Hey team. U.S. Futures are trading higher on renewed hopes around US/EU trade talks and some relief in global bond markets, as the BOJ signals a move to tamp down domestic bond volatility.

Let’s see what’s ahead for the market!

Impact Snapshot

🟧 Consumer Confidence - 10:00am

Macro Viewpoint

It was a fairly active long weekend, with markets catching a bit of a bid after the EU/US tariff showdown—originally set for June 1—was pushed out to July. The delay followed what Trump described as "a very nice call" with EU Commission President Ursula von der Leyen.

The yield curve is bull flattening while the dollar strengthens, which could be laying the groundwork for US assets to outperform.

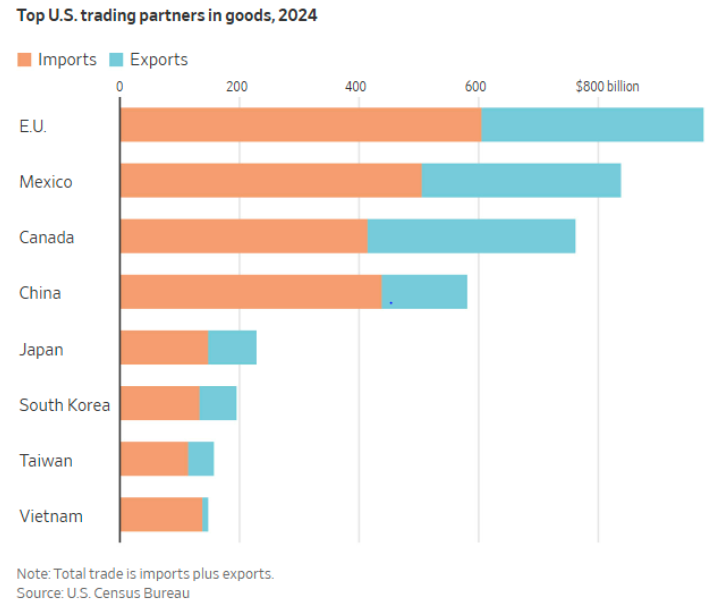

The EU remains the US’s biggest trading partner. Trump had floated tariff increases up to 50%, but the actual decision has been pushed to July 9, lining up with the end of the previous 90-day extension.

After all of the volatility and uncertainty the market has been conditioned to not take these “trade declarations” literally but a part of a continuum of negotiation.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.