The Market Brief

US futures edged higher at the end of a week in which markets saw a slew of tariff headlines, geopolitical developments, and corporate earnings.

Macro Viewpoint

The S&P 500 is hovering close to record levels after climbing 30% from its April lows, driven by strong corporate earnings and growing expectations that the Federal Reserve will lower interest rates to bolster the economy amid signs of a softening labor market.

With “Liberation Day” in the rear-view mirror, companies and households are bracing for higher costs of imports.

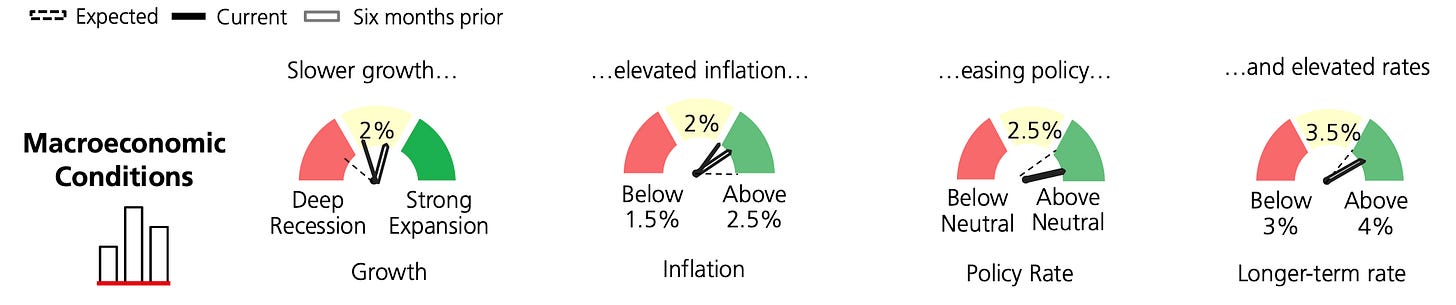

Policy already affecting growth. 1Q and 2Q GDP reports show significant trade-related swings while the underlying growth momentum shows more signs of slowing.

Even with inflation likely to swing higher over the next few quarters owing to tariffs, the Fed will likely cut rates to prolong the cycle starting in September.

This is a FREE edition of the Market Brief. Want our institutional quant insights on a daily basis? Get access by becoming a paid subscriber. 👇.