The Market Brief

Hey team. U.S. equity futures advanced as investors looked ahead to key economic data for insights into the interest-rate trajectory.

Let’s re-cap the prior session and see what’s next for the markets!

Impact Snapshot

🟥 U.S. Q4 GDP - 8:30am

🟧 Unemployment Claims - 8:30am

Macro Viewpoint

U.S. stock index futures advanced on Thursday after Nvidia’s optimistic forecast helped alleviate concerns over weakening AI demand, which had weighed on the sector in recent months. Investors also assessed the broader impact of the Trump administration’s latest global trade threats.

January’s launch of cost-effective AI models from China’s DeepSeek had disrupted Wall Street’s two-year tech-led bull run, triggering a sharp sell-off in Nvidia that erased half a trillion dollars in market value in a single session.

All three major U.S. indexes remained on course for monthly losses, pressured by escalating trade tensions and signs of slowing economic growth, which have dampened risk appetite.

In his latest remarks on trade, former President Donald Trump proposed a 25% "reciprocal" tariff on European automobiles and other imports, adding to investor uncertainty.

Meanwhile, the market awaits Friday’s release of the Personal Consumption Expenditures (PCE) index—the Federal Reserve’s preferred inflation gauge—which is expected to shape expectations for potential rate cuts this year.

Prior Session Deep Dive

Markets run on information. The three primary sources of market information are company fundamentals, economic fundamentals and technical data.

Evidently, the majority of traders have no market plan prior to beginning their trading, and very often they get too attached to company and economic 'news' that comes out during the session and attempt to ride the momentum.

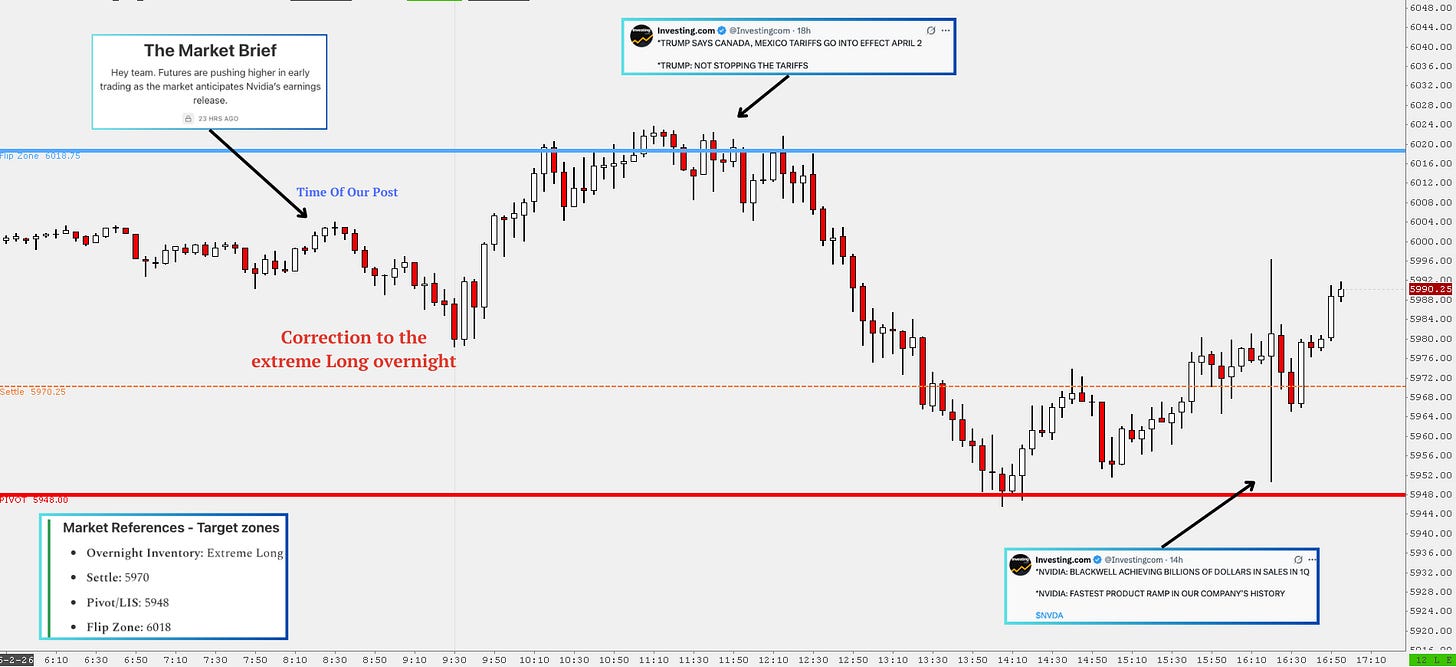

The picture you see above contains our market references we’ve shared prior to the U.S. market open, along with timeline screenshots of the headlines during the session.

The entire session was quite literally contained within the first references we’ve had on our chart for either side, with the absolute top being the flip zone and the absolute bottom, the pivot.

