The Market Brief

U.S. futures hovered near record highs in early trading, lifted by growing optimism that the Federal Reserve may resume its monetary policy easing as soon as next month.

Macro Viewpoint

It was a busy day in markets yesterday, with the US CPI release driving a sharp rally across US equities. Consumer prices rose 0.2% in July, with core CPI up 0.3%, broadly aligned with expectations.

While the details continue to show upside pressure on certain goods, the firming in core inflation has arguably been less than feared.

Technical drivers were also behind the positive price action, including gamma unwind breaching key levels for call options, and positive flows (foreign buying of large caps supports index price action, and CTAs turning more net long).

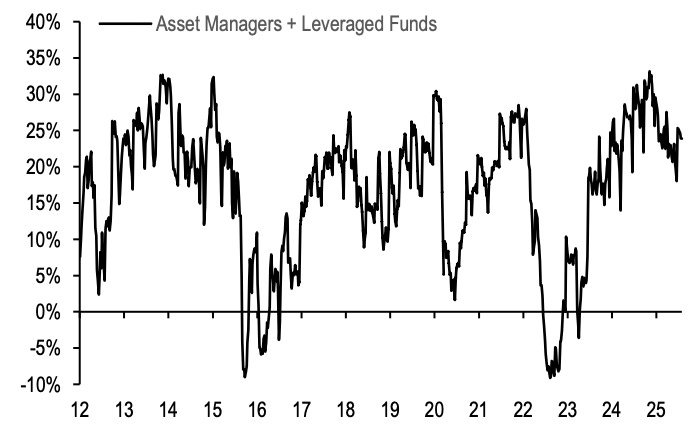

The moves caught some institutional investors off guard, especially leveraged funds that have recently increased shorts in the Russell 2000. AMs and LFs have yet to show signs of chasing the rally to any serious extent.

Investors will be watching US PPI on Thursday and retail sales the following day for fresh clues on how the US economy is holding up.

This is a FREE edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.👇

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.