The Market Brief

Stocks fell across the globe during early trading ahead of President Donald Trump’s deadline for a new set of sweeping global trade tariffs.

Let’s see what’s ahead for the market!

Macro Viewpoint

Welcome to one of the most volatile weeks of the year.

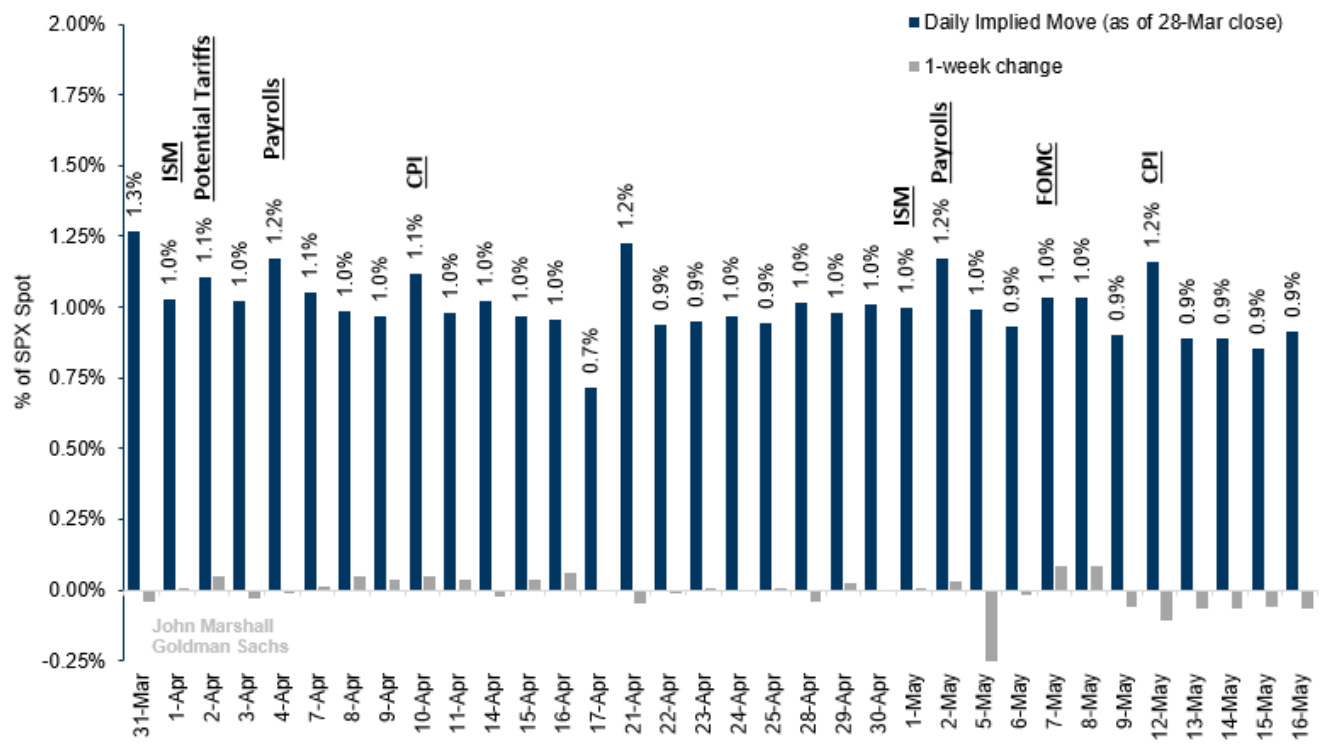

SPX options imply more than 1% moves for each day this week, with several key events—including ISM, tariff announcements, and payrolls—expected.

Governments worldwide are preparing for President Trump’s upcoming reciprocal tariff initiative, set to begin with “all countries” on April 2.

Although the administration has yet to specify which tariffs will be imposed, they are expected to add to the existing trade measures targeting sectors like steel, aluminum, and automobiles.

In response, money managers are adjusting their portfolios by shifting from equities to bonds and other safe-haven assets, while others are using options trades and equity instruments to hedge against volatility, anticipating that the escalating trade tensions could lead to further interest rate cuts by the Federal Reserve.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.