The Market Brief

Hey team. US equity futures rallied during early trading on Thursday on stronger-than-expected tech earnings and relief over signs the Trump administration is stepping back from its harshest tariff threats.

Let’s re-cap the last session and see what’s ahead for the market!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 ISM Manufacturing PMI - 10:00am

Key Earnings: AAPL 0.00%↑ AMZN 0.00%↑ LLY 0.00%↑ MA 0.00%↑

Macro Viewpoint

A shift in trade policy was the most obvious route for recovery in risk assets, and there has been a modest version of that playing out since April 9.

First, the 90-day pause on reciprocal tariffs, followed by product-specific exemptions and, more recently, seeming U.S. openness to negotiate with China.

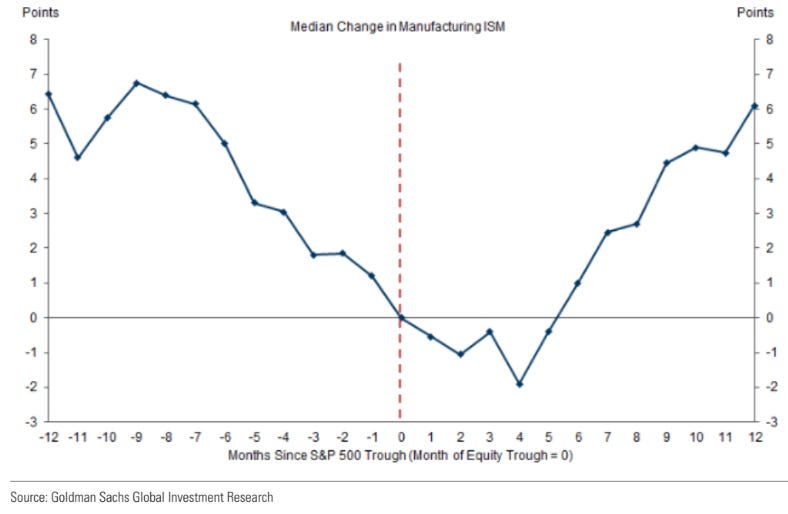

We remain cautious because the economic impacts of the fallout are yet to be fully understood and felt. Looking back through 70 years of history, most equity corrections tend to bottom at the trough in economic activity.

However, in instances of a clear catalyst driving weakness (a “shock”), it was enough for investors to see peak pressure from that source passing, conclude that activity would bottom soon, and therefore buy equities ahead of the trough in economic data.

US retail buying the dip

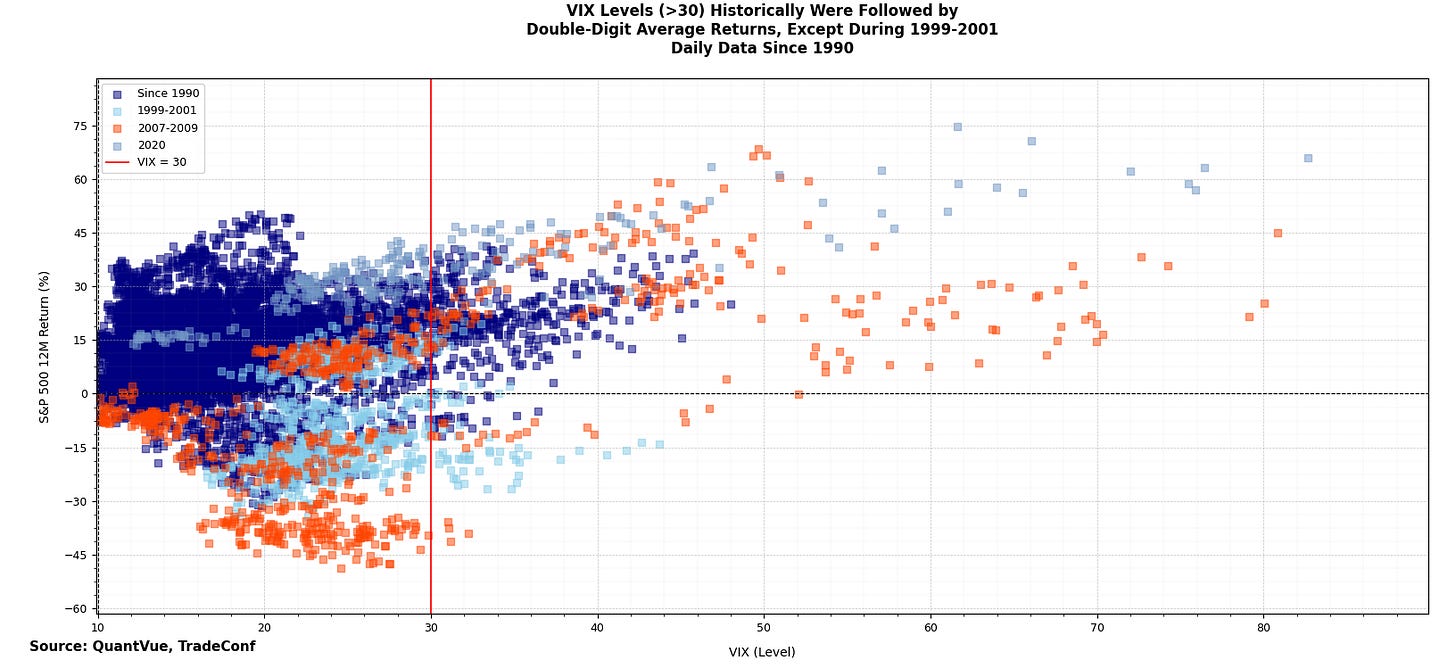

Except during 1999–2001, elevated VIX levels (above 30) have, since the 1990s, been followed by positive returns over the subsequent 12 months, including after major spikes during the GFC and COVID crisis.

