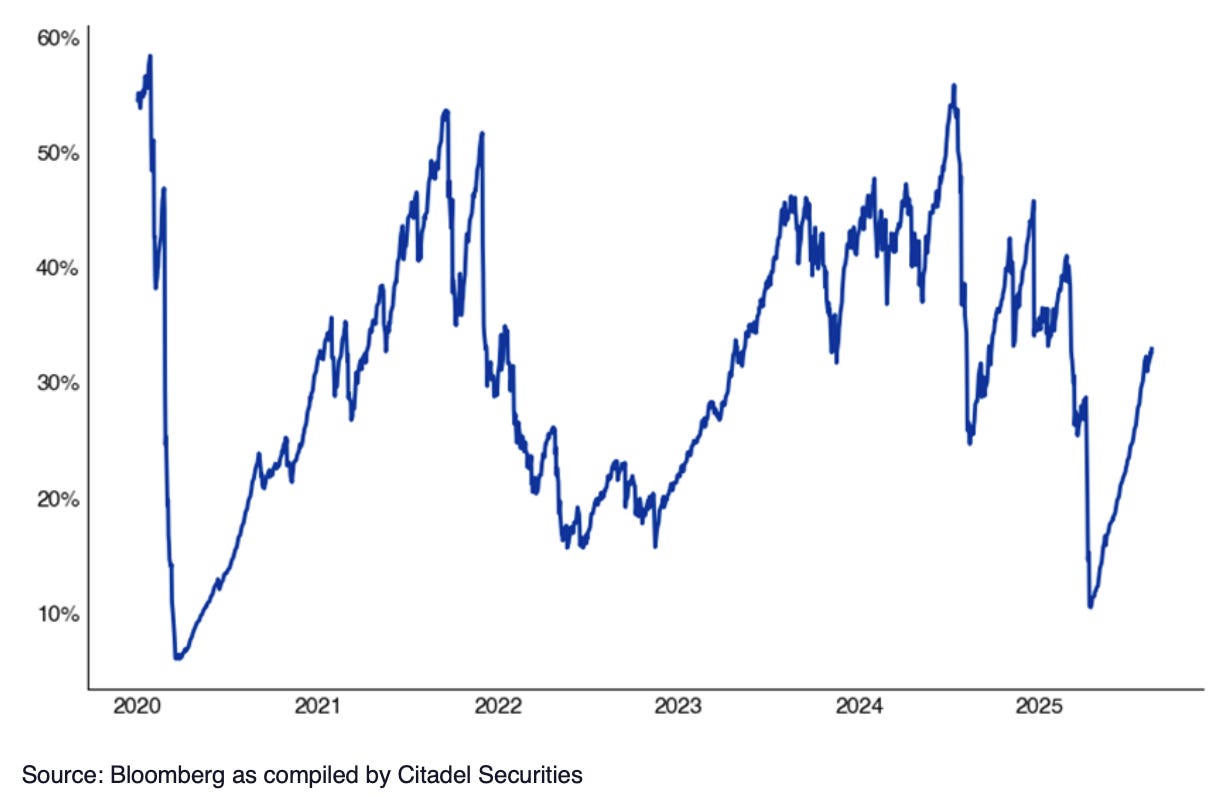

The headline index vol remains confusing for a market that continues to debate and decide on rates, inflation, growth, AI, geopolitics, employment, tariffs, corporate margins, consumer spending, and the housing market... as well as regional momentum, global trade, and the interconnectedness of all the above.

Whatever one believes... the US has mounted a remarkable comeback from the April lows, rallying ~35% and now leading the way once more.

After a summer of relentless upside and heavy positioning, September historically brings a shift. With systematic strategies maxed out, corporate demand waning into blackout, seasonality turning negative, and volatility set to rise, downside hedges are especially prudent.

Prime Intelligence

Vol-Control strategies — which take cues from the realized volatility market — have already increased exposure substantially.

This is one of the sharpest rebounds in equity exposure we’ve seen, something we shared with our subscribers months in advance.

Our forecast of collapsing realized volatility implied that the removal of put hedges would lead to both direct and indirect equity buying.

🚨 Today we’re sharing the latest positioning of systematic hedge funds, institutional asset managers, and the key levels to watch that could trigger a positioning unwinding. 👇

This is the FREE edition of the Market Brief. To access our institutional market intelligence, consider becoming a paid subscriber.