The Market Brief

U.S. futures edged higher during early trading on Wednesday after reinforced optimism around AI and ahead of a Federal Reserve interest-rate cut.

Impact Snapshot

🟥 Federal Funds Rate - 2:00pm

🟥 FOMC Press Conference - 2:30pm

Key Earnings (After Close): MSFT 0.00%↑ META 0.00%↑ GOOGL 0.00%↑

Macro Viewpoint

The FOMC is set to deliver another 25bp rate cut to 3.75–4.00%. We do not expect formal guidance on the December meeting, but if Powell is asked, he’ll likely reference the September dots, which imply a third cut in December.

Prime Intelligence

A large part of this space kept waiting for retail to “capitulate” before buying the market. From a performance and career-anxiety perspective, these types of speculators are now being forced to chase.

But HOW important has retail participation really been?

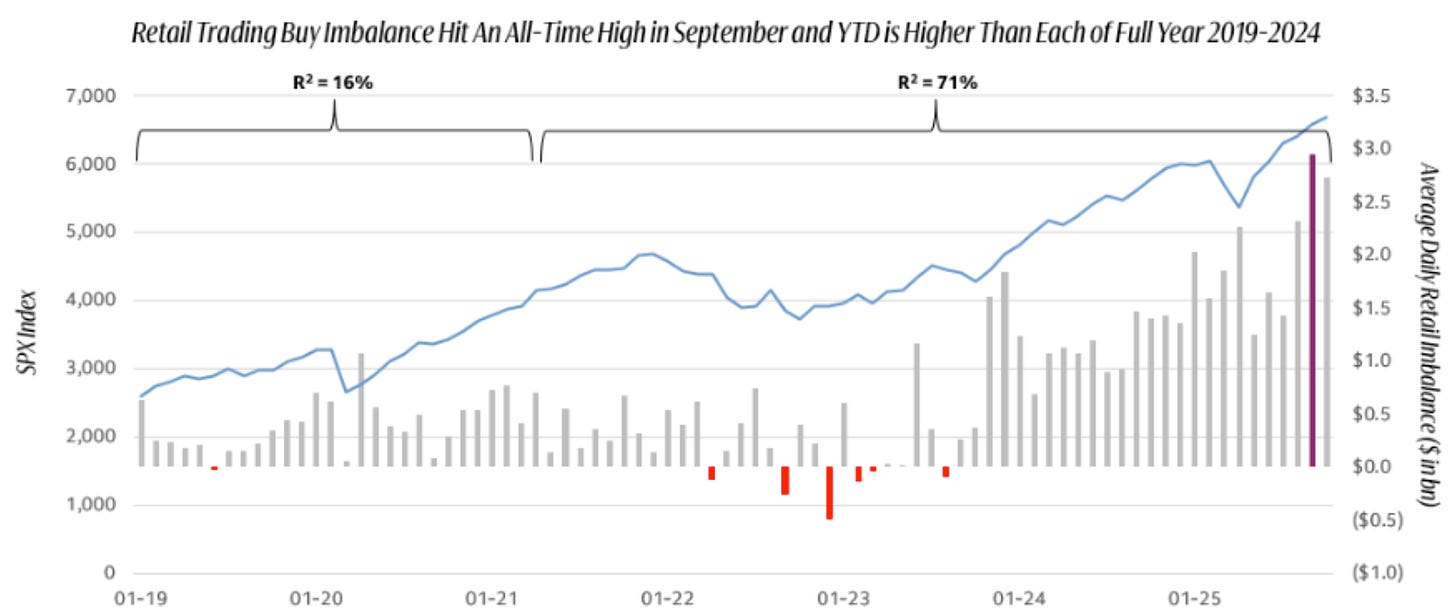

Retail’s average daily buy/sell imbalance has been highly correlated with S&P 500 returns since May 2021. An R² of 71% between market returns and the imbalance highlights a strong and significant relationship.

September 2025 marked the all-time highest daily retail buy imbalance at nearly $3B. We estimate a cumulative $292B in retail buying since the S&P 500 YTD low on April 8, 2025 - an amount over six months that exceeds the cumulative totals of any full year we’ve tracked (2019–2024).

