The Market Brief

U.S. futures inched higher in early trading as investors bet that Wednesday’s economic data will bolster expectations for an interest-rate cut in the coming week.

Impact Snapshot

🟥 ADP Payrolls - 8:15am

🟥 ISM Services PMI - 10:00am

🟥 President Trump Speaks - 2:30pm

Macro Viewpoint

U.S. stock index futures edged higher on Wednesday as investors priced in a high chance that the Federal Reserve will cut interest rates this month and awaited a fresh set of economic data.

Data on manufacturing activity and holiday shopping sales have painted a mixed picture of the economy, although traders have welcomed signs that several influential policymakers have taken a more dovish stance on interest rates in recent days.

Did you.. get chopped?

Most traders check the economic calendar, pick a direction, and full send it, often without realizing they’re taking on significant risk by ignoring the current market environment.

The context and pivot levels above were shared during our pre-market brief yesterday. A look at that context above makes it clear that we expected Tuesday to be a very choppy session.

This newsletter publishes in the overnight hours, often at 5:00 AM. Yet it consistently anticipates market behavior before any news, headlines, economic data, or price action could have ever existed.

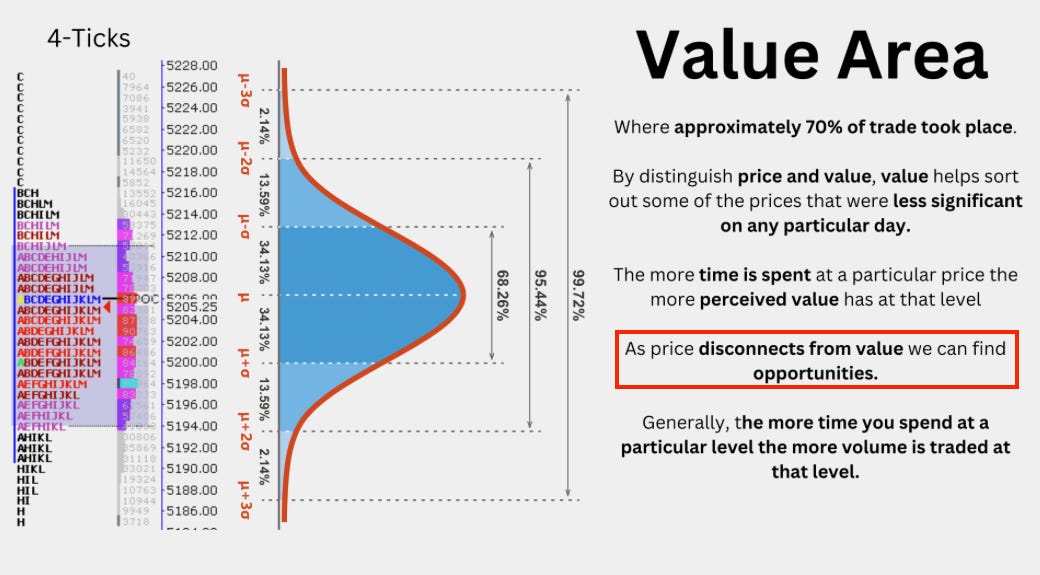

A key part of our approach is applying a probabilistic framework to market analysis. The shape on the image above might look familiar. When there are no catalysts strong enough to push the market away from equilibrium, prices tend to rotate between the edges and midpoint of that distribution curve, creating range-bound conditions.

We offer a FREE ebook with a Substack subscription that breaks down our complete framework for analyzing price action through a probabilistic approach.

Will the chop carry over in today’s session? Let’s find out👇

To receive our daily trading plans directly in your inbox, consider becoming a subscriber below.

We help you develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack. .