The Market Brief

Hey team. U.S. futures cautiously higher during early trading on Thursday as traders staying on the sidelines before the Federal Reserve’s monetary policy decision and release of new forecasts for the economy.

Let’s see what’s ahead for this market!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 Fed Rate Decision - 2:00pm

🟥 FOMC Press Conference - 2:30pm

Macro Viewpoint

Stocks closed lower y-day: Oil added 4.6% on the elevated tension in the Middle East, given the concerns over direct US involvement.

Macro data was not supportive: headline Retail Sales disappointed, but the upside surprise in the Control Group still suggests positive momentum in consumer spending.

FOMC Preview

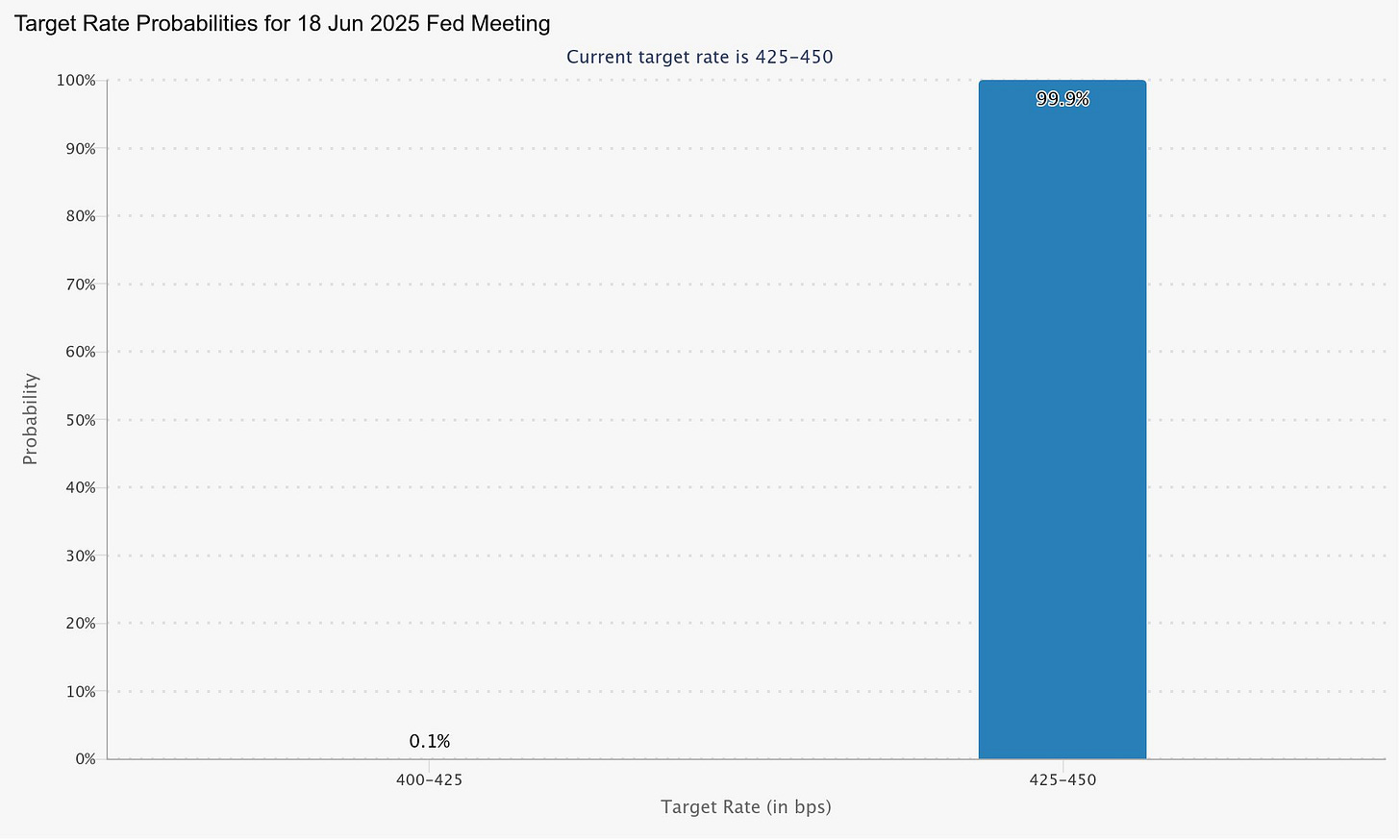

The Fed is expected to keep rates on hold in June.

