The Market Brief

Hey team, US equity futures traded mixed in early trading, setting the stage for another volatile session on Wall Street as the threat of new tariffs continued to weigh on the market.

Let’s re-cap the last session and see what’s ahead for the markets!

Impact Snapshot

🟥 ISM Manufacturing PMI - 10:00am

🟥 JOLTS Job Openings - 10:00am

Macro Viewpoint

Traders received more information about when Trump will reveal his reciprocal tariff plan — 3 p.m. on Wednesday during an event in the White House. However, the specifics of his tariffs are still uncertain.

The president has described his April 2 announcement as a "Liberation Day," marking the beginning of a more protectionist approach aimed at punishing trade partners he has frequently accused of taking advantage of the U.S.

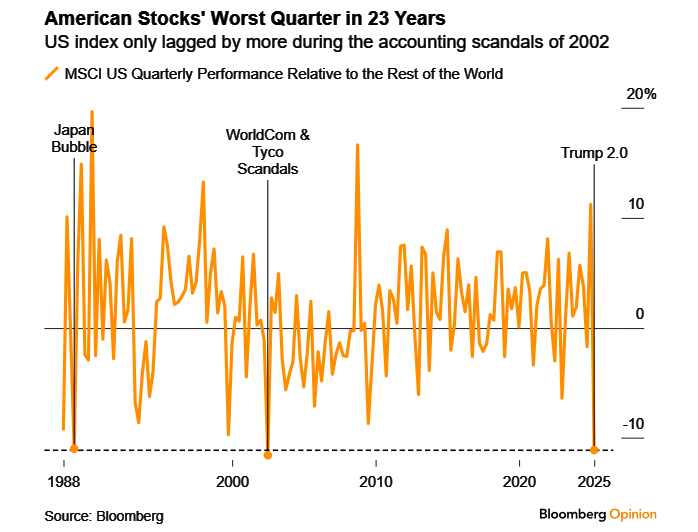

In Q1, there was a significant global asset "regional rebalancing," with funds flowing into countries focused on fiscal expansion and stimulus measures, such as Europe and China. Meanwhile, money moved out of the U.S., which is seen as a "source of funds" due to its fiscal contraction policies.

This marks the worst relative performance of U.S. equities compared to global markets since 2002.

“Market Action Discounts Everything”

If everything that affects market prices is ultimately reflected in market price, the study of that market price is all that is necessary. Market price tends to lead the known fundamentals.

While the known fundamentals have already been discounted and are already in the markets, prices are reacting to the unknown fundamentals. By the time those changes become known, the new trend is well underway.

If you don’t understand the above, or you disagree with this being a fact, you’re much better off stopping reading the rest of this article and opening CNBC to hear what the talking suits think about the market, as the rest of this article won’t make much sense.

More Than Science To It

If hedge funds had a formula that would beat the market based on math or science, they wouldn’t need to “hedge” risk. They would just short/long certain companies based on those valuations and make trillions a day.

Guess what? Even with their vast resources, hedge funds don't have a guaranteed formula to predict the market's direction. Despite employing research teams worth millions, staffed with some of the brightest PhDs, and utilizing complex risk models, they still can't accurately forecast where the market will go next.

Technical analysis is an art, not a science

Much of technical analysis has to do with understanding human psychology.

What happens if all these guys are suddenly wrong and can’t break below a support?

What is it going to feel like on their end when the trade suddenly goes against them?

This isn’t the stock market, and “buy and hold” strategies don’t work here. You don’t have that luxury with futures. Margin requirements on futures are low enough that a relatively small price move in the wrong direction for an undercapitalized trader will force that trader out of the market.

Be flexible and nimble, always have an open mind, and be ready to make adjustments as the day progresses. Look at what the market is doing and what it is communicating to you on the chart.

If you enter the market with a hard bias, you’ll have a terrible time and will constantly look for “confirmation” of that bias when there isn’t any.

Who could have thought of it, right?

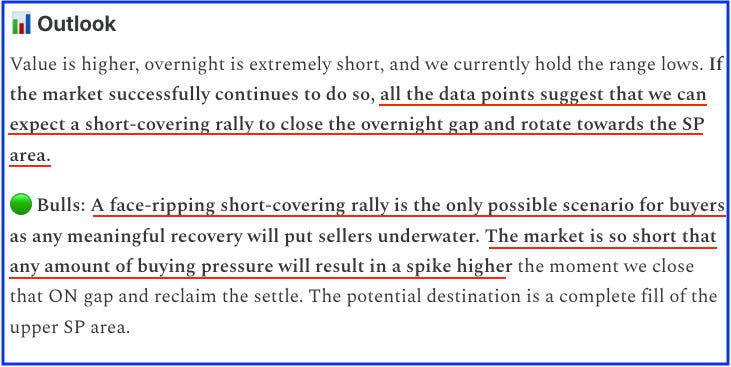

The following picture shows a partial piece of context from our market plan that we shared with our subscribers yesterday and what we were seeing at 6:00 AM ET.

