The Market Brief

U.S. stock futures were cautiously higher during early trading on Tuesday as traders increasingly stoked bets that the Fed will kick off rate cuts this month.

Macro Viewpoint

Rangebound session yesterday to start what's expected to be an extremely active week between macro (PPI Wednesday, CPI and ECB Thursday).

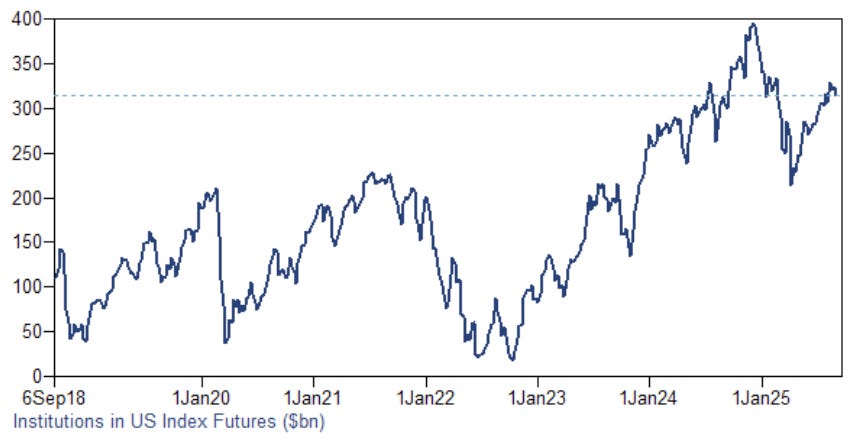

Flow-wise, institutions are still reluctant to chase all-time highs. Hedge funds continue to reduce their gross and net leverage. The ‘non-economic’ cohort offered more support, with CTAs arguably close to max length but not selling U.S. indices just yet.

Small to moderate changes continued through the end of summer/August, as institutional and total non-dealer U.S. equity lengths stand at their 73–79% historical ranks, an area they’ve been in for some weeks.

Navigating Chop

Most people don't understand that being profitable with trading is not just about the strategy. Strategy plays a smaller role than risk and self-management. You can give a profitable strategy to anyone and they still lose money.

Understanding the trading environment and being prepared means you’re not surprised when something does happen, and you’re ready to act at a moment’s notice when it does happen.

We’re talking about potential and framework. We’re not talking about prediction. We’re simply setting up the framework for how we are going to potentially react if it happens.

The image above shows a piece of context from our outlook along with our first two references, delivered at 5:00 a.m. E.T. yesterday for our paid subscribers.

Think of the risk you would have exposed yourself to if you thought this was going to be a trend day and headed in with that expectation in mind during that session.

Our forecast of a chop session hours before the fact, along with our references, played a significant framework in how the entire session unfolded hours after the fact.

Good luck going into the market blind and expecting everything to work out for you.