The Fed’s main message will be that it remains comfortably in wait-and-see mode. Investors should focus on Powell’s take on the softening labor data, the recent benign inflation prints, and the risks of persistent tariff-driven inflation.

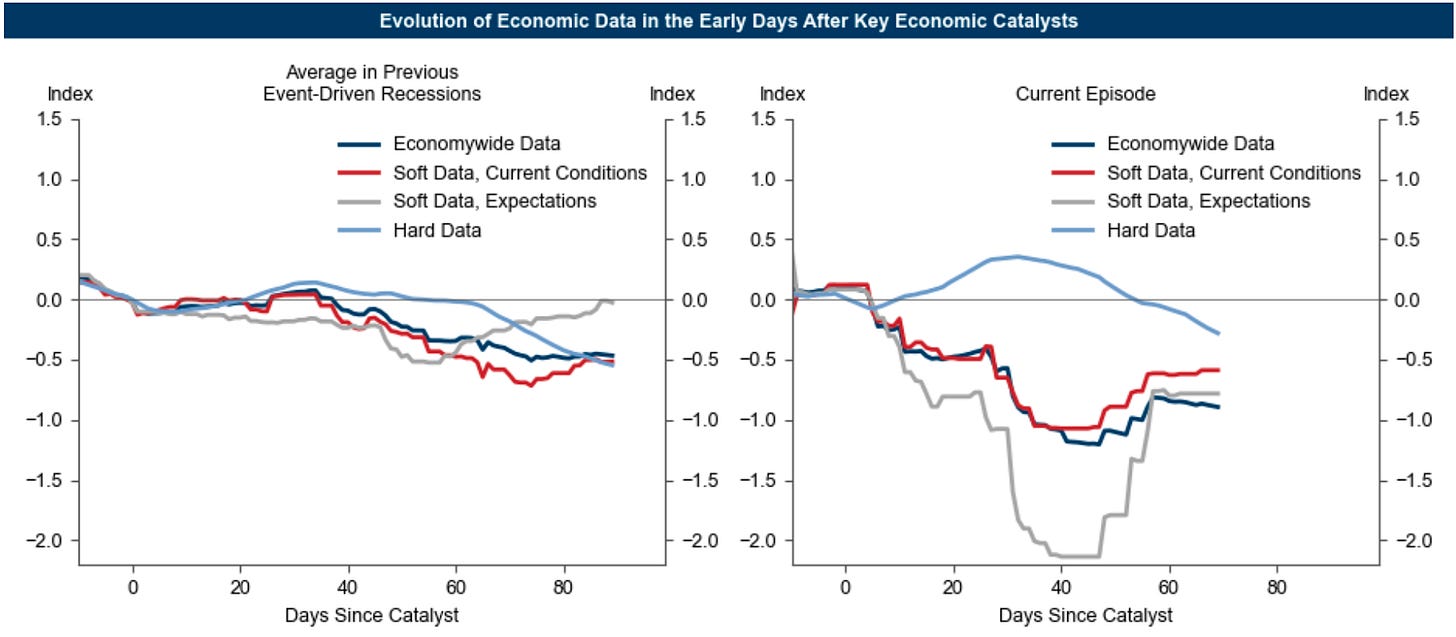

Since the last FOMC meeting in early May, trade tensions have diminished dramatically with the US-China tariff reductions. Inflation has come in low, as tariff effects have so far appeared modest, and the hard data have shown only limited signs of softening.

It often takes longer for the hard data to deteriorate, and front loading of imports and spending has made them harder to interpret. The image below shows that the soft, or survey, data remain noticeably weaker than before tariffs were announced, despite rebounding a bit.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.