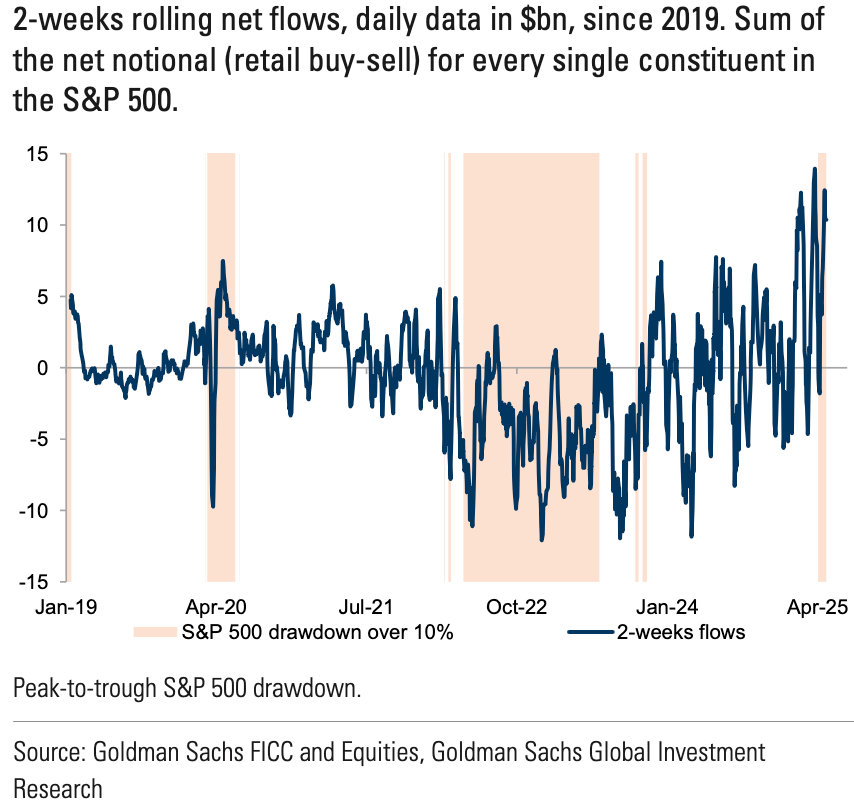

U.S. retail investors followed that historical template and bought the dip, while hedge funds partially added net exposures again after a sharp deleveraging.

Retail flows throughout the recent drawdown have been among the strongest in recent years — a third of the episodes where daily retail flows exceeded $2bn since 2019 occurred in March 2025, despite the potential for more negative macro momentum and lingering risks from trade tariffs.

Prior Session Deep Dive

The odds that you will succeed in the long term with trading are against you. It doesn’t matter whether you like hearing this or not — it’s simply a fact. About 90–95% of traders are unprofitable. Only 1% of retail traders stick around past five years.

One of the key reasons most fail is poor risk management and a lack of understanding of the market’s true intentions and objectives.

It’s easy to blame everything on a headline: “Well, U.S. GDP contracted — that’s why we dropped so much.” But what if you could see the move before that number came out?

The picture above shows the market outlook along with the references we shared with our subscribers yesterday at 7:00 a.m., when there was no news, no catalysts, or anything in between. We were simply looking at the market and charts.

More often than not, the market has to break before it can rally back up. This allows it to shake out some of the weaker longs that have driven the upside and replace them with stronger money buying in.

We would consider a 128-point intraday pullback “significant” any day of the week. The market retraced all the way back toward our references and bounced to the tick from our first downside support.

A face-ripping short-covering rally followed, targeting a bounce of over 168 points to find the cash session top at our first upside level of 5624.

“It was just the news”

“CNBC: Yeah, Jim, these were some bad GDP, ADP, and PCE numbers. Look at the market reacting to them. Yep, they didn’t like it—surely down only from here.”

Most of the “talking suits” you see sitting on these panels every morning discussing markets can’t see past their noses, and whatever they’re yapping about has to do with longer-term horizons.

Go attempt to day trade the “recession” everyone in there talks about, and go short every rally — see how it goes. Investing and day trading are two completely different fields.

“CNBC: Quick, pass us the next positive headline so we can justify why the market bounced and the entire market is somehow green now.”

These guys don’t get or know when the market is coming to support. They don’t understand what the imbalances are or where key market participants bought or sold and are likely to defend their positions. They don’t know what systematic CTAs turned to buyers this week means.

You must enter the market every day with an open mind and a fresh look, free of hard bias and outside noise.

They won’t make it easy for you, but if you truly understand what’s happening under the market’s surface, you will begin building that field of vision and anticipate things before any news or catalysts could have ever hit.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.