The Market Brief

U.S. stock index futures edged higher on Thursday after Nvidia's stellar results eased concerns around AI, which has shaken markets for the last few weeks.

Impact Snapshot

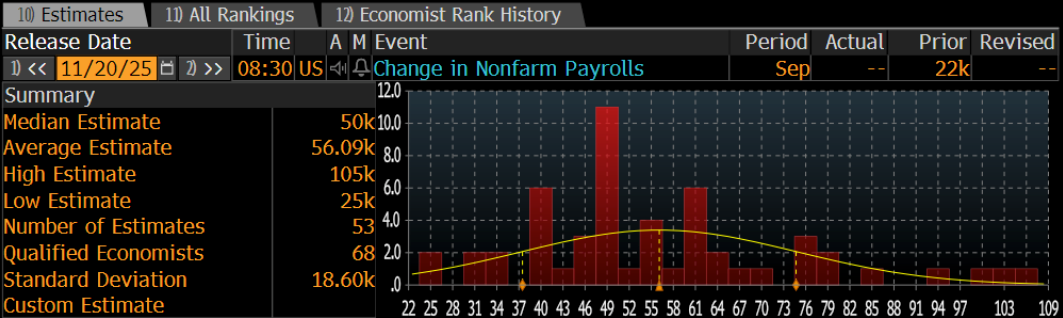

🟥 Nonfarm Payrolls (Sep) - 8:30am

Macro Viewpoint

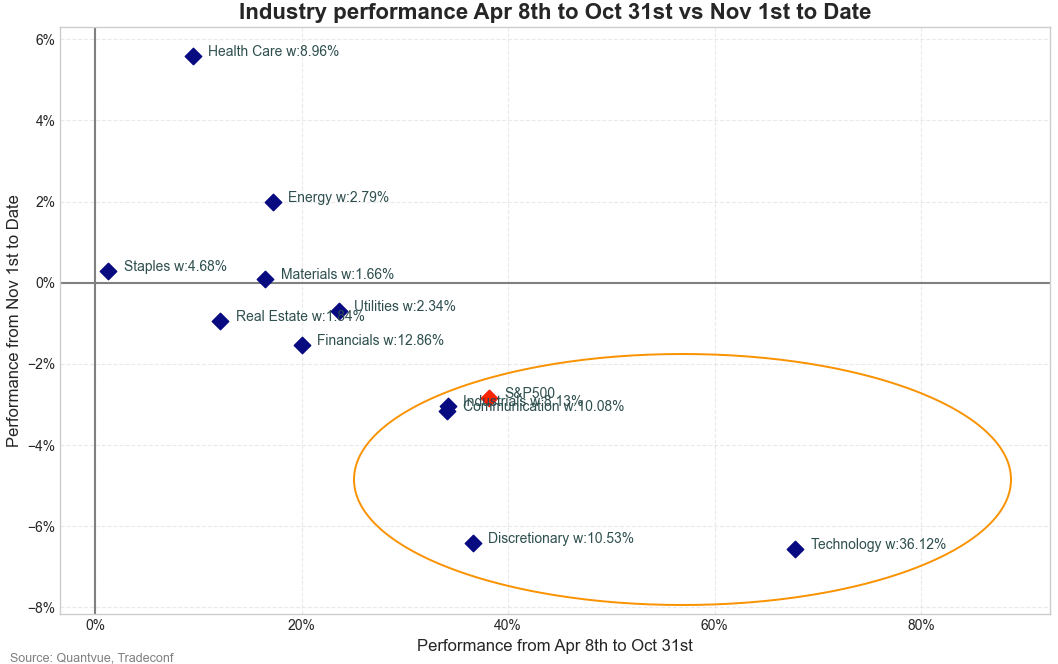

NVDA 0.00%↑ posted a strong earnings report after the close. While attention now turns to the earnings call, where management’s tone could influence market sentiment, any reaffirmation of its bullish outlook could serve as a strong catalyst for renewed rotation into AI and tech.

This would be especially meaningful given the month-to-date risk-off trend we’ve seen across Tech and other cyclical sectors that have suffered the most.

