The Market Brief

U.S. futures edged higher as indices pulled back from fresh all-time highs, with the government shutdown dragging into its ninth day during Thursday's session.

Impact Snapshot

🟥 Consumer Sentiment - 10:00am

🟥 Inflation Expectations - 10:00am

Macro Viewpoint

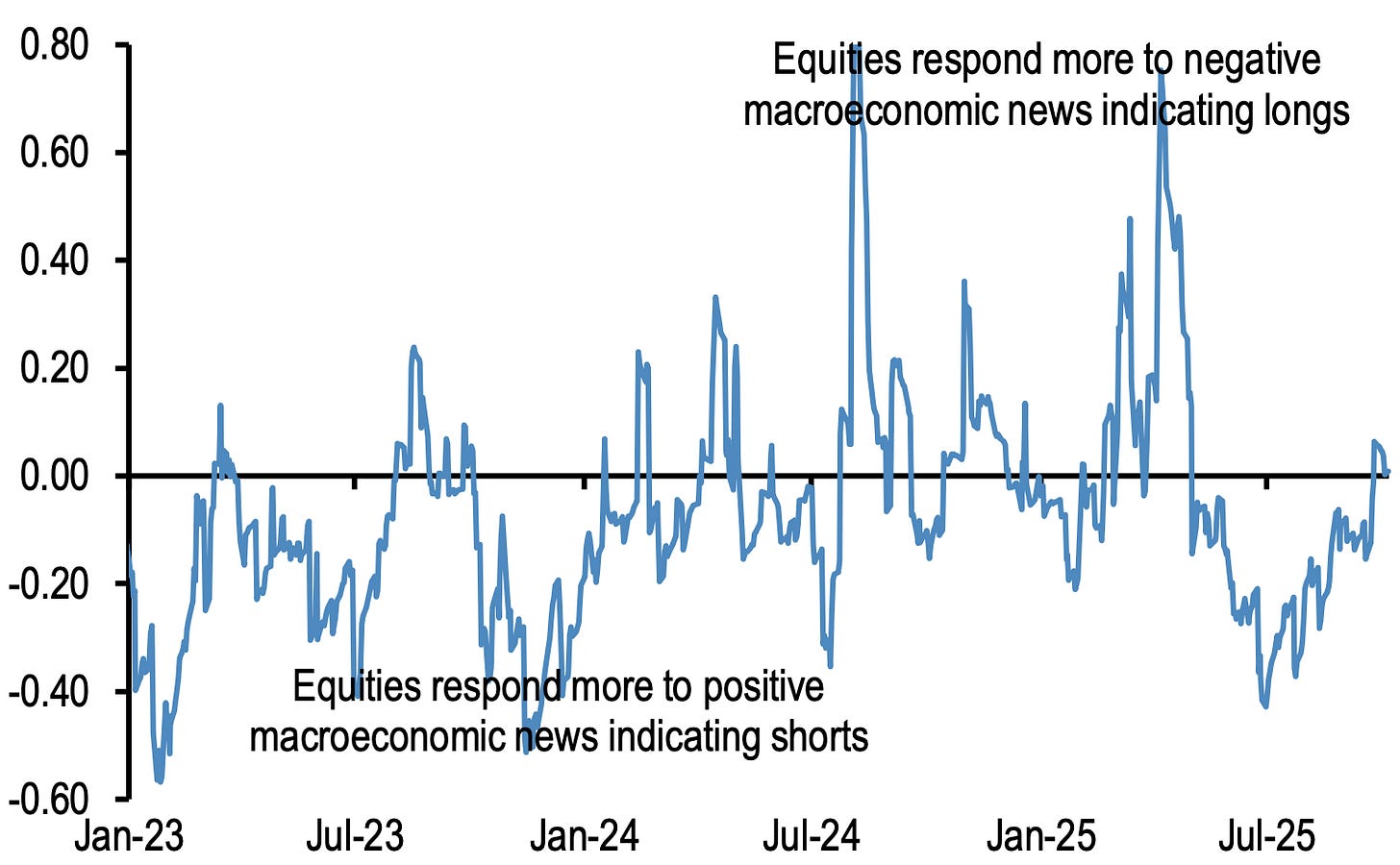

The equity market has been trading short until the last few weeks.

While overall reactions to positive and negative news have become more normalized at the aggregate level, positioning proxies indicate that some investors continue to exhibit more cautious positioning.

