The Market Brief

Hey team. U.S. stock index futures edged lower on Wednesday as investors awaited details on President Donald Trump’s tariff plans, which are anticipated to disrupt global trade.

Let’s re-cap the prior session and see what’s ahead!

Impact Snapshot

🟥 ADP Payrolls - 8:15am

🟥 Trump will announce tariffs - 4:00pm

Macro Viewpoint

Trump is close to finalising his plan for new tariffs, with his team still working out the details before the official announcement on Wednesday afternoon. The announcement is set to take place in the Rose Garden at 4 p.m., just as U.S. markets close.

Since reaching record highs in February, the S&P 500 and Nasdaq have dropped 8% and 12%, respectively, as investors grow more concerned about a potential recession and weaker corporate earnings.

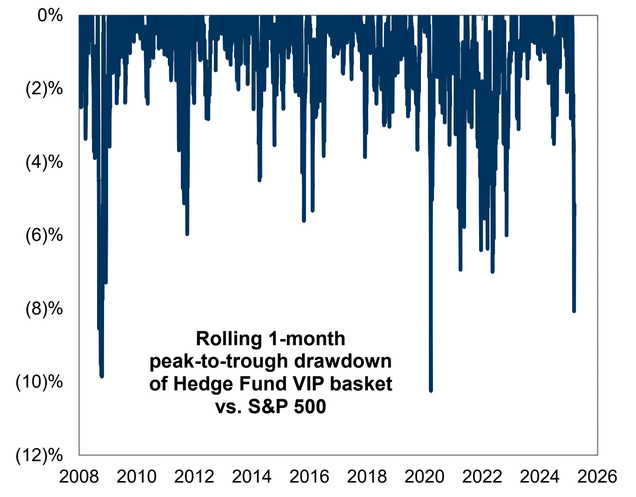

Recent correction has been especially painful for HFs.

You might assume that "big money" are always making a profit or that they have some secret formula backed by millions of dollars in research to predict market movements. That’s not the case.

This is one of the worst periods of hedge fund position underperformance in 15 years.

Some of the big money still remain “tactically bearish”, viewing today’s tariffs not as a resolution but as the start of a larger trade war.

Policy uncertainty continues to drive the markets, with neither the "Trump Put" nor the "Fed Put" expected to provide support in the near term. While softer economic indicators show signs of weakness, stronger fundamental data may help stabilize the next downturn in the U.S. market.

However, because expectations are already low, markets could see a rebound if the tariff announcement turns out to be less severe than feared.