Hey team. U.S. equity index futures declined, putting the S&P 500’s longest winning streak in 20 years at risk, as uncertainty about US trade policy hung over markets.

Let’s see what’s ahead for the markets!

Impact Snapshot

🟥 ISM Services PMI - 10:00am

Macro Viewpoint

U.S. stock index futures slipped Monday as renewed tariff threats from President Donald Trump reignited fears of a broader global trade conflict.

Last week, markets found some temporary relief as signs emerged that trade tensions between Washington and Beijing might be easing. However, the ongoing tit-for-tat tariff exchanges have kept global markets on edge.

Meanwhile, economic data showed the U.S. economy unexpectedly contracted in the first quarter—the first decline since 2022. The drop was largely attributed to businesses accelerating imports ahead of expected tariffs, fueling concerns over a broader slowdown, even as the labor market remains robust.

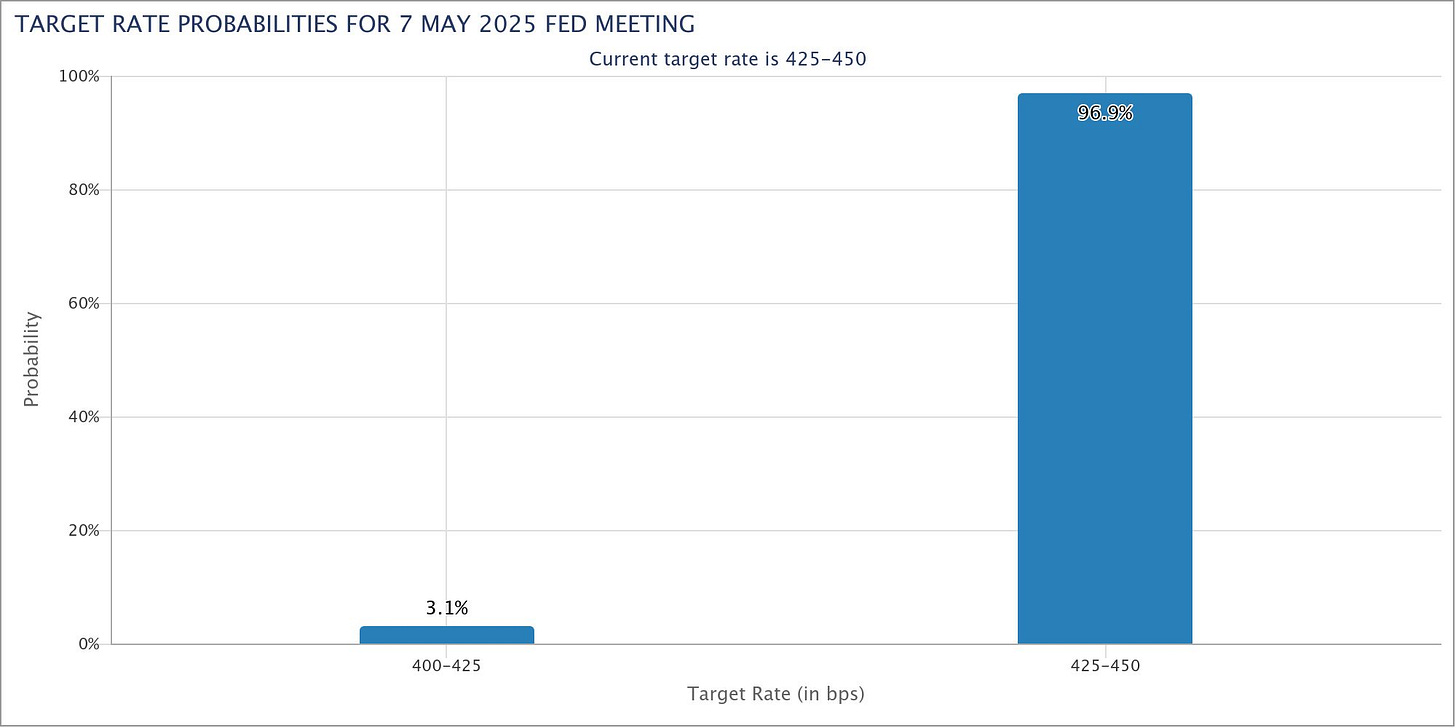

Looking ahead, all eyes are on the Fed, which is widely anticipated to maintain current interest rates when it announces its policy stance this week.

Traders are pricing in 25 basis points of easing only by July, and see a total of 116 points of cuts by the end of the year.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.