The Market Brief

Markets reacted to the U.S. tariffs, which were more aggressive than expected. For the U.S., this will hit GDP growth, push inflation higher, and keep pressure on the U.S. stock market.

Read our latest Market Brief showcasing what we were seeing leading up to this event and what all of this means for the market moving forward.

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 ISM Services PMI - 10:00am

“Liberated”.. of your net worth

Investors sold off stocks and turned to Treasuries for safety as President Donald Trump's push to change global trade raised worries about economic growth.

Trump’s Liberation Day announcement unveiled a remarkably large and broad-based hike in US tariffs. Starting April 5th there will be a minimum 10% tariff on all goods imports coming into the US.

We knew it would be bad. As in, we specifically said that all the evidence we saw from institutional forecasts—both from their flows and research analysis—suggested that we would see an initial announcement that negatively surprises the markets.

Read our initial report here.👇

Wall St. Prime Intelligence

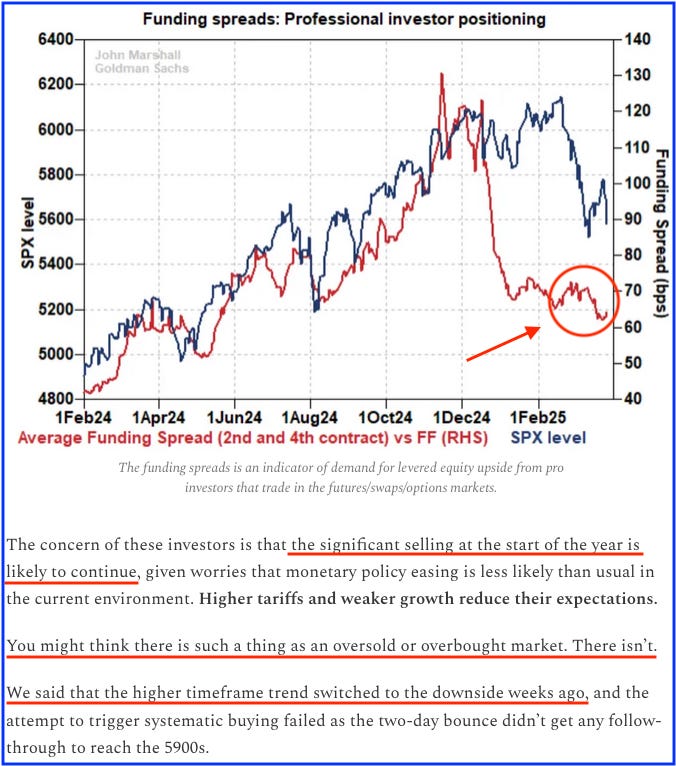

The market is not going anywhere without the participation of senior money. Retail is not capable of triggering any serious advance in the S&P 500.

Last few sessions could be described as “no adults in the room”.

We shared evidence through both our macro sentiment and Wall St. Prime Intel that money managers were expecting this exact market reaction and were either hedged for this downside or hadn’t been adding any longs since last week.

The picture above shows the exact context we shared with our subscribers on the Mar 31 report here.

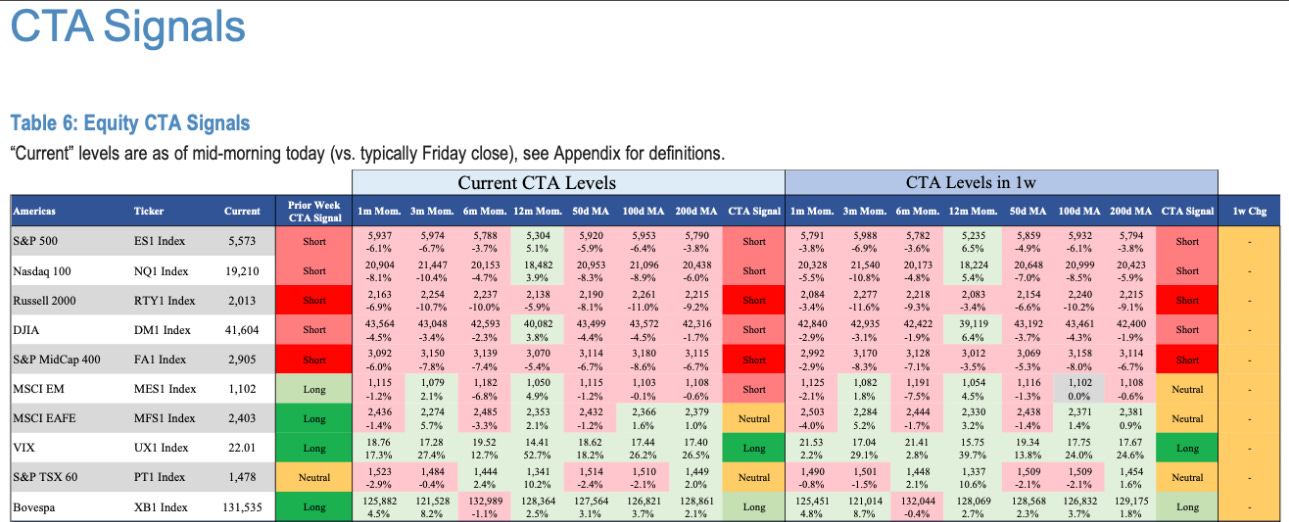

A 2-3 day advance will do little to slow the growth of shorts, as these returns carry little weight in a CTA’s moving average crosses, which determine allocations.

Bottom line: We saw consistent derisking from both asset managers and HFs into this event over the last two weeks. (The picture above is a snippet we shared on April 1st, showing the position of CTAs, signaling that they remained well short on U.S. markets.)

What’s next?

Trump’s Liberation Day announcement unveiled a remarkably large and broad-based hike in U.S. tariffs.

This will hit GDP growth, push inflation higher, and keep pressure on the U.S. stock market. Uncertainty has not been tamed.

We have written a full research report in today’s Prime Intel with all the evidence and numbers we’ve got straight from the biggest investment banks that showcase the consequences to the economy if these tariffs are implemented to their full extent.