The Market Brief

Hey team. Futures edged higher during the early overnight session as the market is highly anticipating the Fed’s preferred inflation measure, the PCE number, due at 8:30 AM, which will sprinkle another round of volatility to close the week.

Let’s recap the last session and see what’s ahead for the market!

Impact Snapshot

🟥 PCE Inflation - 8:30am

🟧 Employment Cost - 8:30am

Macro Viewpoint

U.S. stock index futures rose in early trading, boosted by gains in Apple after the company projected strong sales growth.

The S&P 500 and Nasdaq remained on track for weekly losses, as technology stocks took a hit earlier in the week. The sell-off was sparked by Chinese startup DeepSeek's breakthrough in low-cost artificial intelligence models, which led to a sharp decline in AI-related stocks.

Meanwhile, the Federal Reserve kept interest rates unchanged in its latest decision, with Chair Jerome Powell emphasising that rate cuts would not be rushed and would depend on inflation and labor market data.

Investors are now turning their attention to the latest core price index data—the Fed’s preferred inflation measure—which is expected to show a slight increase for December, keeping concerns over tariffs and economic policy in focus.

Prior Session Deep Dive

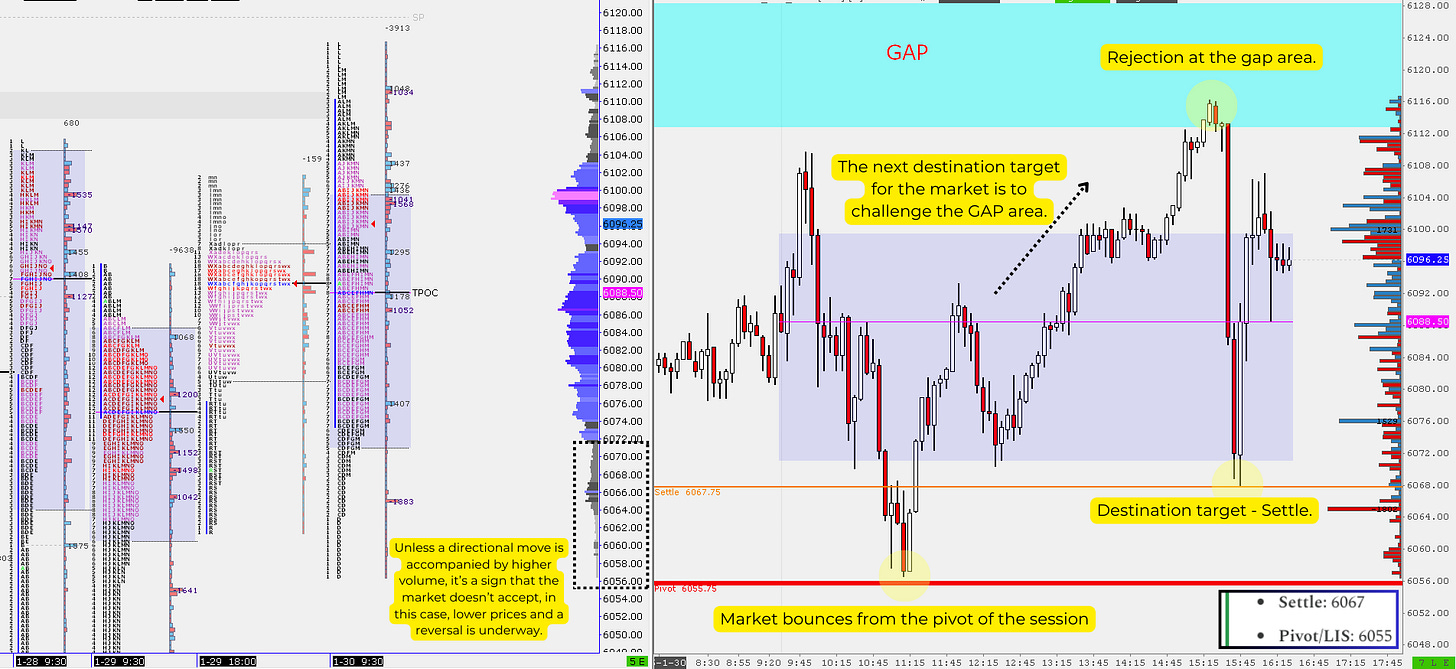

Thursday’s session kicked off with an initial swing high that didn’t get any sustained continuation, with the market having a lot of room to break, as our bearish scenario for the day suggested.

The single and only reference the market found solid support for that session was the pivot of the day, where the market saw a bounce of over 60 points, with the destination target being the gap.

As we always say, markets have objectives. Gaps highlight a place where emotions were high and where “change” has taken place. They will either reject prices aggressively or find acceptance and march towards the other side of that gap.

After the bounce from our session’s pivot, the market targeted that gap, where we saw that aggressive rejection, leading into a one-way trip with the destination target being the settle, where the market once again bounced right off to close the session.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.