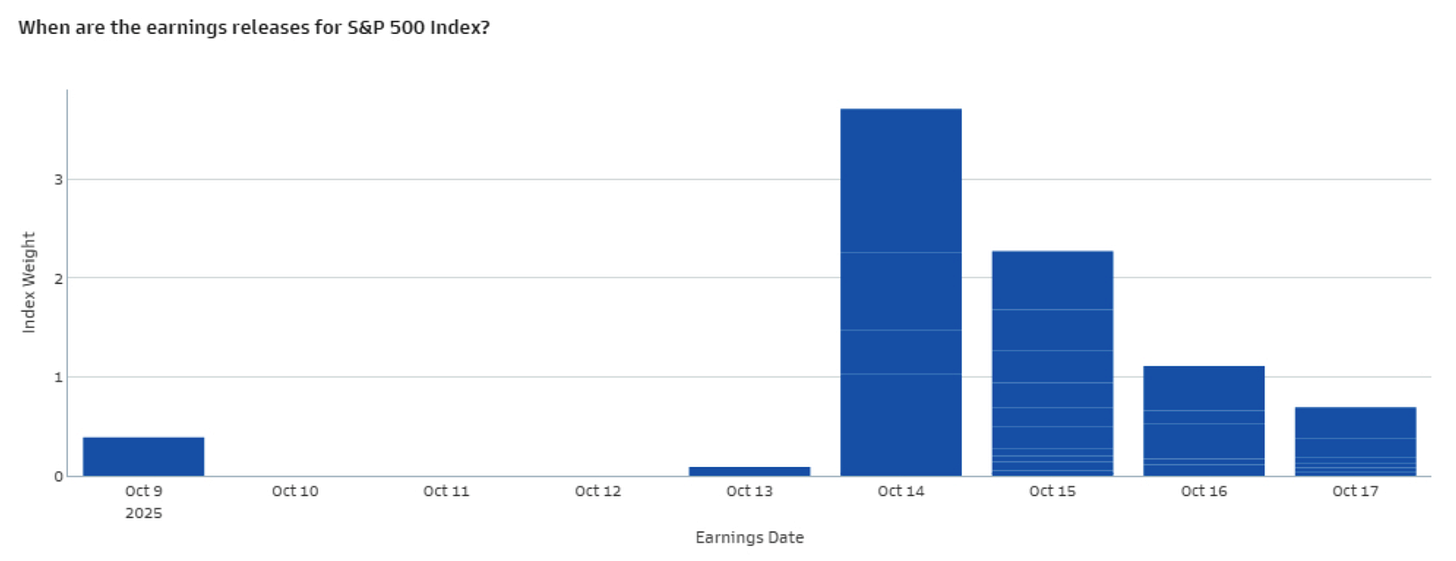

Up next, the Q3 earnings season is kicking off, the moment when numbers meet narratives. Several major financial institutions report next week, and together they make up more than 7% of the S&P 500.

Wall St. Prime Intelligence

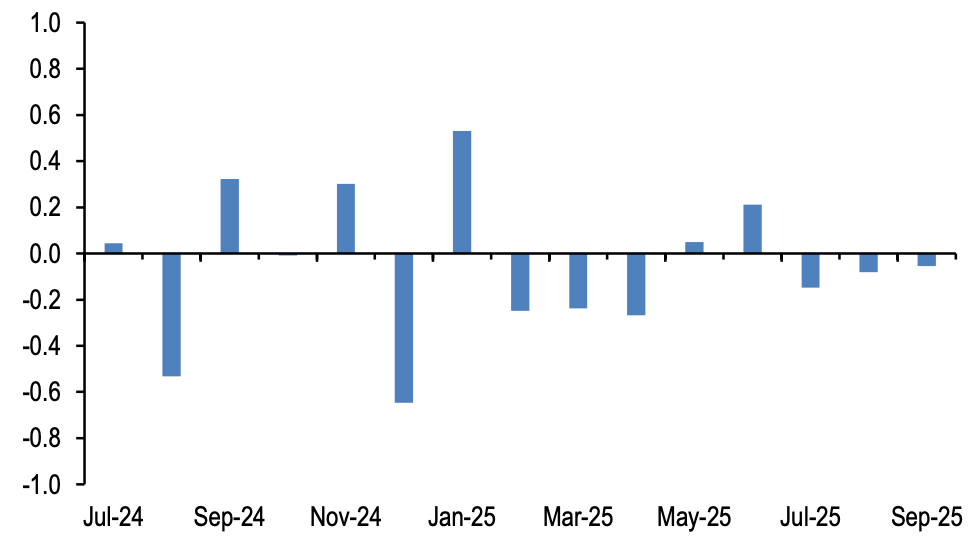

The beta of global equities to economic news shifted into negative territory from early May, with this negative beta reaching its most elevated level at the end of June.

Effectively, this suggests that as the equity market recovery from the April troughs gathered pace, investors found themselves more short than they would have liked, given the resilience in economic data releases, which in turn, helped further propel the equity market recovery.

Only in late September did the beta turn more neutral again, suggesting that the overall reaction to positive and negative news has become more normalized at the aggregate level.

One group of investors that still appear to be somewhat cautiously positioned are macro hedge funds.

This suggests that speculative investors’ exposure to U.S. equities is not particularly elevated and, in principle, has room to rise.

This is a FREE edition of the Market Brief. To receive our institutional-grade intelligence every day, consider becoming a paid subscriber.👇