The Market Brief

Hey team. US equity futures rose as optimism grew over lawmakers in Washington reaching a deal to prevent a government shutdown.

Let’s re-cap Thursday’s session and see what’s ahead for the market!

Impact Snapshot

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Macro Viewpoint

Stock futures rose early Friday following a losing session that dragged the S&P 500 into correction territory.

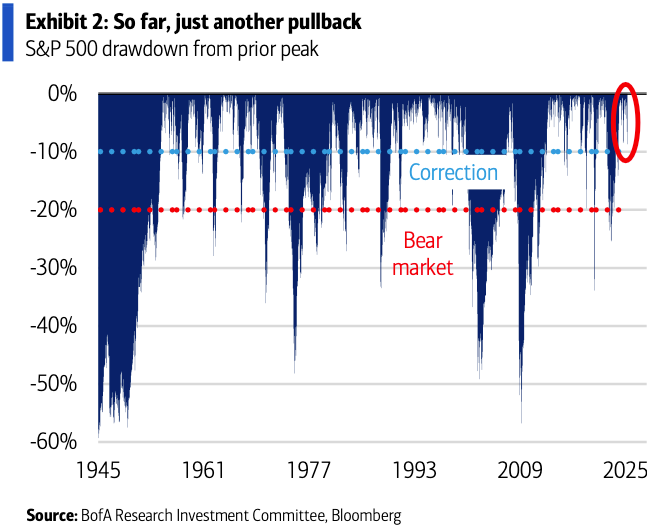

The S&P 500 officially entered "correction" territory yesterday, having dropped over 10% from its highs. However, for now, it remains just another correction.

Low PPI, following Wednesday’s slow CPI and strong jobless claims data—all of which helped ease stagflation fears—should have sparked some optimism, but it didn’t. Right now, the market is reacting more to tariff headlines than to actual economic reports or sentiment.

Stocks are forward-looking, and the two biggest concerns for investors at the moment—AI and a tariff-driven growth slowdown—have yet to fully take effect and reflect on the data.

Last month’s data was never expected to reflect these recent policy shifts, and even last week’s figures may not have been meaningfully impacted yet.

Prior Session Deep Dive

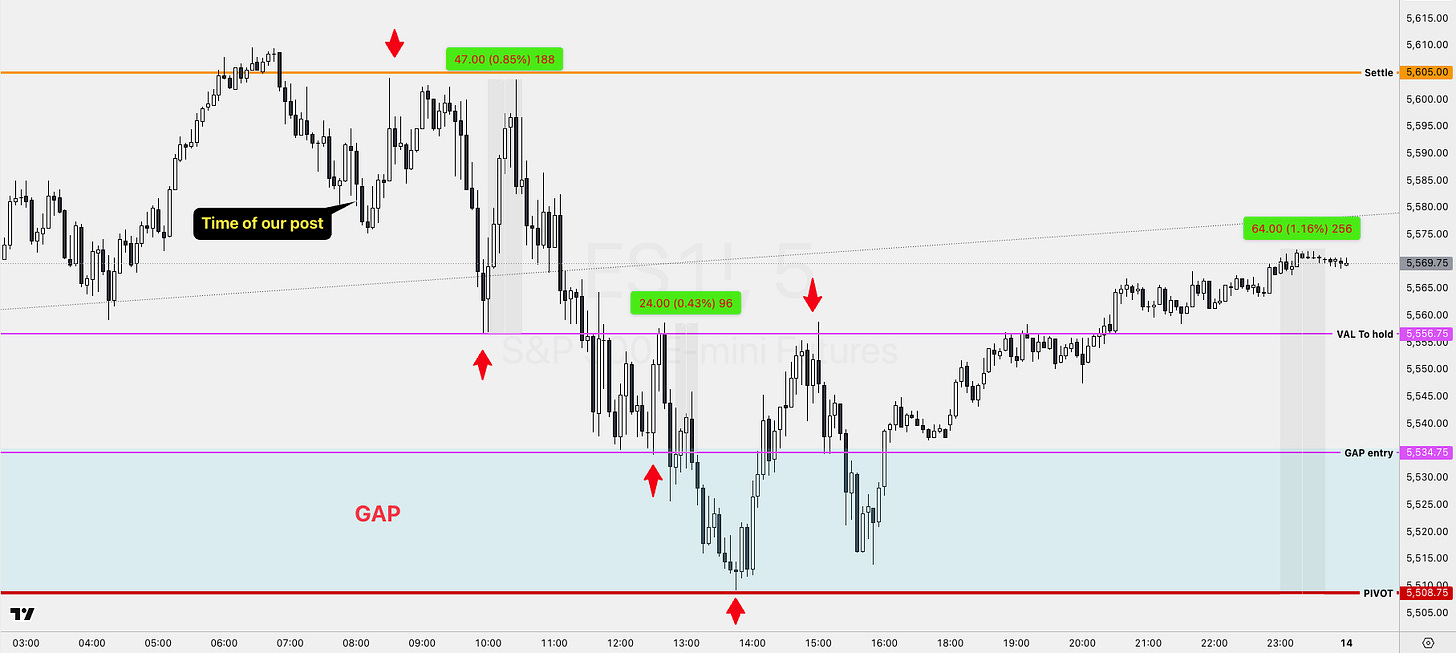

The chart you see above, along with all references, was marked at 8:00 AM ET prior to the PPI release. None of the candlesticks you see in this chart could have existed at that time.

Yet, the price action followed these exact references for profit-taking on a downtrend and bounced off our pivot to end the session.

TIP: It’s much better to trade with the trend by shorting rallies (in this case) and taking profits on breaks rather than attempting to go long on breaks and profit from rallies, which will yield smaller gains and carry higher risk until the market reaches its destination (e.g., Pivot). Profitability in trading is NOT your strategy; it’s risk management.

Wall St. Intelligence

Liquidity in S&P 500 futures has dropped below $4 million, the second-lowest level in two years. When the market lacks liquidity, any aggressive mover—in this case, CTAs hammering futures—can move the market to a greater extent.

Today, we’ve included insights reported by Wall St. dealers regarding the matter.👇