The Market Brief

Hey team, futures have stalled as the market is anticipating the all-important inflationary numbers due tomorrow, which will play a pivotal role in how the market ends the year.

Let’s re-cap the last session and see what's next!

Macro Viewpoint

U.S. stock index futures stalled on Tuesday as investors held back from making significant moves ahead of a key inflation report this week, which could impact the Federal Reserve's decisions at its upcoming monetary policy meeting.

Markets are in a holding pattern ahead of Wednesday's release of the consumer price index (CPI), the last major inflation reading before the Federal Reserve's policy meeting later this month.

Any indication that progress has stalled on the inflation front could well undercut the chances of a third straight reduction in rates.

Investors are closely watching both Wednesday's CPI data and Thursday's producer price index (PPI) report, ahead of the Federal Reserve's meeting on December 17-18.

Prior Session Deep Dive

One thing nobody can take away from you in the market is preparation. Charts reveal what is truly happening, in contrast to fundamental data, which helps us craft market narratives and scenarios that are often executed to the tick, even when shared hours in advance.

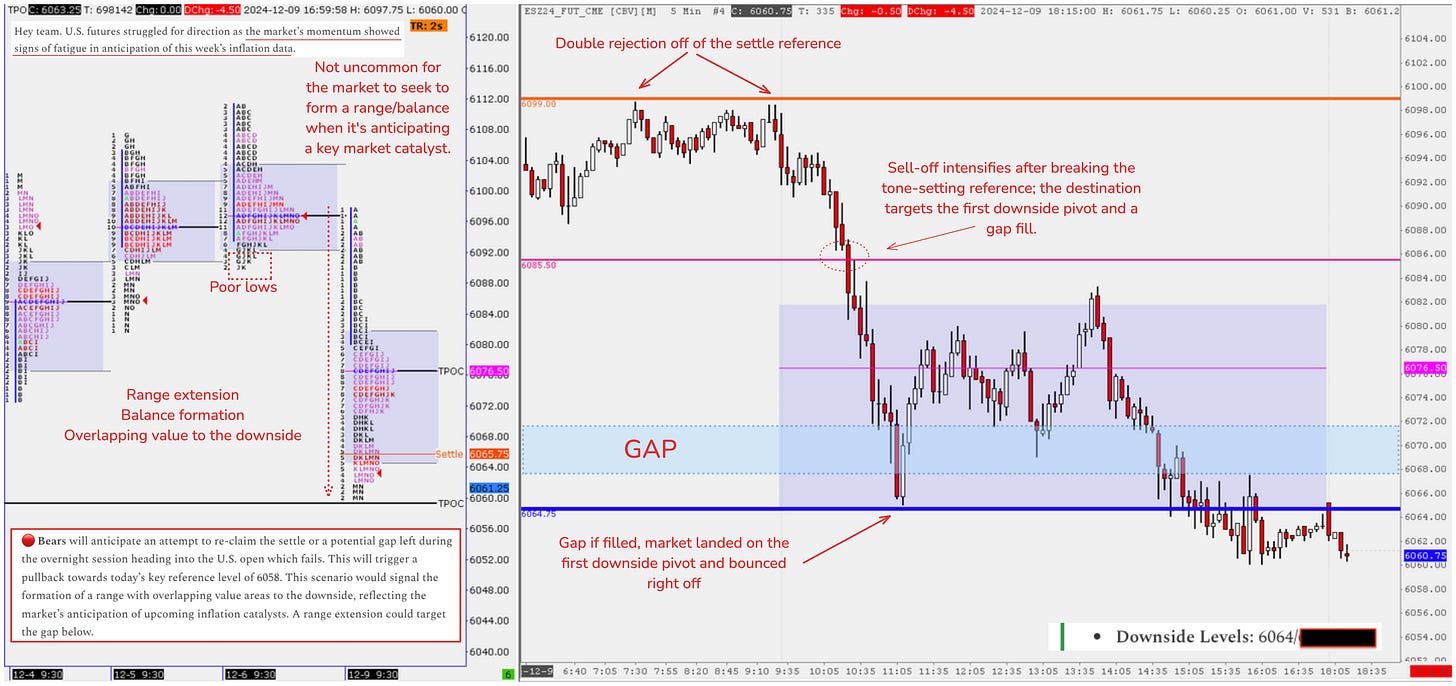

Monday’s session saw the execution of the bearish scenario we’ve shared since 6:00 AM ET play out exactly as anticipated. The goal is not to “predict” what is going to happen but rather to build a solid framework of potential outcomes.

Being prepared and having a solid framework with scenarios and pivots is a mandatory process to compete in the markets, no matter which securities you decide to trade.

A collection of data points was taken into account as we wrote this scenario and placed our reference points.

The market has been rising on thin volume, a clear sign of momentum fatigue.

Friday’s session featured a b-shaped market profile, a typical long liquidation day that left poor lows in need of repair, unfinished downside auction.

The gap to the downside was an obvious destination target for the market to fill, landing on the first downside pivot immediately after.

A double rejection off the settle reference served as the trigger point for the bearish scenario, exactly as highlighted.

When anticipating key economic reports, the market often refrains from making “big bets” and tends to form a consolidation range. This is precisely what Monday’s session demonstrated, with an overlapping value area to the downside as the market entered the balancing phase.