Could we have possibly known at 11:00 AM ET that there would be headlines regarding tariffs, so we could have placed a resistance reference at this area? Could we have possibly known that the market had room to break over 70 points towards the first level of pivot after the 'news,' so we placed it there?Could we have known NVDA earnings and how the market bounced exactly at that reference area?

The answer is obvious. It doesn’t matter what market you trade; if you have a solid framework and market-generated data points, they will provide major confluence to your plan, no matter the volatility that market faces.

Although the landscape can drastically change during any session, intraday accumulation of data points is required. Momentum is the leading indicator; adding context to that momentum is what we do.

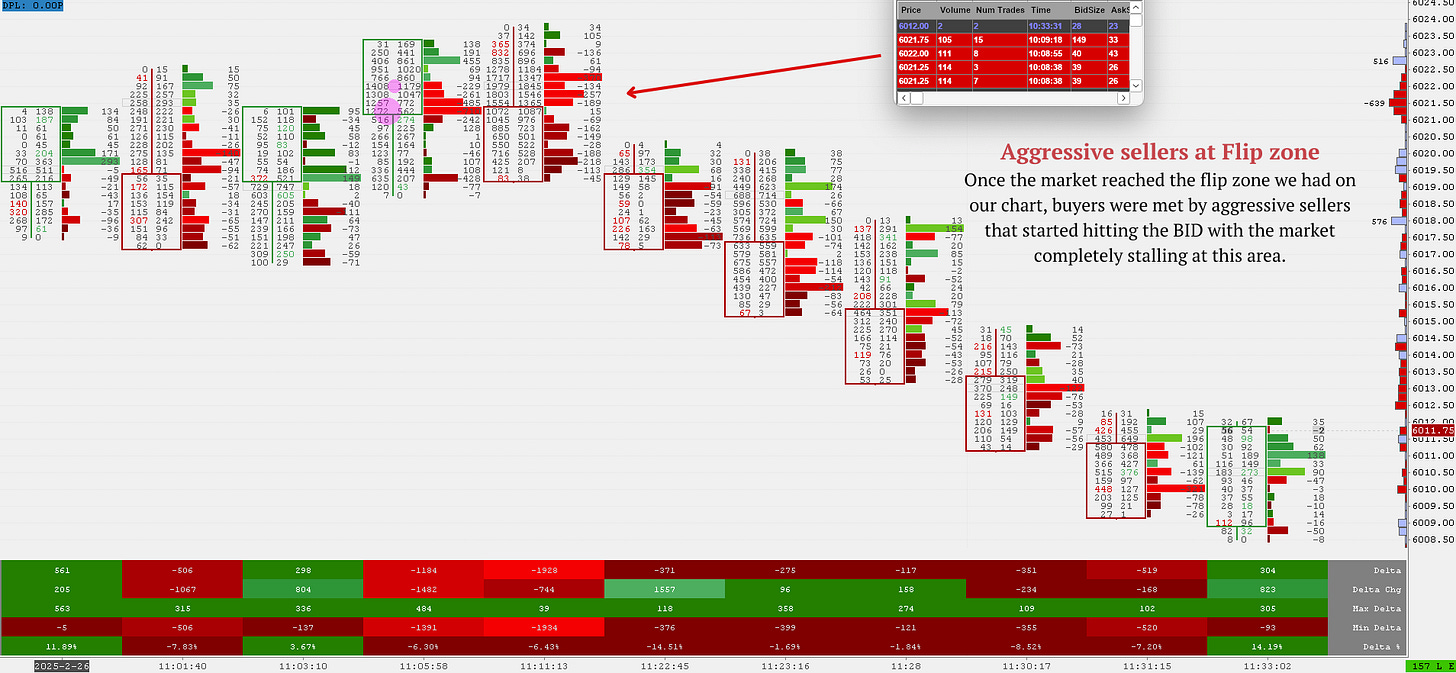

The chart above shows the first signs of 'size' sellers at exactly that flip zone reference. The market spent two whole hours trying to break from that level and couldn’t, further signalling a correction was underway.

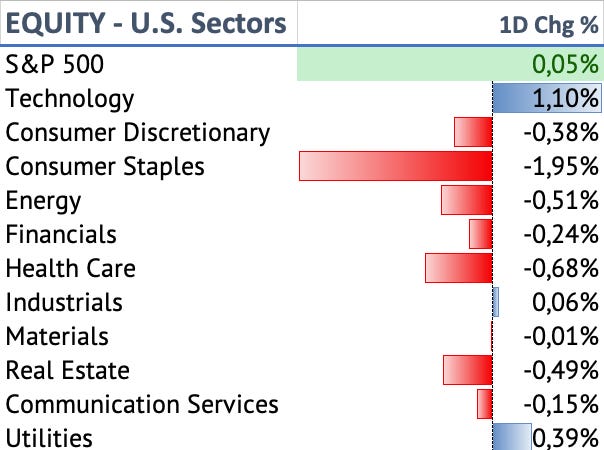

All sectors faced challenges with the recent fundamentals and tariff headlines, yet we closed at around breakeven due to Tech. Once again, the market shows how sensitive it is to specific stocks.