Hey team, U.S. stock futures initially edged lower during early trading and are currently staging a recovery after major averages posted back-to-back gains.

Let’s re-cap Monday’s session and see what’s next!

Impact Snapshot

🟥 Consumer Confidence - 10:00am

Macro Viewpoint

Early Tuesday, U.S. stock index futures edged mostly lower, following a strong rally on Wall Street that pushed major indexes to two-week highs.

Yesterday, we saw a full risk-on rally with nearly 85% of the stocks finishing higher, given a combination of short-squeezing (High Short Interest +5.2%) and crowded longs/Mag 7 being brought back after weeks of selloff.

Tariffs have been a key focus this week, with markets reacting positively on Monday to indications that trade sanctions may not be as broad as initially feared.

However, investors remain cautious as they brace for potential inflationary pressures and slowing economic growth, particularly with the Trump administration set to impose reciprocal tariffs on April 2.

Wall St. Prime Intel

People love grabbing a mic and rambling about why they think the market moved after the fact. They’ll pull up a chart, scribble some lines, call it a “model,” and credit the move to their “bullish signal” or a trending headline—“we went up ‘cause of tariffs.”

The noise on social media about how markets work can seriously cloud your vision.

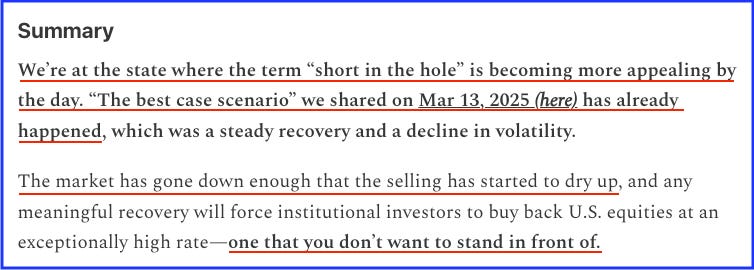

The above picture is a piece of content from our market research we shared during the early morning of Sunday with our followers. That is, before any “news” or globex open.

The opinions we share in this section of the market brief are backed by data that is independent of market events and conditions, reducing reliance on subjective judgment.

Will this information make you a millionaire overnight? No.

But it will help you develop a field of vision that most traders lack and gain a deeper understanding of what is truly happening beneath the market’s surface.