The Market Brief

U.S. futures edge up modestly after a volatile session, as investors factor in the possibility of steeper Fed rate cuts in response to last week’s unexpectedly weak jobs data.

Macro Viewpoint

In complete contrast to last week, this week has an absence of economic report catalysts, and the key focus on a macro level will remain around tariffs and earnings.

With markets again concerned about tariff impacts, downside risks have increased significantly. Hedging therefore continues to be highly important.

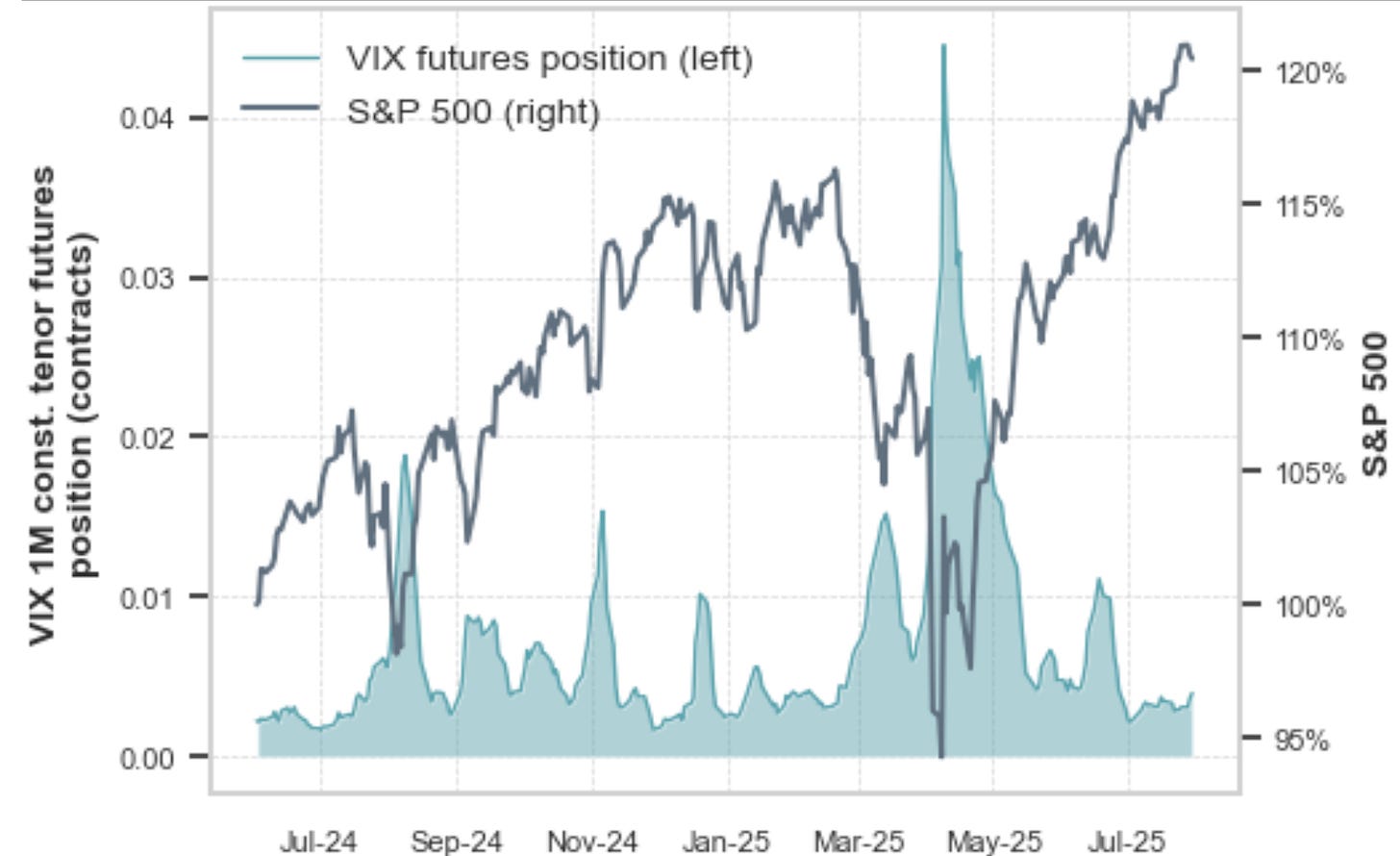

Even a crude but dynamic VIX futures-based strategy can be used to hedge against a pronounced and volatile, but ultimately short-lived, sell-off.

VIX futures react in a convex manner in a high-volatility environment like the one we saw in April this year or August last year.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.👇