The Market Brief

Hey team. US stock futures are bouncing during early trading on Friday ahead of the release of US jobs data.

Let’s see what’s next for the market!

Impact Snapshot

🟥 US jobs data - 8:30am

Macro Viewpoint

Investors turn their attention to the key monthly nonfarm payrolls report, after earlier data this week signaled a cooling labor market, reinforcing expectations that the Federal Reserve will cut interest rates at least twice this year.

US Jobs Data

The market is currently pricing in just over 2 cuts by the fed over the remainder of 2025. We believe the sweet spot for stocks today is a stronger than expected print. A sub 100k print will fan concerns about a growth slowdown and should put pressure on stocks

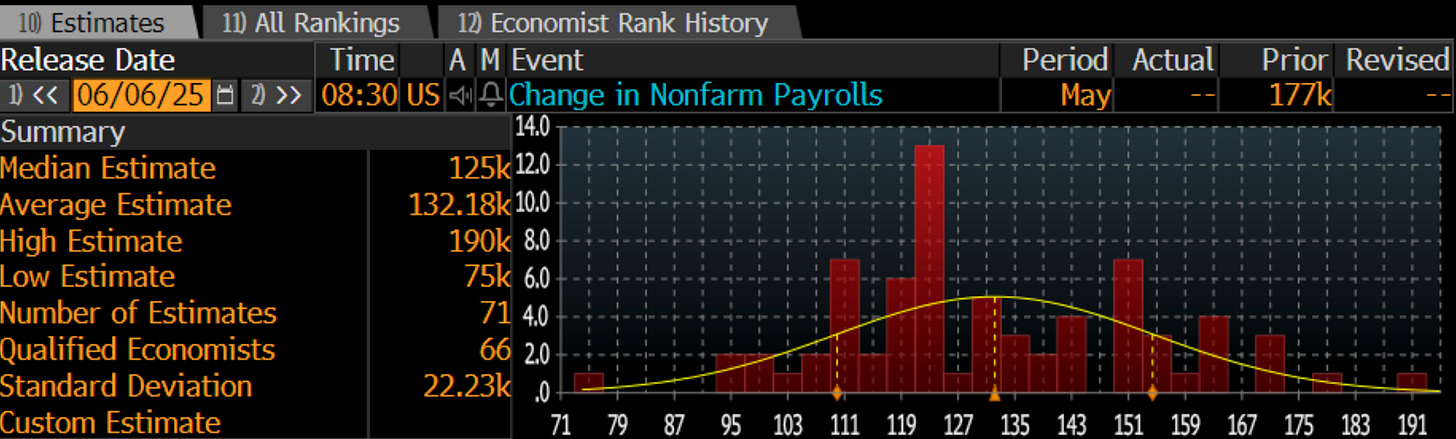

Following the scenarios posted yesterday regarding NFP, we see Wall Street estimates nonfarm payrolls would rise 125k in May. We see estimates that the unemployment rate was unchanged at 4.2% on a rounded basis.

Estimate distribution for May Nonfarm Payrolls

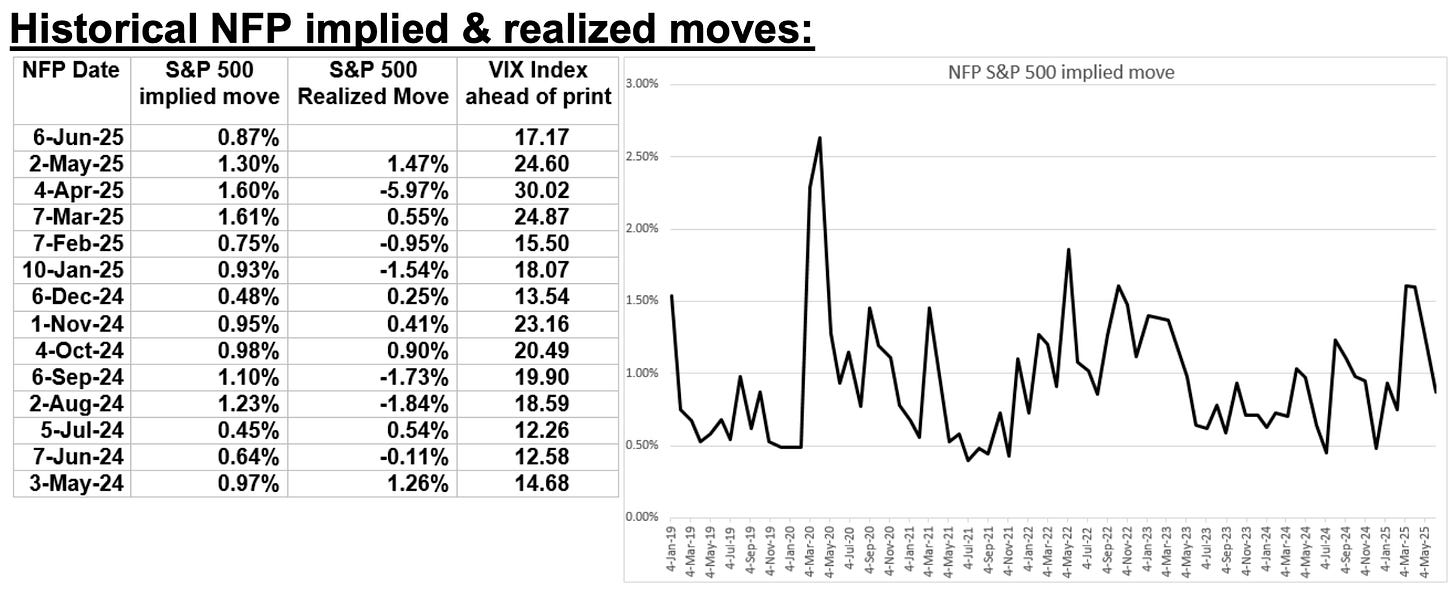

SPX implied move thru today’s close = ~0.87%

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.