The Market Brief

U.S. futures were higher during early trading on Friday, ahead of Federal Reserve Chair Jerome Powell’s Jackson Hole address, with markets scaling back bets on imminent rate cuts.

Impact Snapshot

🟥 Jackson Hole Symposium

🟥 Fed Chair Powell Speaks - 10:00am

Macro Viewpoint

A selloff in big tech this week has halted US stocks’ record-breaking rally.

Investors are awaiting Powell’s latest policy blueprint, weighing whether the Fed will stay cautious on inflation, which is showing signs of stickiness, or tilt toward supporting a softer labor market.

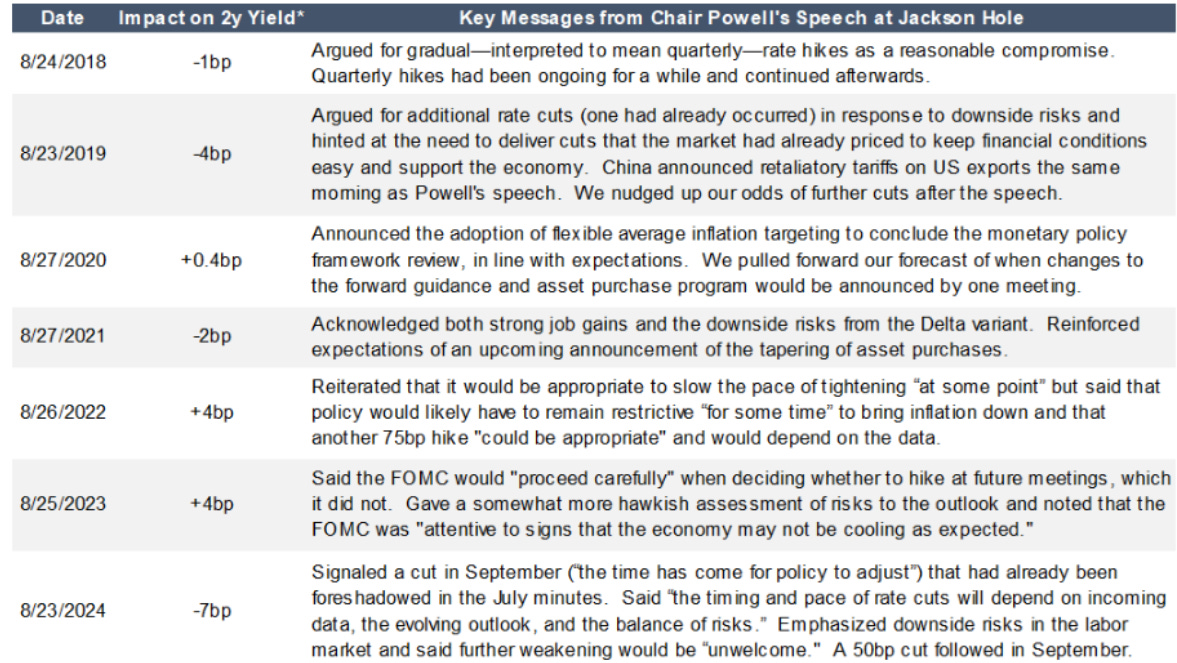

Jackson Hole

Chair Powell has often given policy guidance and moved markets in his speeches at Jackson Hole.

We expect Powell to modify his statement from the July FOMC press conference that the FOMC is “well-positioned” to wait for more information.

He will likely note that the FOMC is well-positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We do not expect him to decisively signal a September cut, but the speech should make it clear to markets that he is likely to support one.

