The Market Brief

Hey team. U.S. futures surged overnight after a court ruling blocked some of President Donald Trump’s import tariffs.

Let’s see what’s ahead for this market!

Impact Snapshot

🟥 Q1 GDP - 8:30am

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

U.S. stock futures rose Thursday after a trade court largely struck down President Donald Trump's proposed tariffs, offering some relief to markets rattled by weeks of uncertainty.

Meanwhile, shares of Nvidia jumped as the AI chipmaker reported better-than-expected quarterly earnings.

The court’s decision marked another turn in a volatile stretch for investors, who have watched markets swing sharply since Trump introduced the idea of reciprocal tariffs in early April.

Since then, markets have been on a rollercoaster—gaining and shedding trillions in value—as shifting messages, delays, and policy reversals clouded the outlook for trade negotiations.

Wall St. Prime Intel

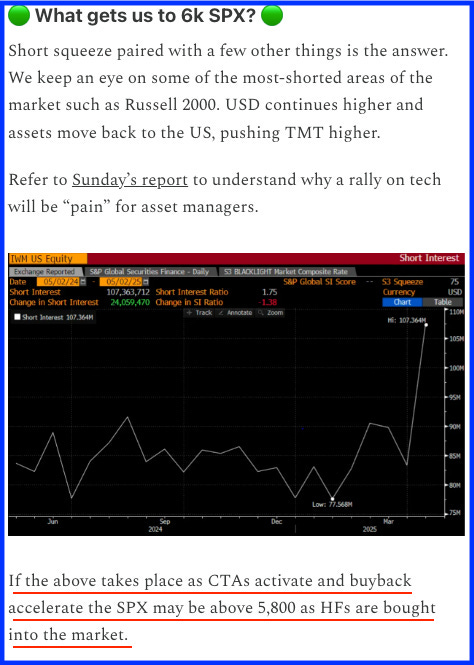

We’ve been reiterating our near-term outlook since we called bottom at 4800.

On May 14, 2025, we shared our outlook again, highlighting that we believed market had much better odds to reach 6000 than to fall back to 5000.

“Since everyone is bearish because of tariffs, I’m much better off spamming bearish headlines like everyone else and being with the herd, and if I’m wrong, nobody will care anyway because 99% of the herd of traders held the same view.” – YouTube Influencing LARPs of 2025.

There is some serious trouble involved if you take in information based on thin air by people who have zero clue how the markets operate on a broader level.

We try to simplify institutional data and share all the facts—the same exact data portfolio and asset managers receive from the biggest banks of Wall Street.👇

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.