The Market Brief

U.S. futures ticked higher in early trading as the week begins, with investors looking ahead to the Federal Reserve’s final meeting of 2025 for signals on the interest-rate path heading into next year

Macro Viewpoint

U.S. stock index futures moved slightly higher on Monday, supported by growing expectations that the Federal Reserve will finally deliver an interest rate cut later this week at a meeting that’s shaping up to be one of the most debated in years.

Updated data from last week showed consumer spending rising at a moderate pace toward the end of the third quarter, giving investors more confidence that the Fed will shift its attention toward easing borrowing costs on Wednesday—supportive for both growth and the broader labor market.

Prime Intelligence

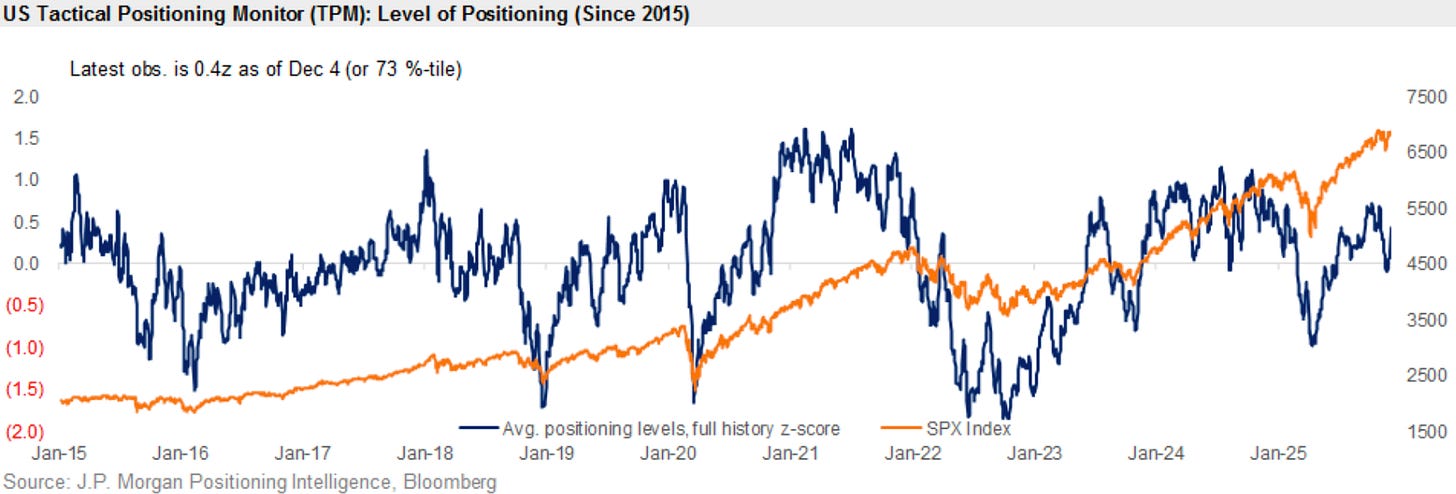

Two weeks ago, the script was very different. Positioning was declining, HFs were selling, hedging was increasing, CTAs were reducing, and Retail was slowing. Now, things have flipped as buying has picked up strongly across multiple cohorts.

While this recent buying could lead to some volatility if the Fed is very hawkish this week, a large flip from negative to very positive changes in positioning have generally been followed by further market gains in recent years.

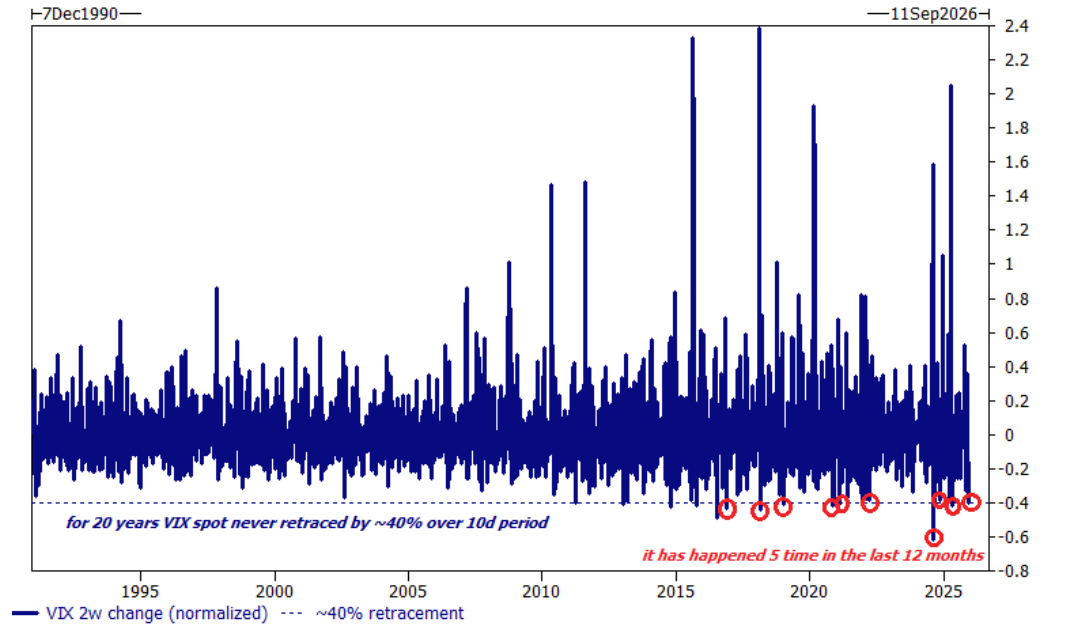

It’s remarkable how quickly fear gets priced in and then washed out in today’s market. Before 2011, the VIX had never retraced roughly 40% from spot within a two-week window. What was once unheard of has now become routine, with this kind of sharp pullback happening five times in just the past twelve months.

📰 Does this positioning reversal has room to run?

We’re exploring the volatility dynamics and much more in today’s brief to answer that question.