The Market Brief

Hey team, the market is awaiting several Fed speakers today, leading up to the all-important CPI inflation number tomorrow. We are beginning to see some profit-taking following the impressive rally triggered last week.

Let’s recap yesterday’s session and see what’s next!

Macro Viewpoint

Stocks took a breather early Tuesday, as signs emerged that the recent rally might have driven valuations too high.

Investors were also in wait-and-see mode, anticipating news about President-elect Donald Trump’s cabinet selections.

Market participants have been channeling funds into assets expected to benefit from Trump's second term, during which he has pledged to increase tariffs on imports from major trading partners, implement tax cuts, and roll back regulations.

Attention is now focused on upcoming U.S. inflation data, set for release on Wednesday, which could influence the Federal Reserve’s decision on a potential interest rate cut next month.

Prior Session Deep Dive

Yesterday, we introduced the concept of evaluating how “new” or “old” a trend is becoming.

About 70% to 80% of the market is in a rotational state, and the rest of the time it is trending. Understanding when the market is transitioning or when a trend begins to “age” can make a substantial difference in how you approach trading it.

One way to spot a loss of momentum in a trend is by monitoring value and observing how it begins to overlap, potentially signalling the start of a balance range.

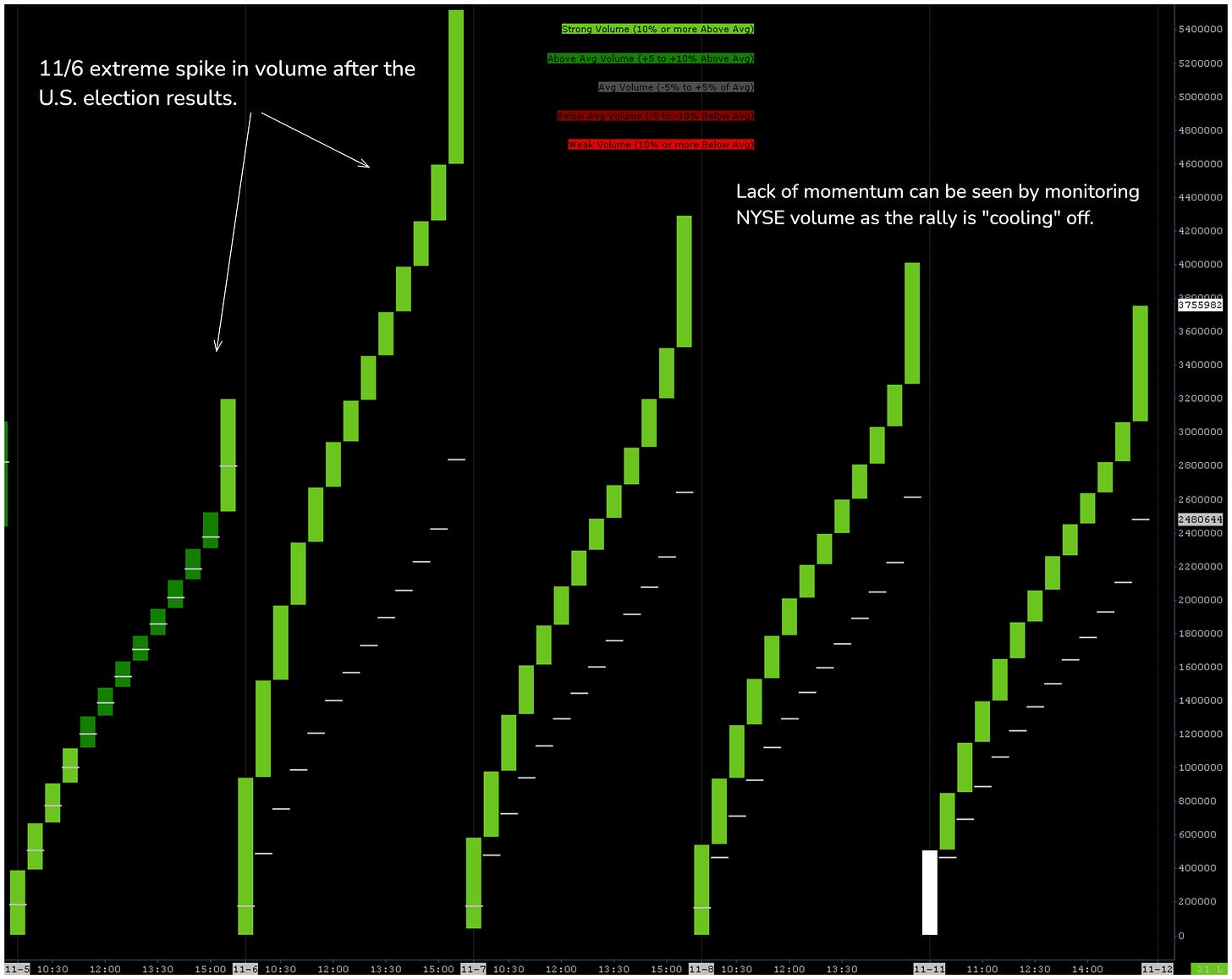

On the profile shown on the left side, you can clearly see how the explosive momentum after 11/6 led to an extreme gap, with upside value positioned far outside the previous range the following day.

You can drive a car between these two value areas. Then following the next session you can see that it starts to slow down and that gap is getting smaller.

When you begin having overlapping values like that and potentially to the downside, doesn’t mean the trend is over, it means it’s aging.

Taking a look at NYSE volume is a good way to identify this market behaviour and the loss of momentum which was the result of Monday’s session after it failed to breakout from our key flip zone of 6054.