Next time your favorite furu influencer that is allergic to math and data talks about “retail can’t be right” show them the above context and chart.

Prior Session Re-cap

You won’t believe the difference it makes to have a pre-market plan and clear context before the market opens. A solid framework is key to long-term trading success.

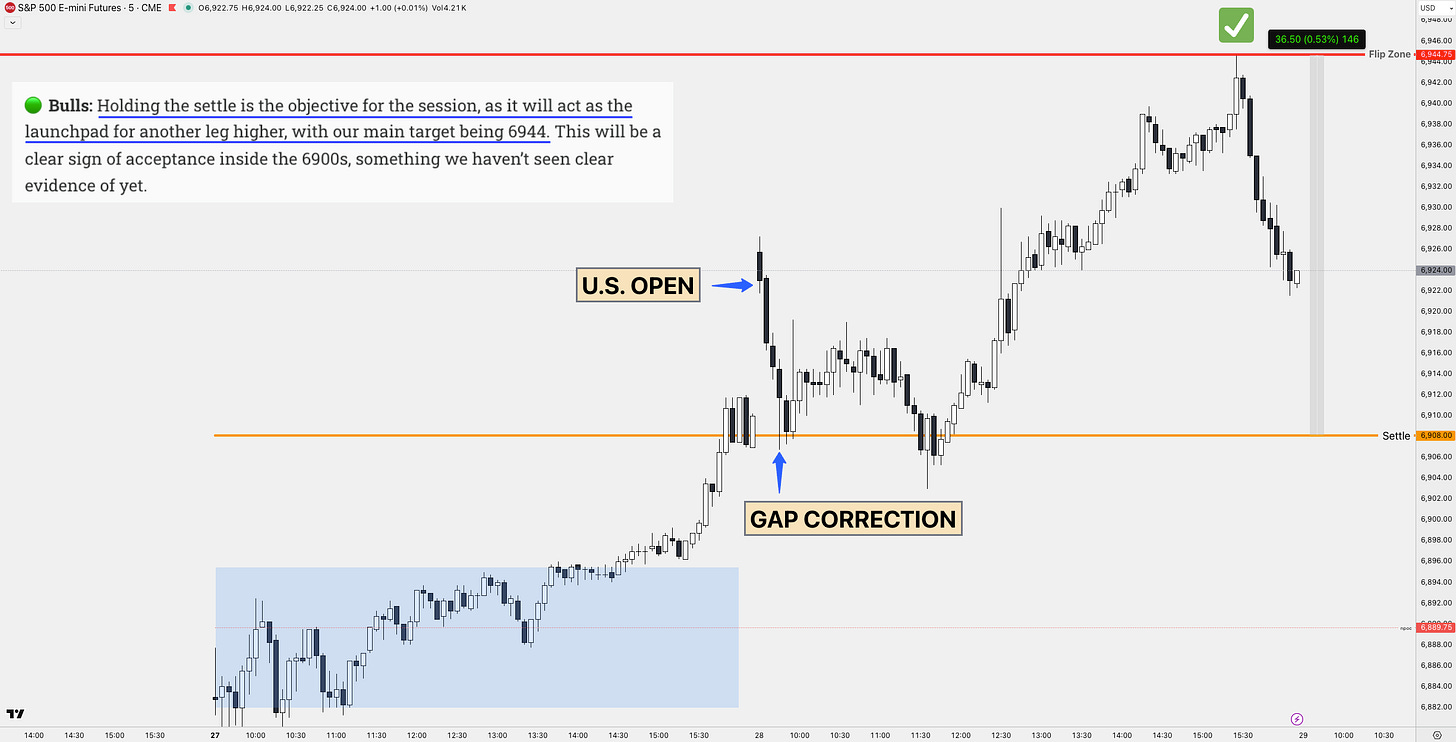

✅ For the second day in a row, the session ended right at our first upside level, despite no overhead historical prices. Levels and context on the chart were shared at 5:00 A.M. ET with our subscribers.

A lot can change between our posting time at 4–5 A.M. and the U.S. open, but core concepts like ON inventory correction remain the same.

The ON gap corrected at the settle pivot, and failure to break and hold below settle = our target of 6944 for TP, which was the tick-perfect top for the session.