The Market Brief

Hey team. US stock futures rose and the dollar gained after President Trump suggested a major trade deal was near, fuelling hopes of progress in tariff talks.

Let’s re-cap yesterday’s session and see what’s next!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

As widely expected, the FOMC left the fed funds rate unchanged and offered little guidance about its next move at its May meeting.

Chair Powell said repeatedly that while tariffs have increased the risks of both higher unemployment and higher inflation, policy is in a good place and the FOMC can wait and see how the economy evolves for now.

Three key Points from Powell’s press conference

The bar for a rate cut will be higher than in 2019, when inflation was much lower.

While the FOMC puts some weight on the survey data, it will need to see weakness in the hard data to cut in light of the surveys’ poor recent track record.

The case for a cut would be most compelling if the hard data broadly gave a sense that the unemployment rate is trending higher.

For markets, this means that there are no easy answers about the Fed path for now. Where tariffs stand now, though, suggests that they will eventually weaken the economy enough for the Fed to cut.

It usually takes longer for the hard data to deteriorate during slowdowns, and for a few reasons, it might take a bit longer than usual this time.

Prior Session Deep Dive

You don’t know

It’s not easy to try and “read” what’s coming. The fact is, nobody knows. If someone told you they “know” 100% what the market is gonna do, they are full of it.

Hedge funds with multi-billion dollar capital that employ the most sophisticated strategies don’t either. They wouldn’t be called “hedge” funds and wouldn’t have to “hedge” risk. They would just go max long & short any asset and make trillions a day.

They employ people with the brightest PhDs to make models that assess risk and build frameworks to be ready for what’s coming (e.g., hedge upside short-term risk with futures, hedge downside risk with VIX options, etc.).

Frameworks & Preparation

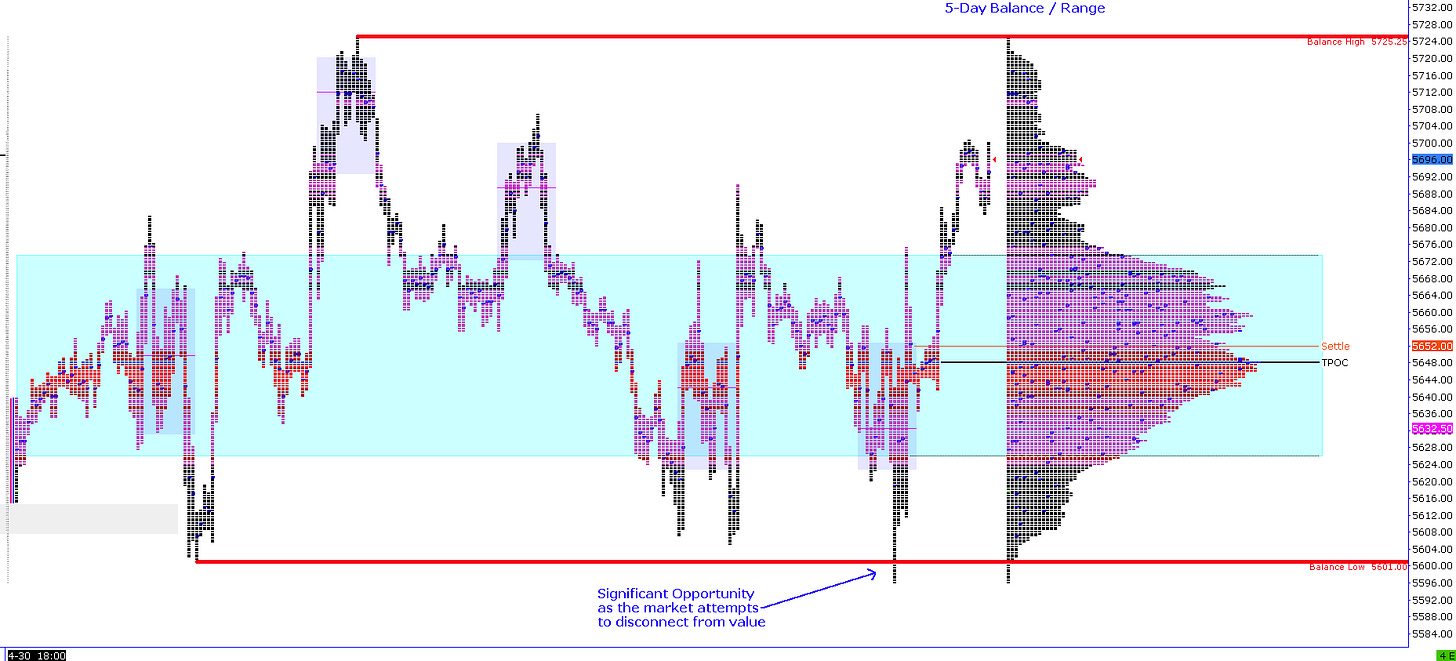

Sit back and digest the significance of the outlook context we shared yesterday prior to the U.S. open. This is the exact context we shared before none of these candlesticks or “news” could have existed at 7:00 a.m. ET. [Here]

You might think that the price action at 2:00 p.m. after interest rates was “fully random” but how could we expect the exact follow-up the market did and be ready for it?

Watch this replay of yesterday as the market comes into the 2:00pm and visualise what happened related to what we expected on our Outlook. (Replay is x60 time speed).

Ask yourself, and be able to answer with honesty: how many would tell you this was just “random FOMC news price action”? Now look at the replay after the fact and ask yourself—what really happened?

The look below balance and fail coincided with the 'swing in one direction followed by an equal swing the other way' nuance we shared. It’s almost an art how well that played out.

Make Randomness Work

Markets are random. Any long-term success you’ll have will be based on gaining a probabilistic advantage that has the odds in your favor. Remember, it’s just odds, not absolutes.

Hope is not a strategy. Good luck going against probabilities with zero confirmation whatsoever of any follow-up. It’s better to be a bit late to a move than be too early and wrong.

The low from yesterday was a look below balance, which saw a bounce back in value and a rotation toward the other end of that balance.

We gave you the blueprint of how to look at markets based on stats one day ago [Here]. Whatever happens in lower time frames exist on higher time frames.

If you want to receive our daily market nuances and outlook just like the one you see in today’s deep dive, please consider becoming a paid subscriber.