The Market Brief

US equity futures edged higher as investors weighed President Donald Trump’s fresh tariff threats, underwhelming economic indicators, and a flurry of corporate earnings announcements.

Macro Viewpoint

The underwhelming ISM-Srvcs led to concerns in stagflationary pressure, as equities sold off after the 10AM ET print.

Bull markets don’t die of old age. Objectively, the only lasting impact of the slew of negative U.S. payroll revisions appears to be a weaker dollar and lower rates—perhaps a testament to the strength of the secular drivers behind U.S. mega-caps and the AI vertical.

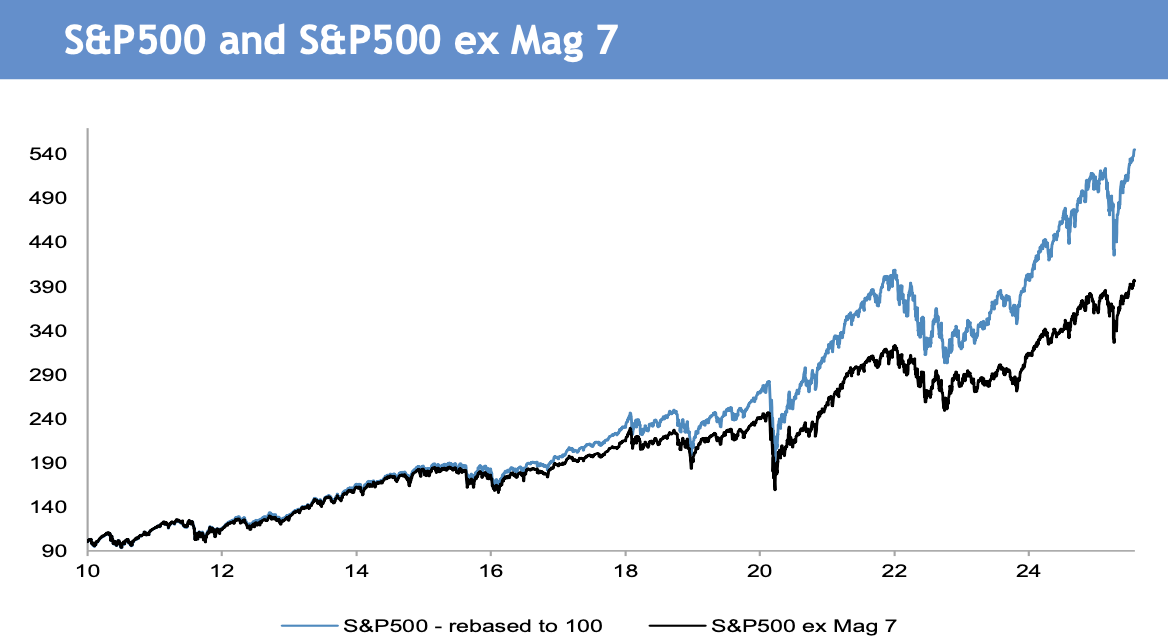

Indeed, the so-called Magnificent Seven stocks have been the dominant drivers of U.S. equity performance over the past decade.

Their outperformance has been underpinned by exceptionally strong and sustained earnings growth, reinforcing their central role in the current market narrative.

This is a free edition of the Market Brief. To receive our additional in-depth institutional research consider becoming a paid subscriber.👇