The Market Brief

U.S. futures fell during early trading on Tuesday as concerns over lofty equity valuations and diminishing prospects for an interest rate cut weighed on sentiment.

Prime Intelligence

There were no headlines driving yesterday’s move lower, just broad, panicked selling from traders who didn’t fully understand what was unfolding.

Over the last two briefs, we’ve highlighted the potential unwind from systematic funds, something we’ve been tracking closely and sharing exclusively with our Subscribers. A lot of that activity is now happening beneath the surface.

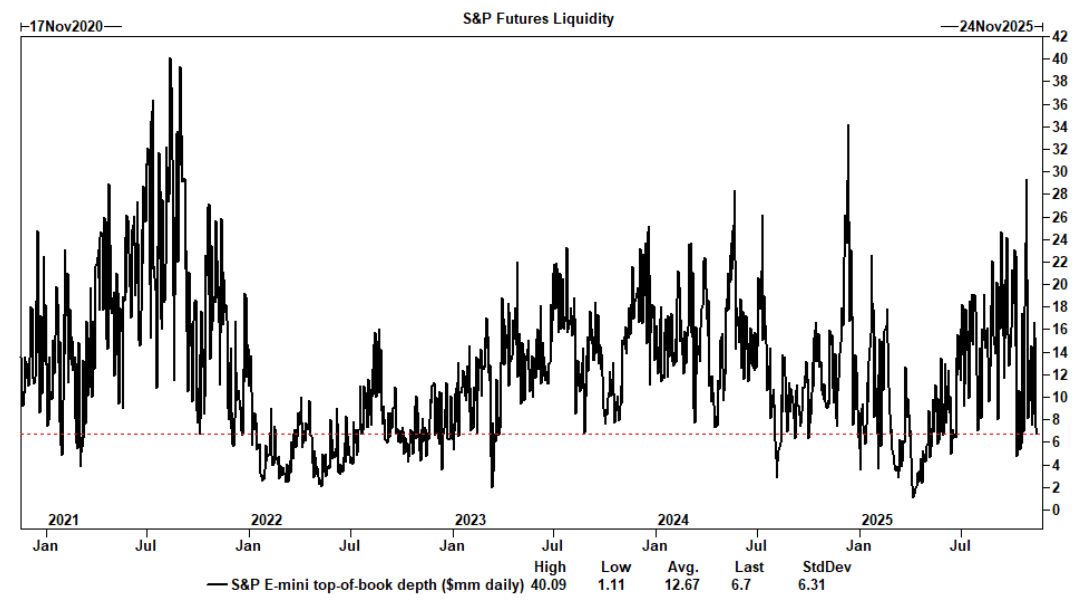

The current backdrop is low liquidity combined with a negative gamma regime, which forces market makers to sell into weakness/ buying into strength which is amplifying market moves. This is the recipe for a pickup in volatility regardless of news and headlines, and you will more than likely feel that this week.

It’s a changed environment and you should adjust yourself to it. The market is certainly not going to adjust to you.

Fragile Monday

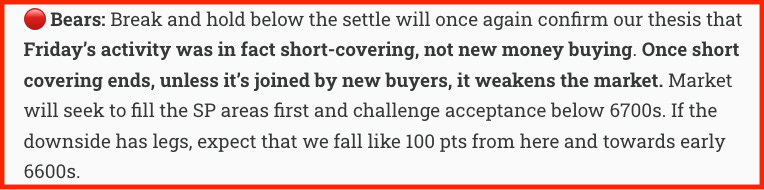

If Sunday’s brief, “Fragility Emerges,” wasn’t a clear clue as to what we believed was coming, we reiterated our downside thesis again yesterday, emphasizing that last Friday’s rally was driven largely by short-covering, not genuine strength. Below is the exact commentary we shared exclusively with our Subscribers.

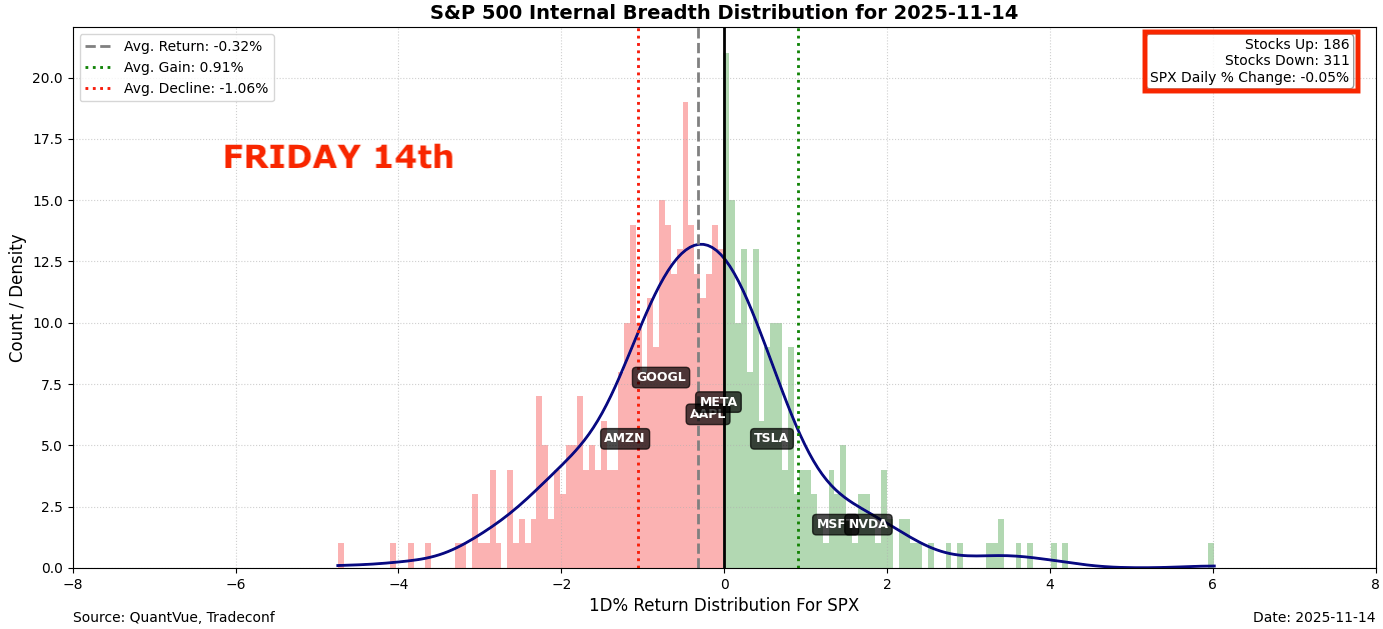

Our breadth distribution backed up this view. The skew was noticeably to the left, showing that most stocks were actually down on the day, with only a few large-cap names holding up the indices. The headline price action suggested stability, but the underlying participation told a very different story.

The context above gives you a look into the framework behind our briefs, an approach grounded in quantitative research that goes well beyond price action.

So, is there more selling ahead? In today’s article, we break down how systematic funds and institutional money managers are positioning in this increasingly complex environment, and what their next moves could mean for the market.