The Market Brief

Hey team. U.S. futures edged slightly higher during early trading as the trade optimism lifted sentiment with investors now focused on the outcome of the weekend trade talks between China and the US.

Let’s re-cap yesterday’s session and see what’s next!

Macro Viewpoint

U.S. equities jolted higher yesterday after Trump announced a trade deal with the UK, while noting that if China talks go well, tariffs could be lowered.

Weekly jobless claims were uneventful, so we continue to await any erosion in the 'hard data.'

Hard data is likely to stay elevated for as much as another two months, as the impact of forward buying (by consumers and companies) ahead of tariffs continues to affect the data being reported today.

Wall St. Prime Intel

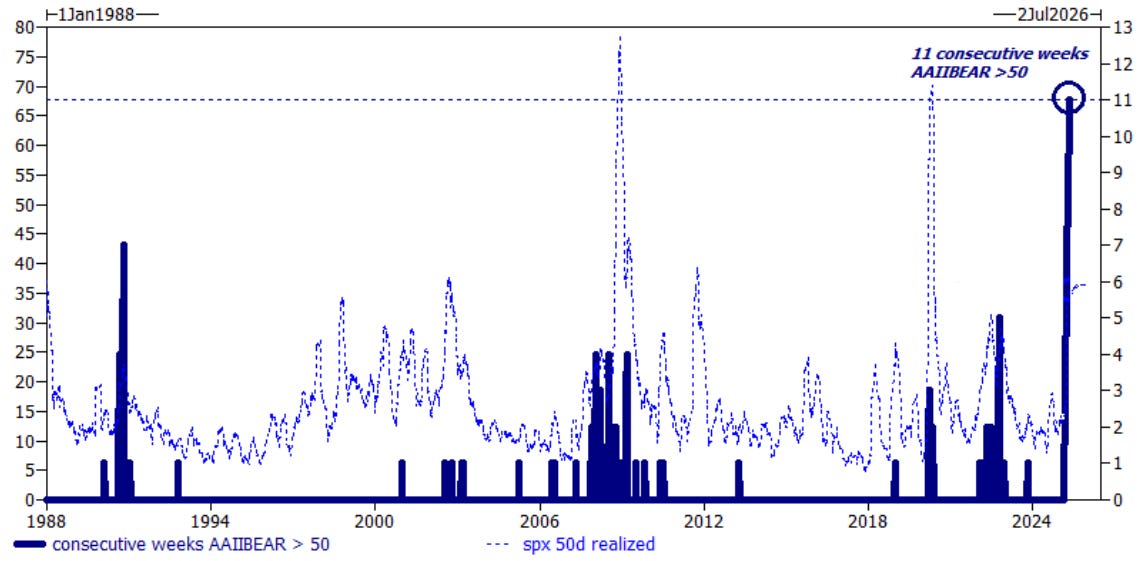

If you're bearish, you're consensus… it doesn't mean you're wrong, but you are in the majority. The AAII survey has been published every week since 1987.

In the history of this survey, investors have never been this consistently bearish… for 11 straight weeks, over 50% of respondents have been negative on the market.

If everyone is so bearish, WHO is buying this market?

We answer that question in today’s prime intelligence. 👇👇

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.