The Market Brief

U.S. futures are near flat as third-quarter earnings continue to flow in, which so far have been broadly positive, helping to support equities amid a mix of macro fears weighing on sentiment.

Macro Viewpoint

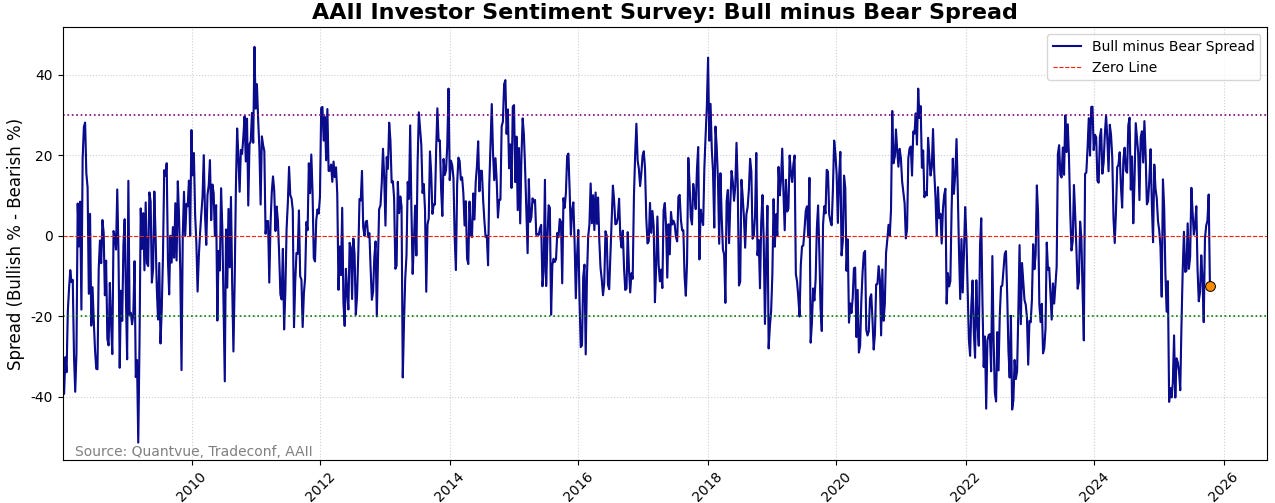

The market remains near extreme fear while the SPX is 1% away from its all-time high. We noted this on Monday and want to emphasize it again, this is not the type of activity typically seen before a major market crash.

Meanwhile, the U.S. government’s data blackout continues. We have not received the September jobs report, any key inflation data, or initial jobless claims for weeks.

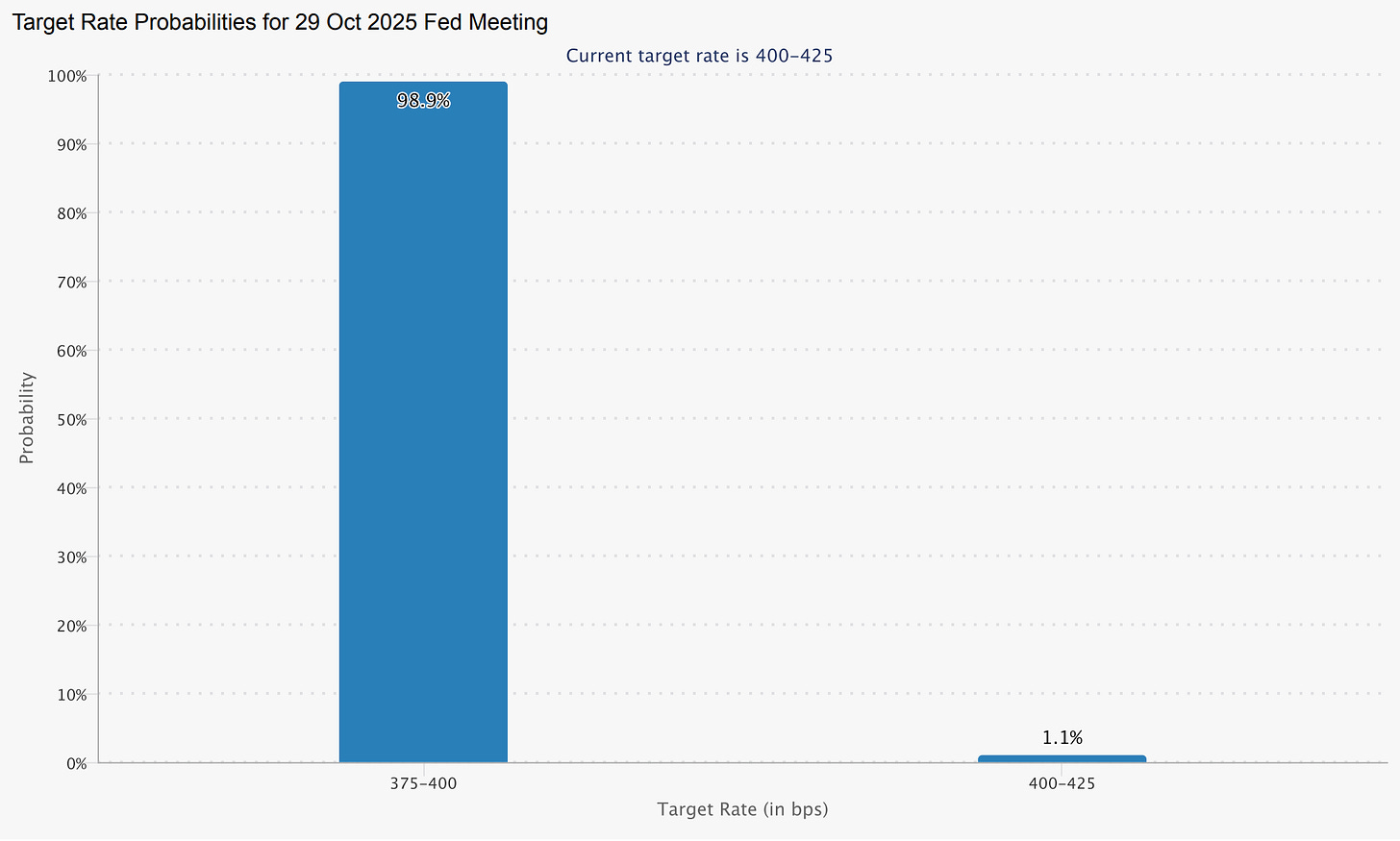

The market is pricing in a nearly 100% chance that the Fed cuts by 25 bps next week.

As the labor market rapidly deteriorates, the Fed simply cannot afford to fall behind. For that reason, the Fed must lean even more dovish as the government shutdown continues, and they must cut rates.

All eyes are on the CPI tomorrow. If we see a hawkish print for Core Goods, then it may be worthwhile to consider that another inflation peak has yet to form.

This is a FREE edition of the Market Brief. To receive our institutional-grade research, sign up below. Join hundreds of subscribers already on the inside!👇