Hey team. Futures dipped during early trading as markets continue to weigh trade risks and the uncertainty surrounding how the new U.S. administration’s policies will impact global growth.

Let’s recap yesterday’s session and look ahead to what’s in store for the markets!

Impact Snapshot

🟥 Consumer Confidence - 10:00am

Macro Viewpoint

S&P 500 futures edged lower as concerns over U.S. efforts to curb China’s technological advancement led to a broad selloff in chipmaker stocks.

Market participants weighed the implications of potential new restrictions on Nvidia’s exports to China, with reports suggesting the U.S. government may further limit the quantity and types of chips that can be sold without a license.

The uncertainty surrounding the new U.S. administration’s economic and foreign policies has also contributed to a more cautious investor stance, as questions remain about their impact on global growth and long-standing geopolitical alliances.

Meanwhile, Nvidia’s earnings report on Wednesday is expected to be a crucial test for the sector, particularly as investors reassess the sustainability of heavy AI-related investments in the wake of rising low-cost competition from China’s DeepSeek, which unsettled markets in January.

Beyond trade restrictions, investors remain wary of signs of a slowing U.S. economy and the Federal Reserve’s measured approach to interest rate cuts.

Prior Session Deep Dive

Trading is creative problem-solving. Price by itself has no context. The majority of traders are only following momentum and will “ape in” on any move they see happening, often not realizing the amount of risk they expose themselves to.

You really don’t know what is going to happen, but the market does give you clues well before the fact to help you built a solid framework and narrative.

We accumulate all the facts and the analysis we do is data driven. By stacking these clues together, you start getting the probabilities in your favor and develop clarity of what is really happening under the market’s surface.

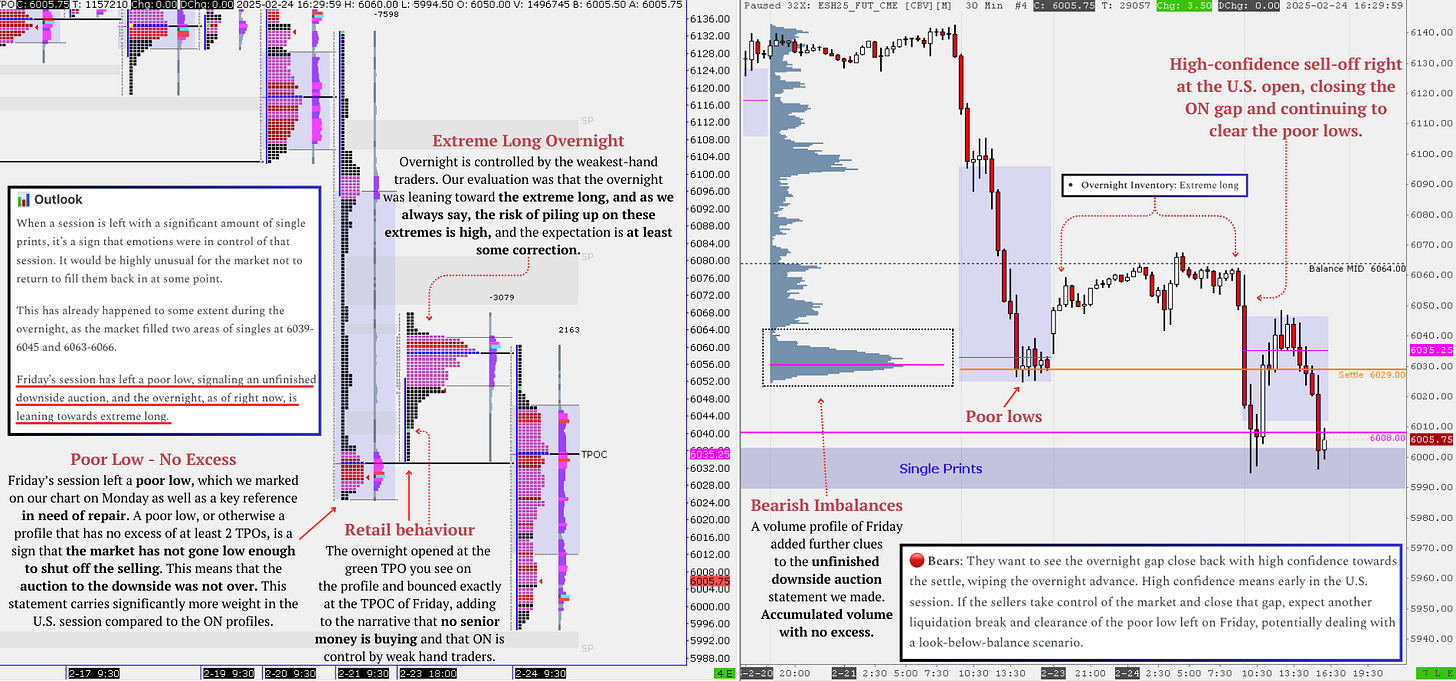

What you see on the chart above is our market outlook prior to the U.S. session open, along with our scenarios and references. Up to this point, a day after the fact, it would have been impossible to write a better context than this.

From the weak-hand traders driving the overnight session toward the extreme long to the “clues” such as Friday’s poor lows, bearish imbalances with the accumulation of heavy negative delta leaving an unfinished downside auction.

While the price was up 37-points for the day at the time of our post, the perfect trap was setting itself for those who focus exclusively on price.

It’s easy to open a chart and start talking about what you “think” happened in the market after the fact. “Yeah, my indicator showed bear, so we went lower,” or our favorite: "Yeah, this negative headline drove the market lower." — Average CNBC talking suit reporter.

Everything that can possibly happen in a market is already reflected in that market’s price action and structure. Therefore, a careful study of that market and an accumulation of data points is all you need to get the probabilities in your favor.

Our Paid Substack is a “live course” on the real, auctionable markets, with before-and-after-the-fact results, helping you develop a field of vision to spot things just like we do—hours or even days before they happen.