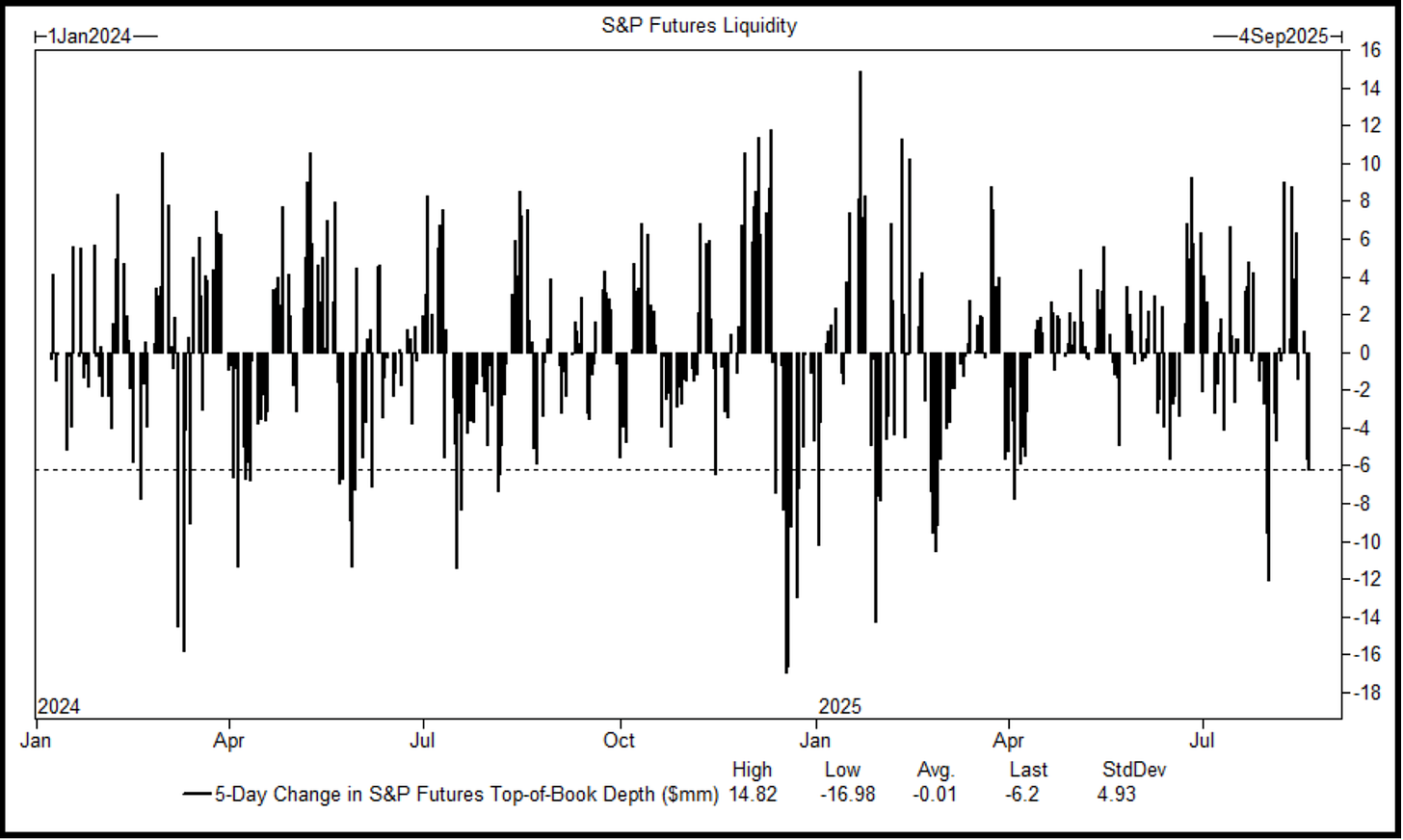

Prime Intelligence - Liquidity

Starting to really feel like the end of August. S&P E-mini top-of-book depth was sub-$10m on the touch yesterday. The 5-day decline in liquidity of -$6.2m is one of the larger drops we have seen in the last few years.

Leading to today’s “catalyst,” the liquidity continues to suffer. Persistent periods of low liquidity can increase risk for all market participants by making markets less efficient, more volatile, and more costly to trade.

This is a FREE edition of the Market Brief. Do you want our additional institutional-grade market Intelligence? Consider becoming a paid subscriber.👇