The Market Brief

U.S. futures rose during early trading on Monday, as investors prepared for what is widely expected to be the first in a series of Federal Reserve interest-rate cuts.

Macro Viewpoint

This week’s main focus is whether the Fed will challenge market expectations of a series of rate cuts stretching into next year when policymakers meet on Wednesday.

Investors are largely factoring in reductions at each of the next three meetings, anticipating that the Fed may prioritize easing pressures on a cooling job market, even as inflation stays above its goal.

Road To Rate Cuts

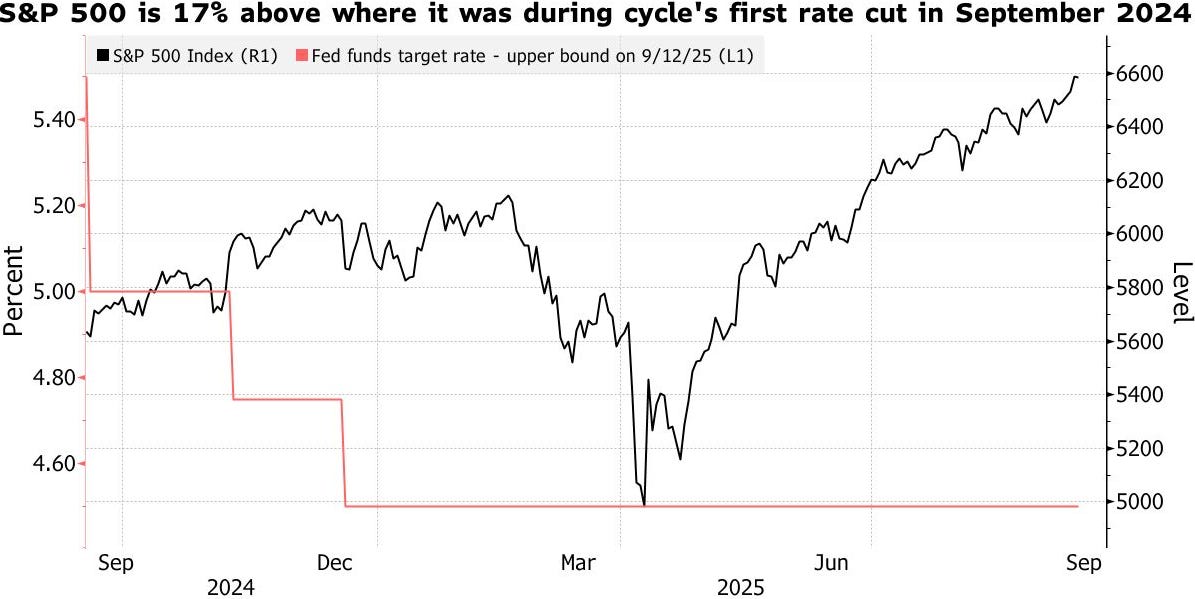

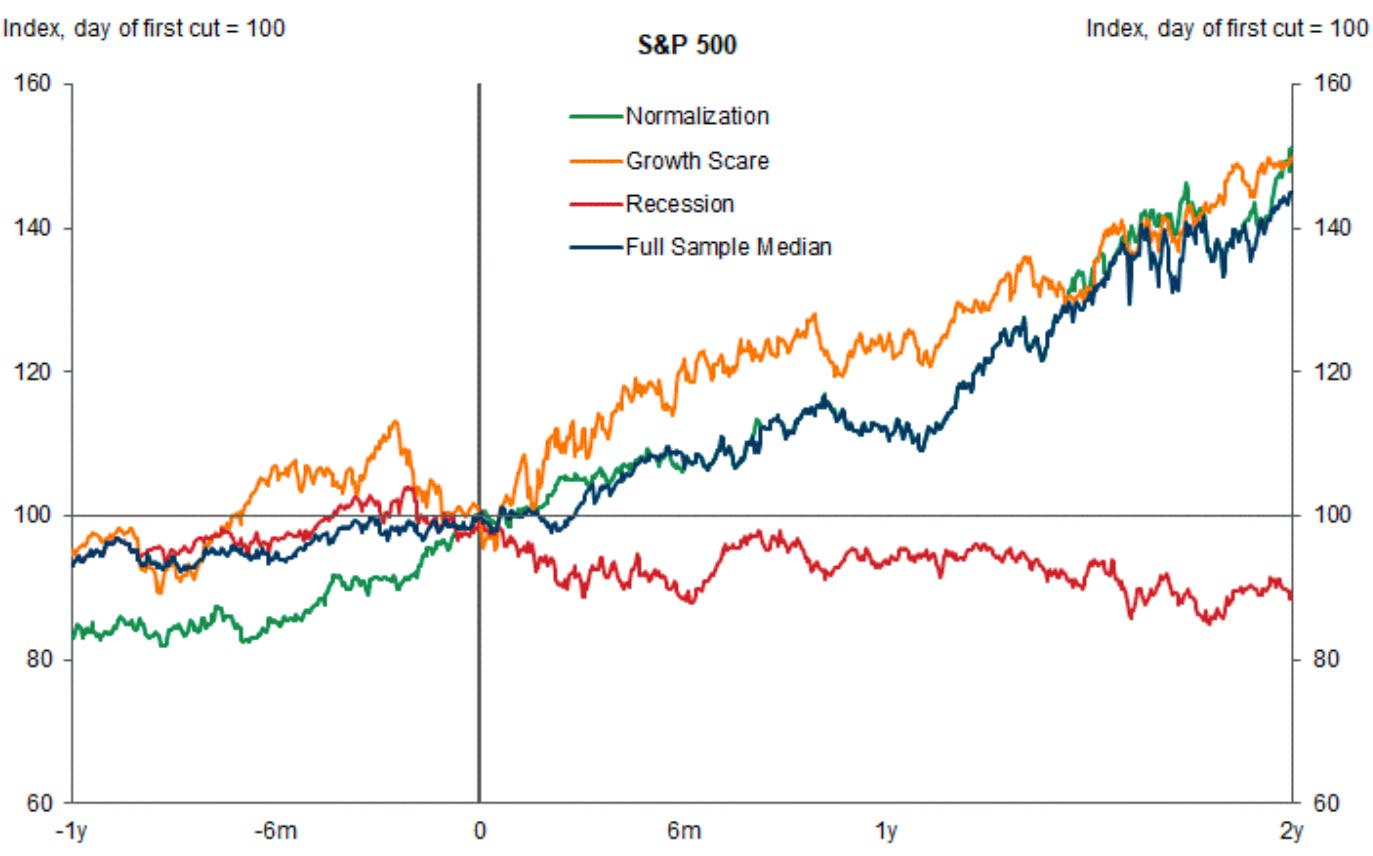

This Wednesday, the Fed is set to lower rates for the first time in 2025, pointing to a sluggish labor market as the driver. Remarkably, it will mark only the third time since 1996 that rate cuts have arrived while the S&P 500 sits at record highs.

Historically, when the Fed has cut rates while the S&P 500 was sitting at record levels, stocks finished higher a year later in 20 out of 20 cases.

On average, the index gained about 13.9% over the following 12 months. That said, in 11 of the past 22 instances, the market actually pulled back over the next month.

Is the market poised for a correction here on a “sell-the-news” event, or are we looking for continuation?

We’re looking at institutional positioning and flows to answer this question in today’s Prime Intelligence.👇

This is a FREE edition of the Market Brief. To receive our institutional-grade intelligence, consider becoming a paid subscriber.