The reason you want to have scenarios and context in place is to understand potential. You’re not trying to “predict” anything. You simply setting up the framework for how we are going to potentially react if it happens.

What happens if all these guys are suddenly wrong and can’t break below a support?

What is it going to feel like on their end when the trade suddenly goes against them?

What is the potential move and how much room does the market have to the upside?

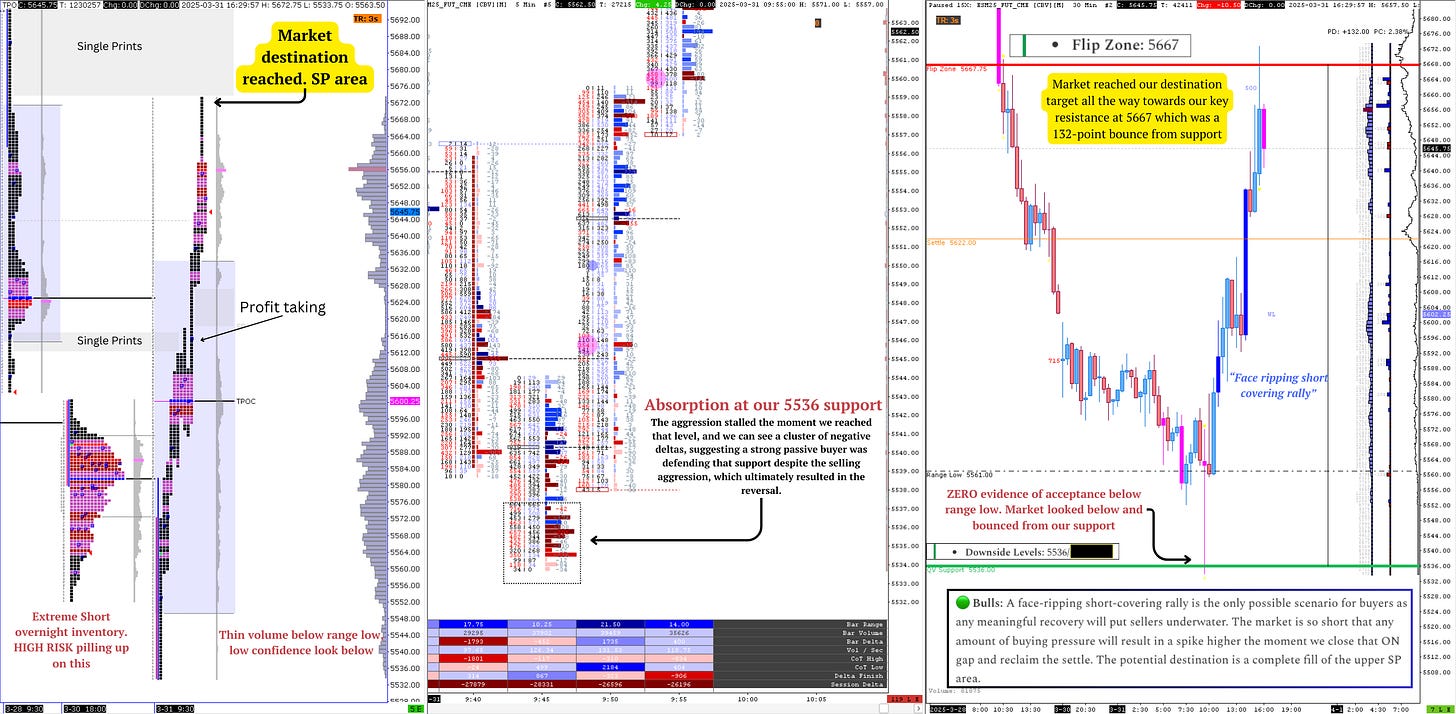

The picture above shows our market references (on the right) and what followed right after. Our first downside support at 5536 was the ultimate bottom of the market, and the bullish scenario was well underway the moment we held this level and lacked that acceptance below the range low.

The market squeezed all the shorts and produced the only possible outcome we suggested would happen—a strong short-covering rally with a spike higher and a 132-point move to our destination target: the absolute top, our first key resistance at 5667.

The market doesn’t care about your emotions

Think of their pain. Feel the emotions of traders being wrong and their extreme short bias failing them. Now you get everyone trying to get out of the same door at the same time.

The absolute top and bottom put on a chart at 6:00 AM, with the exact context and follow-through the market would see before no “news” or event could have ever hit.

Now you open CNBC in the PM hours and see everyone on the panel saying, 'Well, yeah, there was some bullish news, the market went up because of it.'

Most people you see sitting on these chairs have zero clue how the market operates on a short-term basis, and any success you have in day trading the futures markets is exactly that ability: to read the market, to understand what it communicates to you through price action, as ultimately, everything is reflected in it.