The Market Brief

U.S. futures lower early Thursday after Oracle's forecasts raised fresh concerns about hefty AI spending and outweighed optimism following a less hawkish tone from the Federal Reserve.

Impact Snapshot

🟥 Unemployment Claims - 8:30a.m.

Macro Viewpoint

A risk-on rally post-Fed yesterday as the press conference came in better-than-feared: Powell said the Fed will be in a wait-and-see mode and sees a rate hike not being the base case.

Powell mentioned the “somewhat elevated” inflation and “gradually cooling” labor market to explain today’s rate cut. He also mentioned that more than half of the excess goods inflation is tariff and sees them to be more “short-lived”.

ORCL 0.00%↑ is a key driver of the overnight pullback after the company reported quarterly revenue below expectations and issued underwhelming guidance that highlighted sharply higher AI-related capital spending and slower-than-expected cloud growth.

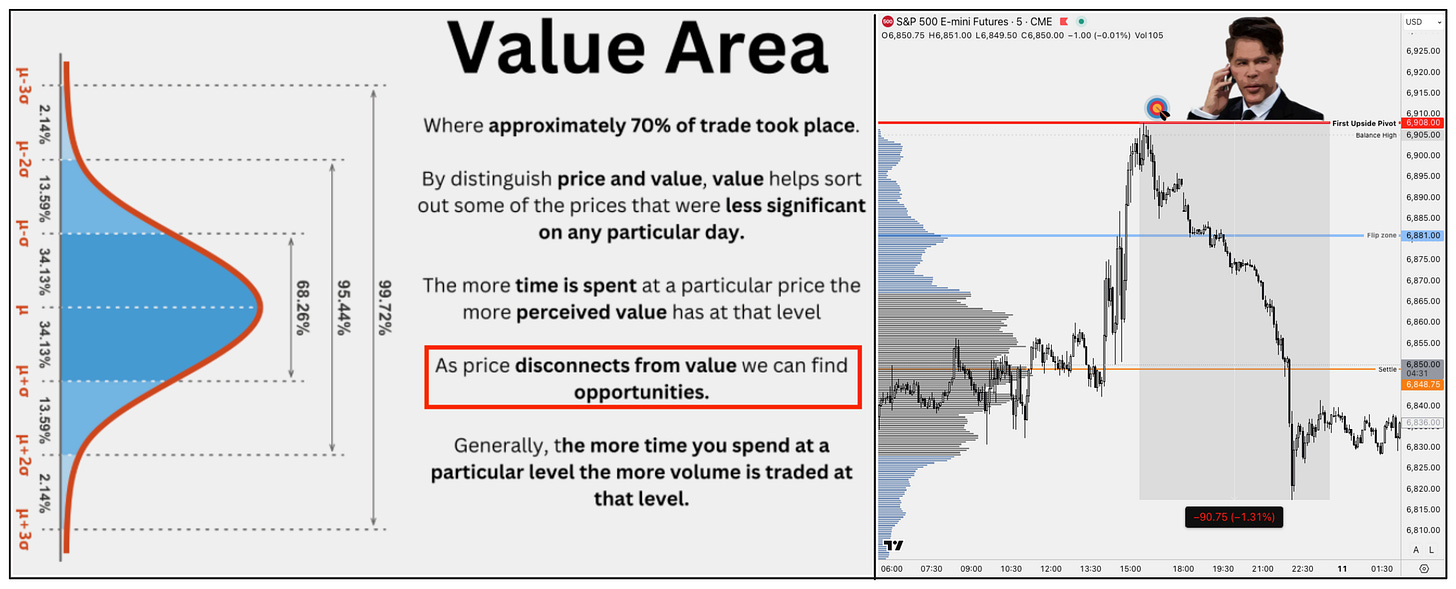

Range Operations

In this video, we share some insights on how we narrated what the market was likely going to do before the U.S. session yesterday, explaining why the volatility that followed occurred as a significant portion of traders removed their limit orders from the bid/ask, which allows aggressive buyers and sellers to freely move the market. (Watch this video for further explanation).

By understanding the environment you’re operating in, the backdrop and market behavior that can follow, you can significantly improve your risk management, and for that matter, save yourself from absolute disaster.

All the concepts mentioned in this video are expanded in detail in the ebook we offer for FREE to our Subscribers. This is a statistical approach to the market that doesn’t care about external factors such as “news”.

Probably has a lot to do with why we can literally explain what the market will do hours before the fact and why there is such an aggressive reaction from our pivots when no news, economical releases or price itself could have EVER existed at that time..

If you want a data-driven approach to the market that justifies market moves based on facts and actual data instead of blaming “the news” for any particular market move, consider becoming a paid subscriber.

Was this really the top of the market, or do we expect more continuation? 👇