The Market Brief

U.S. futures started December on the back foot as investors stepped to the sidelines, awaiting key economic data to gauge the central bank's verdict on monetary policy later this month.

Impact Snapshot

🟥 ISM Manufacturing PMI - 10:00am

Macro Viewpoint

U.S. stock index futures declined on Monday as investors moved to the sidelines ahead of key economic data and comments from Federal Reserve Chair Jerome Powell, looking for clues on the central bank’s stance heading into this month’s policy meeting.

Powell is set to speak later today, and traders will be parsing his remarks for any signal on the timing and likelihood of upcoming rate cuts.

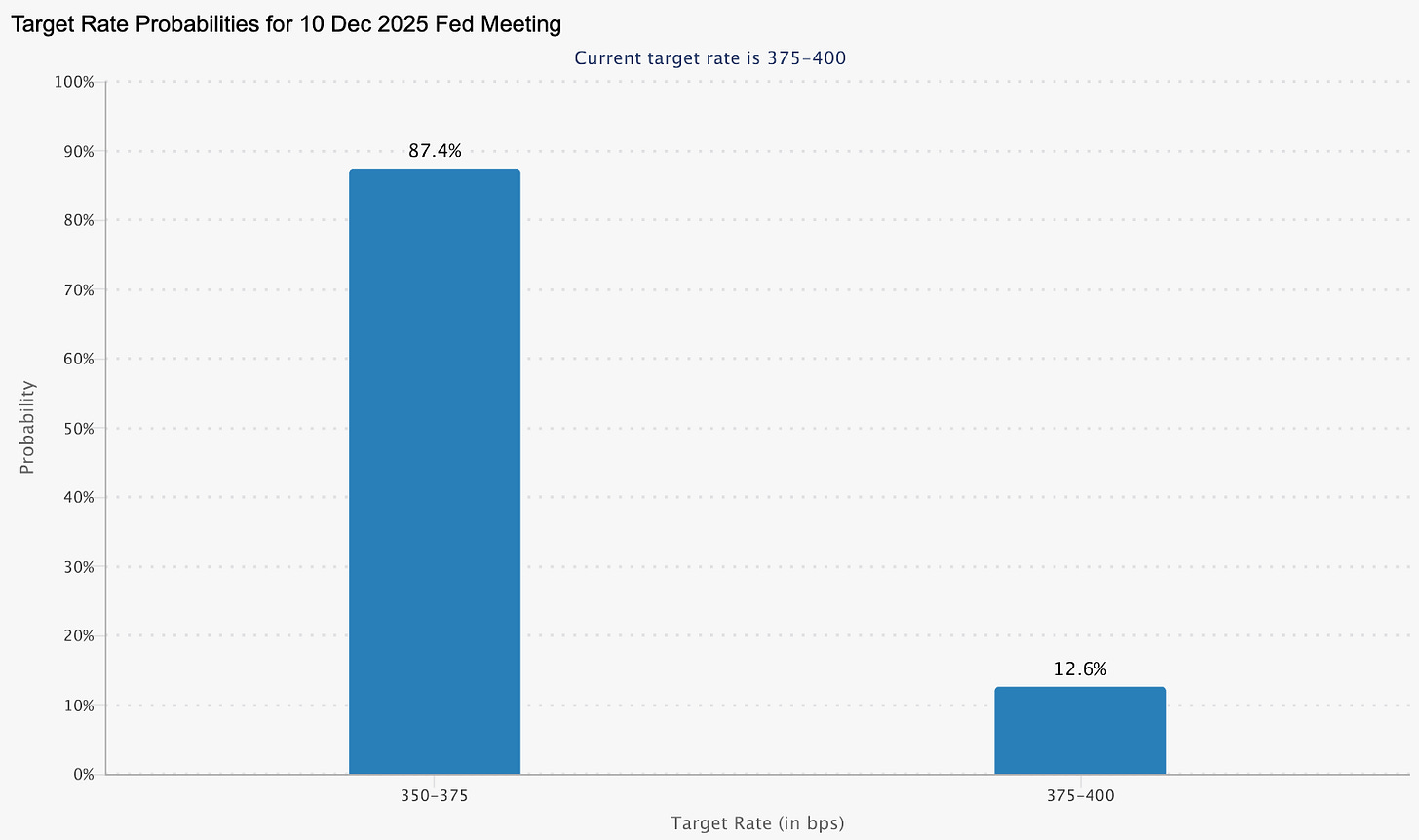

Markets are currently pricing in an 87.4% probability of a 25-basis-point cut in December, roughly double the odds from late last month.

The key focus this week will be the delayed September Personal Consumption Expenditures Index, the Fed’s preferred inflation gauge, which is set to be released on Friday.

Prime Intelligence

November marked the first month in the current rebound where the S&P 500 Equal Weight Index delivered a sustained performance edge over the cap‑weighted S&P 500.

Information technology currently represents roughly ~36% of the S&P 500, so the recent AI‑related tech sell‑off had an outsized impact on the cap‑weighted index.

This points to rotation away from the largest tech names and toward the broader market, leaving a much cleaner positioning as we enter the final stretch of the year.

📰 Can this rally sustain itself or there is more weakness ahead?

Let’s find out in today’s brief! 👇