The Market Brief

U.S. futures were little changed following the previous session’s broad-based rally, as investors looked ahead to a packed week of earnings reports that could shape the direction of the market.

Macro Viewpoint

Stocks climbed on Wall Street yesterday as upbeat corporate reports and signs of easing friction between the world’s two biggest economies lifted investor confidence.

With earnings season in full swing, roughly 85% of S&P 500 companies that have announced results so far have surpassed profit expectations.

That wave of strong performances has powered a rally in equities, giving the benchmark index its strongest two-day advance since June. Optimism was further supported by growing hopes that trade tensions will ease as the US and China prepare to resume talks.

Prime Intelligence

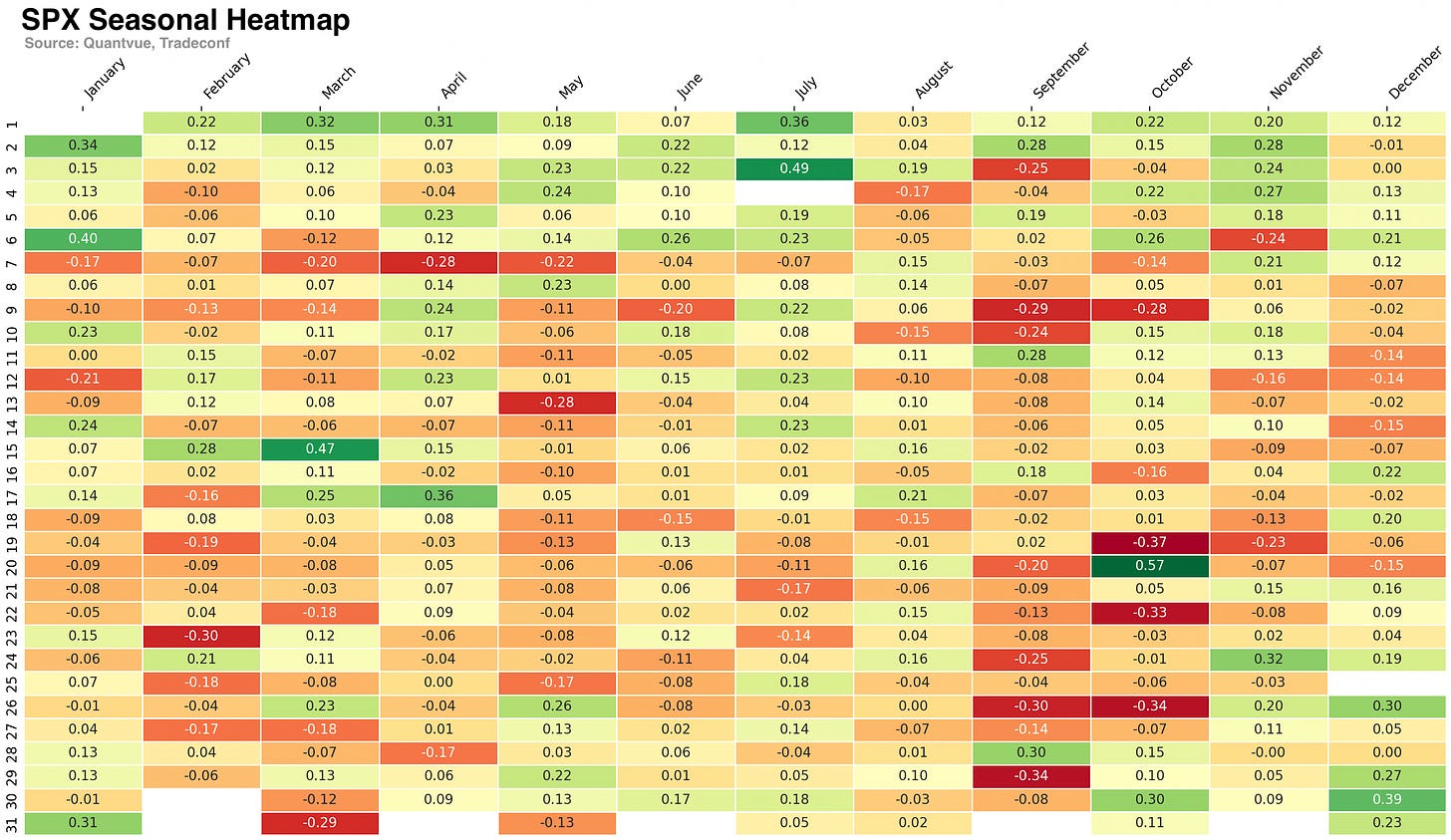

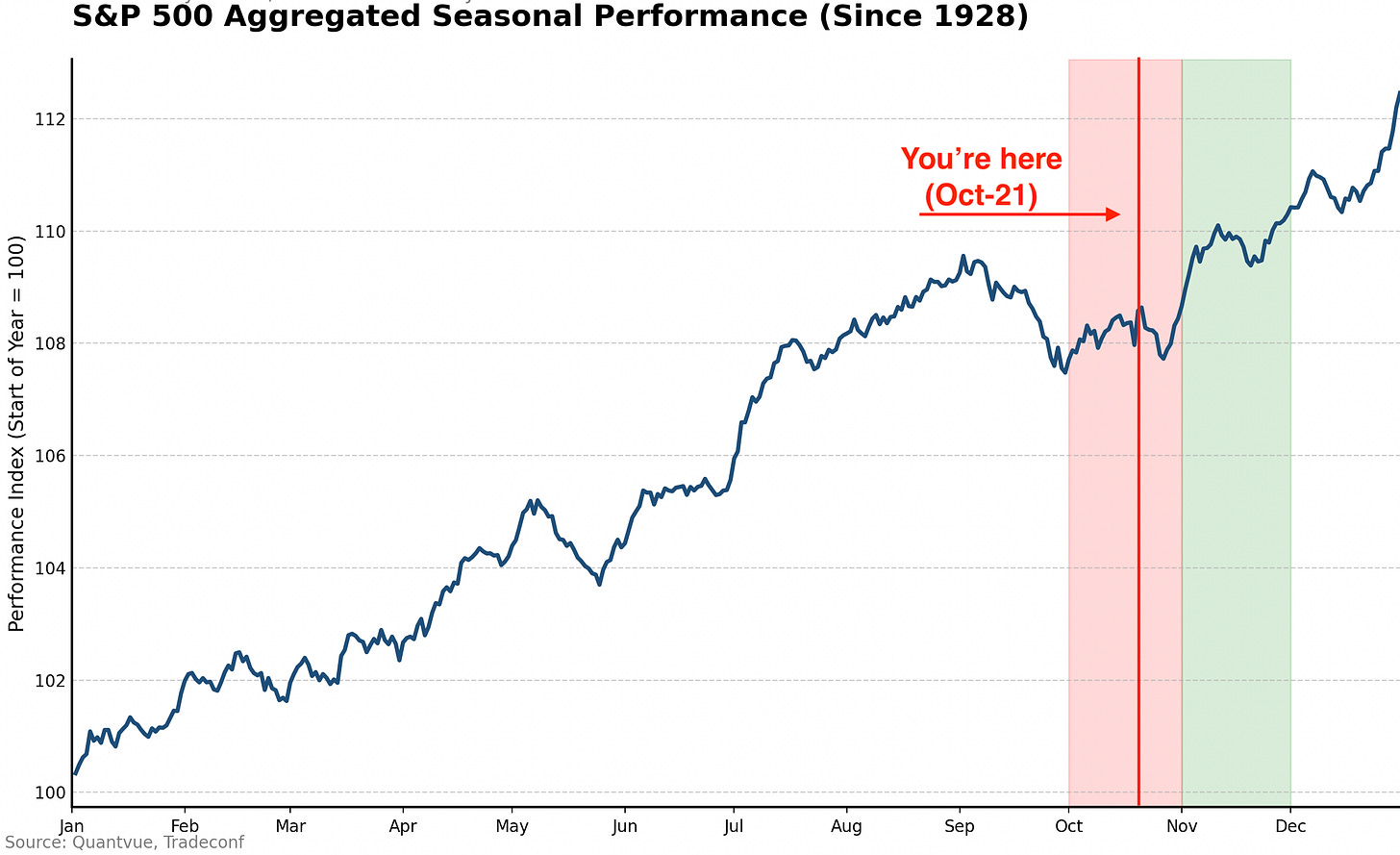

Looking back from 1928, October 20th (y-day) was the seasonally best trading day of the year with an average return of +57bps. The remainder of October has historically seen choppy price action prior to year-end holiday euphoria.

The average S&P 500 return from October 20th to December 31s is +4.08% since 1928. The average NDX return from October 20th to December 31st is +8.48% since 1985.

📰 In today’s brief, we’ve authored an article on why volatility is high and will persist, as we’re covering the activity of dealers gamma, mutual funds, and much more.