The Market Brief

Hey team. We hope you had a wonderful Thanksgiving and are enjoying the break from the charts during this shortened week!

As we transition into Black Friday with an early market close, here’s a recap of Wednesday’s session along with a summary of this week’s key events.

Macro Viewpoint

U.S. equity futures advanced, signalling modest gains in Wall Street’s shortened post-holiday trading session on Friday.

The S&P 500 has climbed 5% so far in November, positioning it for its strongest monthly performance since February.

Optimism surrounding President-elect Donald Trump’s Treasury secretary nominee has lifted U.S. stocks and bonds, while weakening the dollar, amid hopes that any future tariffs will be measured.

This week also marks the end of November’s trading, which has been driven by a post-election rally following Trump’s victory.

Prior Session Deep Dive

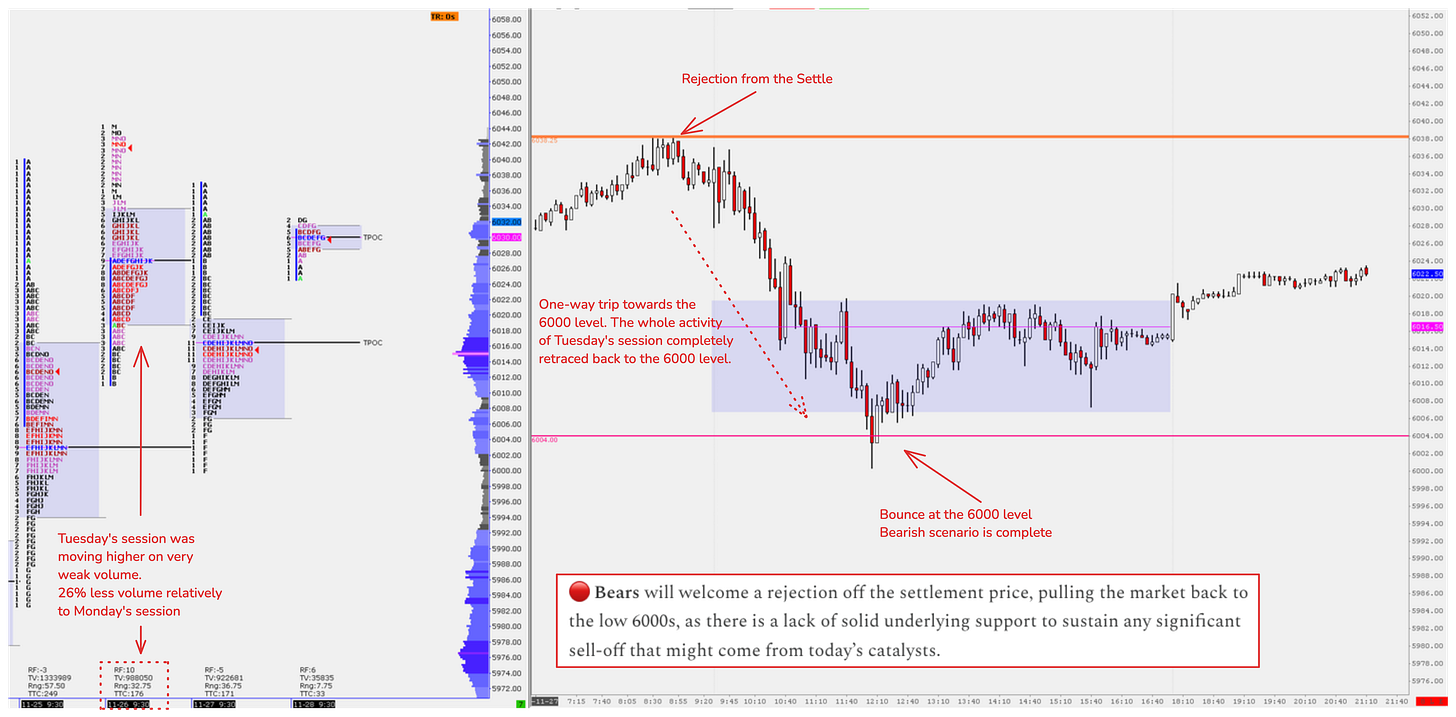

This is a market breakdown of Wednesday’s session that highlighted the importance of understanding the market environment you’re trading in.

One of the reasons we manage to narrate scenarios that often play out to the exact tick is our understanding of the market environment and the strength or weakness of a move.

As highlighted during Tuesday’s session, the volume traded that day was incredibly low relative to Monday’s session. Low-volume sessions without any significant catalysts often edge higher, creating an incredibly weak underlying structure. Such structures are frequently taken out easily by the market.

The bearish scenario we highlighted prior to the U.S. open on Wednesday perfectly demonstrated this principle. It was a clear interpretation of the lack of support, with nothing significant to hold the market up until the early 6000s which is why we didn’t place any downside pivot up until that area.

As we often emphasise, once a market objective is completed, don’t overstay your welcome. The market bounced 15 points off the 6000 level and continued its slow grind to the upside the following day.