The Market Brief

Hey team, futures stalled during the overnight session as the market anticipates the jobless claims report in the lead-up to the monthly jobs data on Friday.

Let’s re-cap yesterday’s session and see what’s next!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

U.S. stock index futures showed little movement on Thursday, easing after all three major indexes reached record closing highs in the previous session. Investors are now turning their attention to additional employment data set to be released this week.

On Wednesday, Federal Reserve Chair Jerome Powell noted that the economy is performing better than the central bank had projected in September. His remarks suggested a preference for moderating the pace of future interest rate cuts.

Despite Powell’s comments, market expectations remain unchanged, with pricing still indicating another rate cut when the Federal Reserve meets later this month.

Thursday’s focus will be on the release of weekly jobless claims data before the market opens, serving as a prelude to the highly anticipated monthly jobs report scheduled for Friday.

Prior Session Deep Dive

Sometimes, doing nothing is your superpower. Traders often focus too much on taking action and end up exposing themselves to unnecessary risk. Entering a trade doesn’t take time. Preparing and waiting for it should.

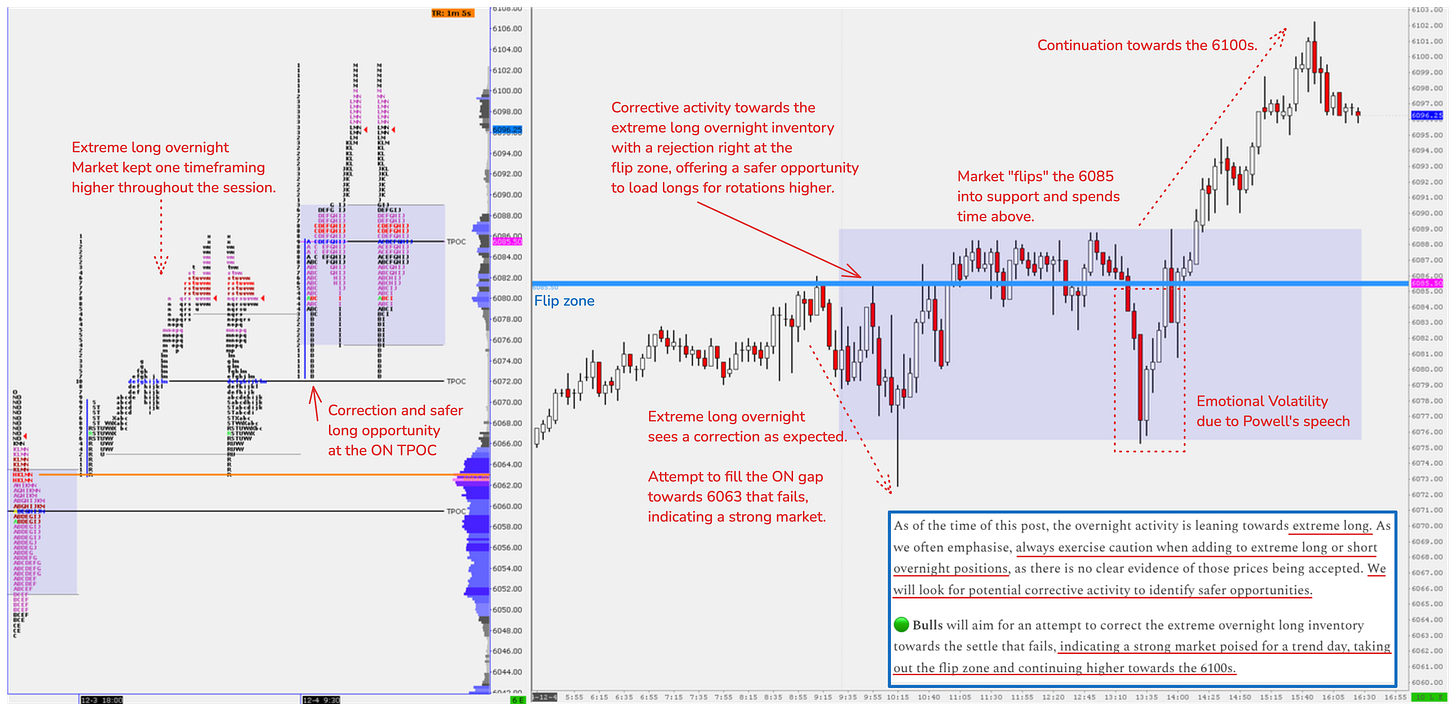

Exactly as anticipated in our brief, shared around three hours before the U.S. open, the overnight was in an extreme long state, and we projected warnings to refrain from piling in on that move without expecting at least some correctional activity.

It might sound a certain way to a beginner in this space, but profitability in trading has nothing to do with the strategy you use. It's all about risk and how you manage it.

Ask yourself: How much risk would I be taking if I simply piled up on an extreme move, and what is my target? If you don’t know the risk-to-reward (R:R) ratio of a trade you’re considering, you shouldn’t be placing that trade in the first place.

The market saw a perfect rejection right at the flip zone, which took three attempts to break through, pulling back over 13 points. This pullback offered a much safer trading opportunity for rotations higher, perfectly aligning with the bullish narrative of 'an attempt to correct the gap that fails.' (Gap is measured from the settle).

This led to a reclaim of the flip zone, which acted as the key level for continuation toward the 6100s, completing our bullish scenario for the session.