The Market Brief

US futures slipped during early trading on Wednesday as the first government shutdown in nearly seven years got underway, threatening a temporary blackout in economic data.

Impact Snapshot

🟥 ADP Payrolls - 8:15am

🟥 Manufacturing PMI - 10:00am

Macro Viewpoint

With key economic reports on hold, traders fear the loss of visibility will leave markets in the dark on the outlook for monetary policy.

The immediate reports at risk are Thursday’s weekly jobless claims and the Oct. 3 release of September’s nonfarm payrolls.

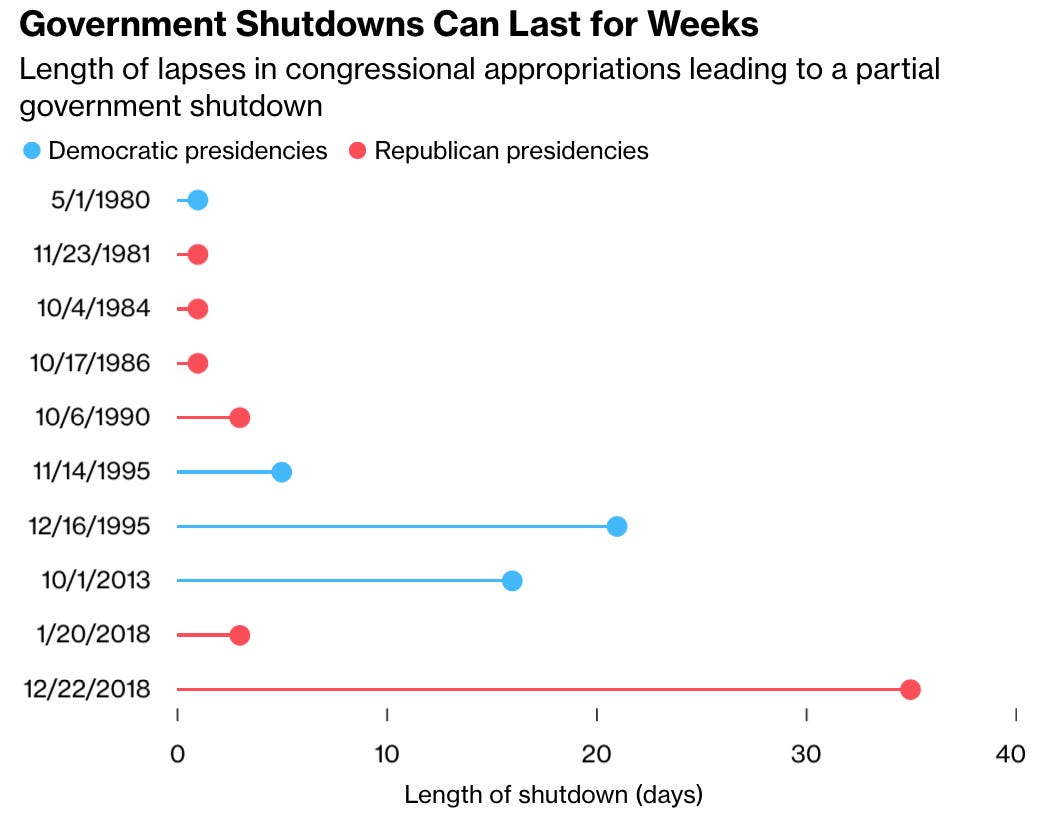

The average length of a shutdown is eight days, and its implications spread further when it lasts longer.

🔄 Prior Session Re-cap

While everyone is trying to blame a headline as to why the market has turned negative or positive at any given time, we’re looking at data that the market gives us before any of the “news” or the candlesticks themselves could have ever existed at the time of authoring our playbook scenarios and references.

The following video is a replay of yesterday’s session close, along with the context and pivots we provided to our subscribers at 4:30am ET.

We noted that the ON session was being too short at weaker hand traders, as the majority of volume traded during the overnight is exactly that.

The market made several attempts to break above the settle that failed during the U.S., which further amplified the inventory being too “heavy” on the short side. The moment we found acceptance above settle, the market triggered a short-covering rally towards our key destination target to book profits.

Short covering is not new money buying but forced buying. Building on that note, we saw absorption take place right at our reference and the market completely stalling. This built confidence to take shorts back into the session’s value area as the absolute top was in.

This is a FREE edition of the Market Brief. To receive our playbook scenarios and pivots on a daily basis, consider becoming a paid subscriber.👇