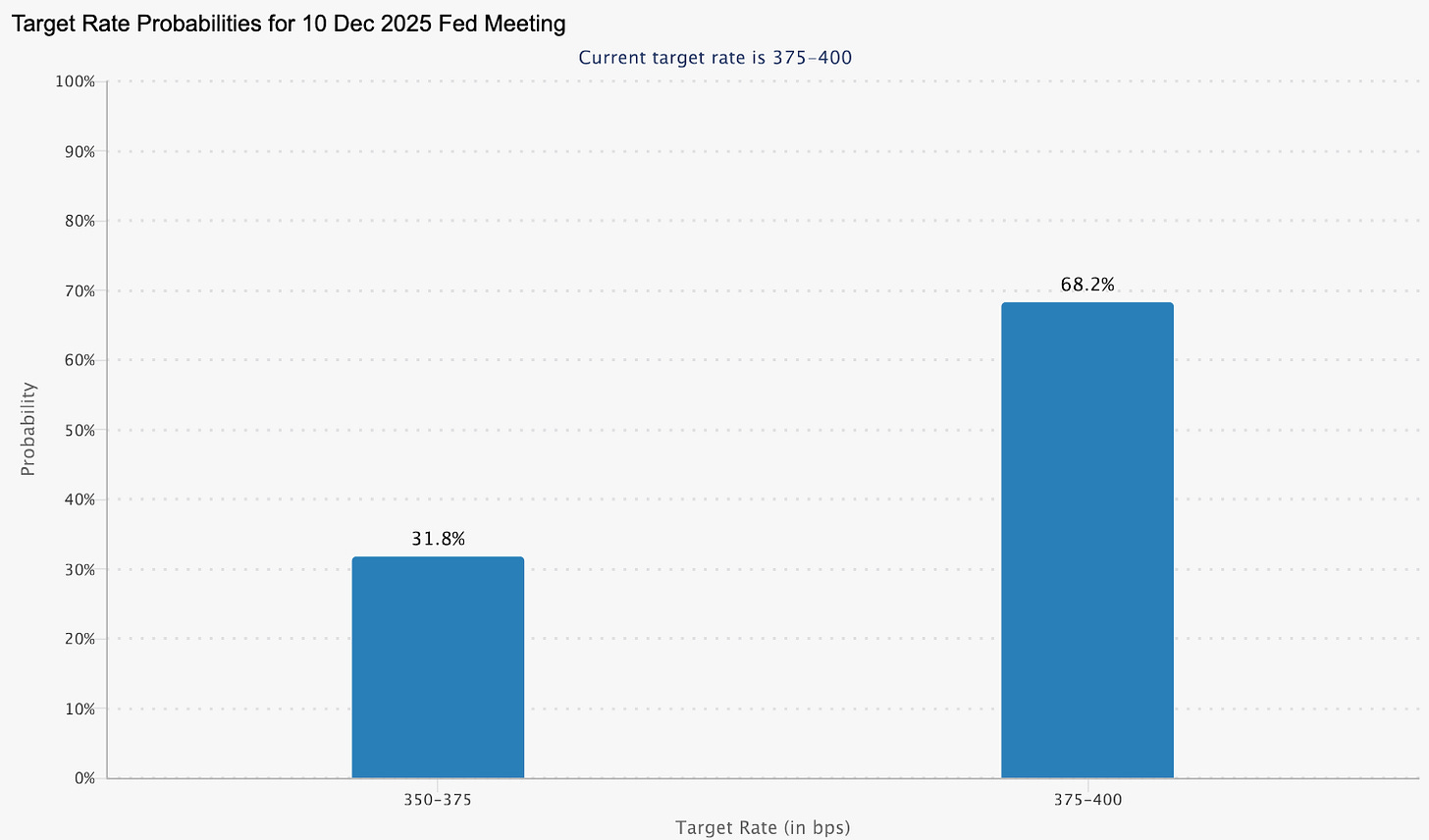

The most notable macro event was the release of the Fed minutes, which leaned hawkish and reinforced the higher likelihood of no rate cut versus a 25bp move.

In addition, the BLS announced it will not publish a standalone October jobs report. Following these updates, the market’s implied odds of a rate cut fell from 45% yesterday to about 31% today.

NFP Scenario Analysis

An inline print around 50k would be a “balanced” outcome. It would be solid enough to ease concerns about slowing economic growth, yet not so strong that it revives inflation worries.

Some scenarios and market reaction estimates:

Above 100k. SPX is flat to losing 1.5%

Between 70k – 100k. SPX +0.5% to -0.5%

Between 30k – 70k. SPX gains 0.5% – 1%

Between 10k – 30k. SPX gains 0.25% - 0.5%

Below 10k SPX is flat to losing 1%.

A print that’s too strong would likely keep the Fed on the sidelines; if the Fed is pausing because growth remains robust, markets would generally take that as a positive. Alternatively, a too cool print will spark recession / stagflation fears.

📰 Have we entered an “all clear” regime after yesterday’s earnings report, or is there still more selling pressure ahead?

We break down that question—and much more—in today’s brief. 👇