The Market Brief

Hey team. U.S. futures edged cautiously higher in early trading, as ongoing concerns around trade and policy uncertainty continue to weigh on sentiment.

Let’s re-cap Monday’s session and see what’s next!

Impact Snapshot

Key Earnings: TSLA 0.00%↑ VZ 0.00%↑ GE 0.00%↑

Macro Viewpoint

S&P 500 futures rose by 1% in early trading, but market participants remained fixated on the potential consequences of any move by the White House to replace Federal Reserve Chair Jerome Powell.

Stocks opened the week on a weaker note, with the S&P 500 recording its third drop in the past four sessions, while the Nasdaq has now fallen for four consecutive days. Trading volumes were subdued, in part due to closures in several international markets.

Monday’s decline has been widely attributed to growing concerns about the Federal Reserve's independence, a worry that was further magnified by thin holiday trading conditions.

Wall St. Prime Intel

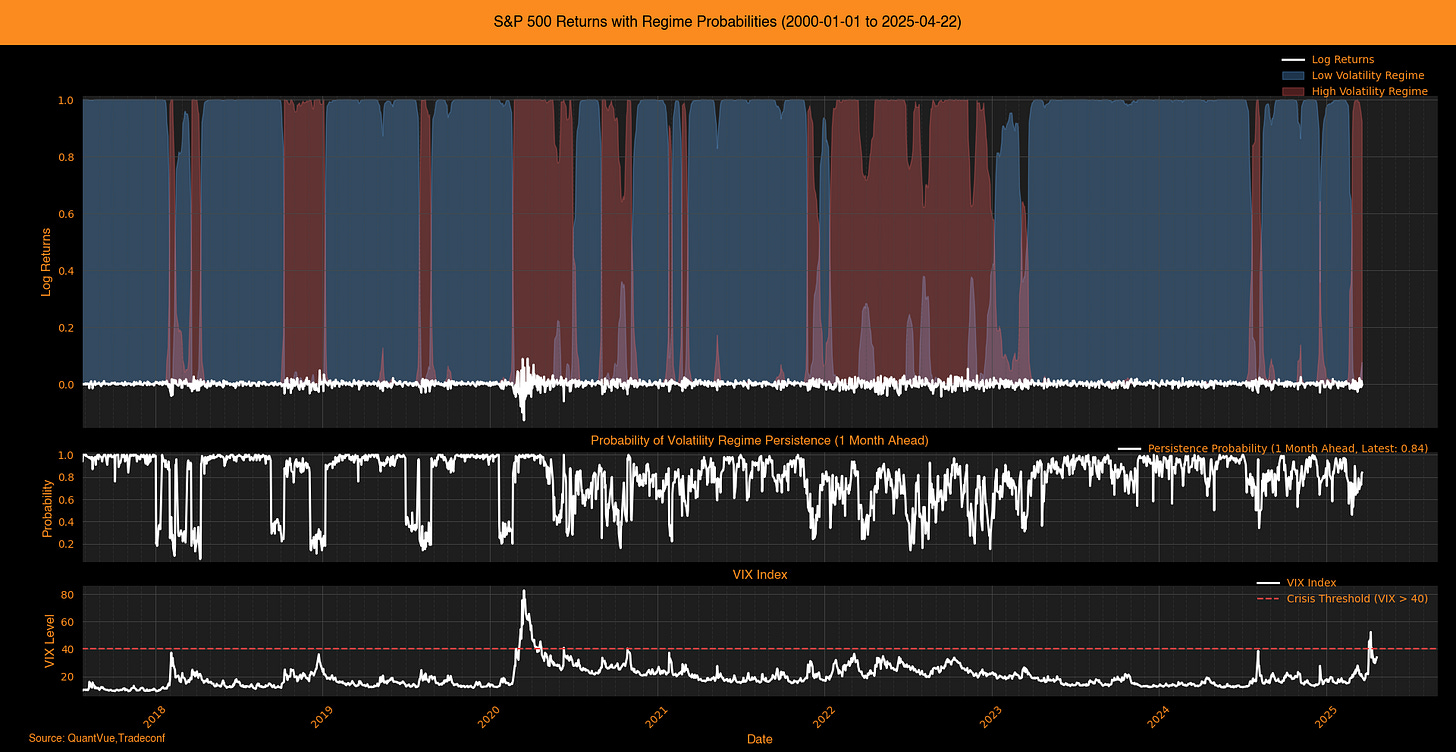

In our market brief yesterday, we noted that the current volatility regime may persist. Using ML on a dataset from 2000 to today, we analyze historical S&P 500 returns and VIX levels to predict volatility regime persistence.

Our model suggests a 84% probability that the current high volatility regime will persist for at least a month forward. Review the chart below for context. In 2020, we saw VIX levels spike above the crisis threshold (VIX > 40), similar to patterns observed during high volatility periods now.

How to Leverage This Volatility Insight

Anticipate wider intraday ranges for instruments like the E-mini S&P 500 (ES). A year ago, a 50-60 point move was a “significant rally”. Now you can get that in 30min periods.

Adapt Your Trading Approach:

Recalibrate Take-Profit, and Stop-Loss: Align your targets with increased volatility to capture bigger moves while managing risk in a less liquid environment where price levels see thinner order books.

Refine Your Strategy: Strategies optimized for last year’s tighter 40-point ranges may underperform in today’s high-VIX market. Tailor your approach to the current high-volatility regime for better returns.

By understanding the market’s narrative and adjusting to its evolving dynamics, you can position yourself to capitalize on larger moves and navigate the challenges of reduced liquidity.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.

Develop better context and create a robust entry model by understanding all the market nuances we share on a daily basis. This will help you build the market understanding that most traders lack.