The Market Brief

Hey team. S&P 500 futures were little changed, erasing an early gain seen during the overnight open as the market gears up for another slew of corporate earnings.

Let’s recap the last session and see what’s next for the markets!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

Key Earnings After Close: AMZN 0.00%↑ NET 0.00%↑

Macro Viewpoint

Futures tied to Wall Street's main indexes traded mixed on Thursday ahead of a wave of corporate earnings. A weekly jobless claims report is due before markets open, leading up to the all-important January nonfarm payrolls report on Friday.

Yesterday, major U.S. indices rallied, recouping most of the previous day’s losses, with the S&P 500 up 0.75%.

The JOLTS job openings came in below expectations, sending Treasury yields lower and reversing most of Monday’s move.

The markets got off to a rocky start this week after Trump unveiled broad trade tariffs over the weekend. However, the levies on goods from Mexico and Canada were temporarily suspended on Monday for a month.

Analysts have broadly estimated that Trump's tariff plans could spur domestic inflation and would likely slow the Fed's rate cuts.

Prior Session Deep Dive

Reading the market is distinct from trading a market. It’s one of the skills you have to hone through time spent in front of the screen in order to accumulate all the nuances that most traders lack.

It’s not exclusive to retail trading but also to institutional trading. Any major fund has dedicated research teams that run risk models, and their sole purpose is to produce trading ideas and evaluate market conditions, then pass them on to the execution trading desks.

What we do here is work on that market-reading skill, so that no matter what strategy you use, you can better equip yourself to see what is really going on beneath the market surface, as opposed to being emotionally attached to price itself.

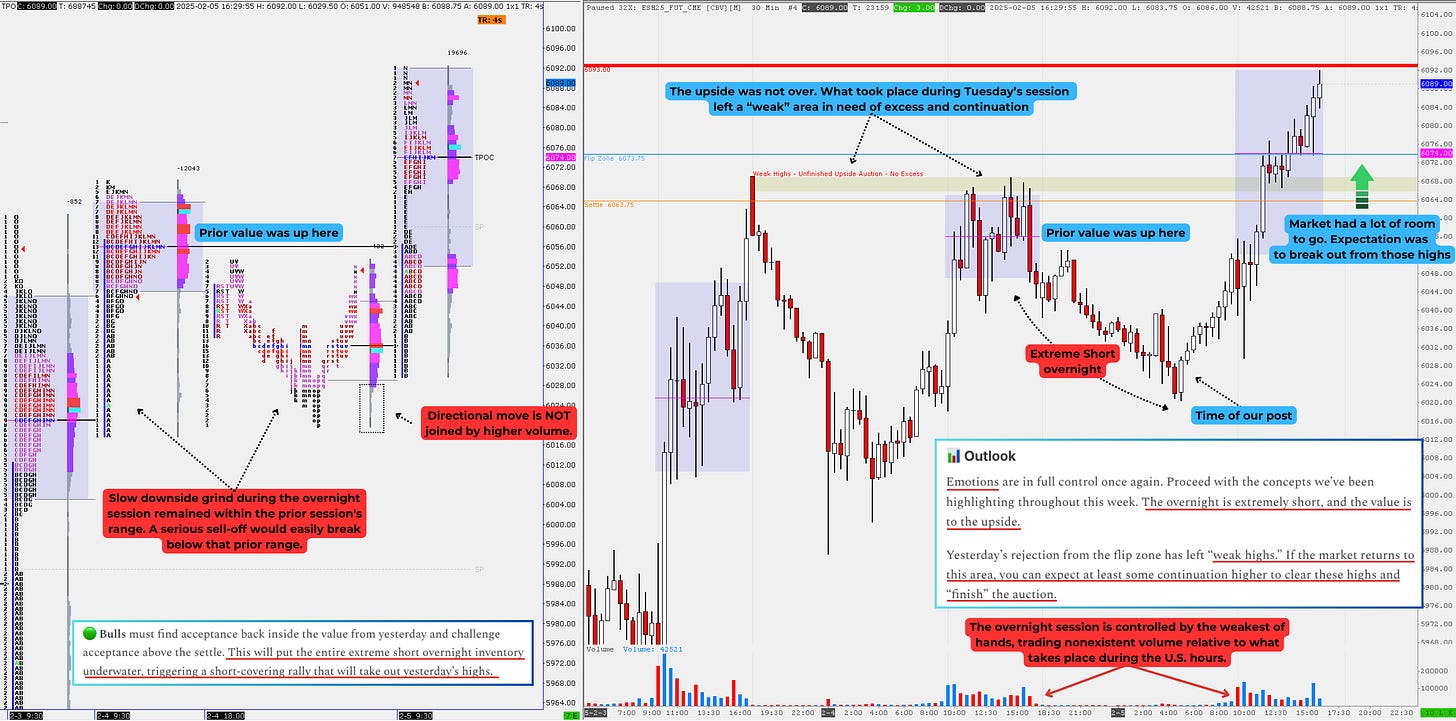

Every line you see on the chart above along with the outlook and bullish scenario were posted on our Paid Substack around 5:20am ET. Take a moment to read the context we shared at that time and what we were looking hours before the fact.

Think about how many traders woke up during the overnight session, saw the market completely underwater, and thought, “Oh boy, we’re really going to zero. Let me just pile in on that slow downside momentum.”

Know your competition. It’s not about whether you have a position open or not. It’s about knowing who is likely in control of that market.

Who is likely in control of the overnight session, pushing the market lower over some negative headlines?

Weak-handed traders.

Guess what weak-handed traders are going to do the moment the market goes against them? They’ll attempt to cover, which will produce a short-covering rally with a destination target: a breakout above those weak highs left during the prior session.

Who could have possibly thought about it hours before the fact, right?